Iovance Biotherapeutics, Inc.

IOVA

incurred a loss of 63 cents per share for fourth-quarter 2021, wider than the Zacks Consensus Estimate of a loss of 56 cents and the year-ago loss of 47 cents.

In the absence of any marketed product and revenue-generating collaboration, the company did not record any revenues during the quarter.

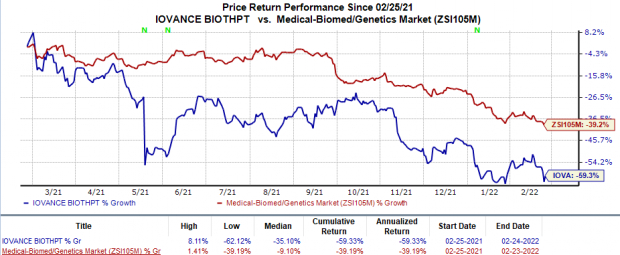

Shares of Iovance have plunged 59.3% in the trailing 12 months in comparison with the

industry

’s 39.2% decrease.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses were $75.6 million, 44.2% higher than the year-ago quarter, primarily due to an increase in related personnel costs, clinical studies costs and facility building costs.

General and administrative expenses increased 48.3% from the prior-year quarter to $23.8 million due to an increase in related personnel costs.

The company had $602.1 million in cash, cash equivalents, short-term investments and restricted cash as of Dec 31, 2021 compared with $660.8 million on Sep 30, 2021.

It expects the cash level to be sufficient to fund the current and planned operations in 2024.

Full-Year Results

Iovance did not report any revenues for the full year. The company incurred a loss of $2.23 per share for 2021 compared with a loss of $1.88 in the year-ago period.

Pipeline Updates

Iovance is developing its lead pipeline candidate, lifileucel, as a monotherapy for treating metastatic melanoma and metastatic cervical cancer in separate pivotal phase II studies — C-144-01 and C-145-04 — for metastatic melanoma and recurrent, metastatic or persistent cervical cancer, respectively, in previously-treated patients.

Following FDA concerns over potency assays for lifileucel, Iovance is currently working with the FDA to resolve the issues. The company reiterated plans to submit a biologics license application (BLA) for lifileucel for the treatment of melanoma in first-half 2022. IOVA also expects to provide data from the pivotal melanoma cohort of the C-144-01 study in connection with its BLA submission.

A resolution for the potential assay for lifileucel will also help Iovance to proceed with regulatory plans for other indications. The company is also in discussion with the FDA for its BLA submission plans for lifileucel in cervical cancer.

Iovance is also evaluating another tumor-infiltrating lymphocyte (TIL) therapy, LN-145, as a potential treatment for head and neck squamous cell carcinoma and non-small cell lung cancer in two separate studies.

A multi-center phase II study — IOV-COM-202 — composed of seven cohorts is evaluating Iovance’s TIL therapies in multiple settings and indications, both as a monotherapy and in combination with

Merck

’s

MRK

Keytruda or

Bristol-Myers

’

BMY

Opdivo/Yervoy.

Keytruda, which is the key revenue generator for Merck, is already approved for the treatment of many cancers globally. For the full year of 2021, Merck recorded $17.2 billion in sales from Keytruda. Merck is also evaluating Keytruda across a wide number of indications that are progressing well.

Both Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers and are key growth drivers of BMY’s top line. During full-year 2021, Bristol Myers generated $7.5 billion from Opdivo sales and recorded $2 billion as product revenues from Yervoy.

IOVA is also progressing well with IND-enabling studies including IOV-3001, a novel IL-2 analog, and IOV-4001, a genetically modified TIL. IOV-4001 leverages the TALEN technology licensed from

Cellectis S.A.

CLLS

to genetically knock out PD-1 in TIL cells. The company plans to start clinical studies on IOV-4001 later this year.

We note that IOVA entered into a collaboration with Cellectis in 2020. Per the agreement terms, IOVA has an exclusive worldwide license to use Cellectis’ proprietary TALEN technology to develop gene-editing TIL therapies targeting cancer. CLLS is entitled to receive milestone and royalty payments from IOVA upon potential development, and successful commercialization of the products developed using the TALEN technology.

Zacks Rank

Iovance currently has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report