Iovance Biotherapeutics

IOVA

announced data from the pivotal Cohort 4 of the phase II C-144-01 study on its lead candidate lifileucel, which is being evaluated in heavily pre-treated melanoma patients.

Per an independent review committee (IRC),data from the pivotal cohort 4 demonstrated that participants who were administered lifileucel achieved an overall response rate (ORR) of 29%, with three complete responses and 22 partial responses. While the median duration of response (DOR) in cohort 4 was 10.4 months, the median study follow-up was 23.5 months.

Data from the cohort 2 of the study showed that the drug achieved an ORR of 35% with five complete responses and 18 partial responses. While the cohort 2 study did not achieve its median DOR, the median study follow-up was 36.6 months.

Shares of Iovance plunged more than 40% in pre-market trading on Friday following the news announcement. Investors were likely not impressed with the response data as the pivotal cohort 4 outcome was lower than that of the supportive cohort 2 of the study.

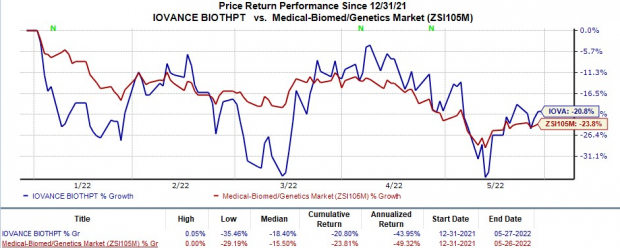

Shares of Iovance have fallen 20.8% in the year-to-date period compared with the

industry

’s 23.8% decline.

Image Source: Zacks Investment Research

However, Iovance also pointed out that data from the cohort 4 showed a higher baseline disease burden than the patients in cohort 2,including higher lactate dehydrogenase (LDH) levels and a greater number of tumor lesions at baseline. The safety profile was also consistent between both cohorts.

Data from both cohort 2 and cohort 4 also demonstrate that a one-time treatment with lifileucel has the potential to provide meaningful benefits to heavily pre-treated patients. In fact, the combined pool of data from both cohorts demonstrates that lifileucel achieved an ORR of 31% at a median study follow-up of 27.6 months. Management plans to report additional data from both cohorts at a future medical meeting.

Iovance plans to use the data from the registrational cohort 4 of the C-144-01 study to file a biologics license application (BLA) come August with the FDA, seeking approval for lifileucel to address the melanoma indication. The BLA filing will also be supported by the cohort 2 of the study.

Iovance intends to start a phase III study later this year for evaluating lifileucel in combination with

Merck

’s

MRK

blockbuster PD-1 inhibitor Keytruda (pembrolizumab). The late-stage study will evaluate the lifileucel-pembrolizumab combo as apotential treatment for immune checkpoint inhibitor naïve frontline metastatic melanoma. IOVA already evaluated this combination for the given indication in a cohort of the phase II study (IOV-COM-202). Data from the cohort demonstrated an overall response rate of 67%.

A multi-center study, IOV-COM-202 is composed of seven cohorts evaluating Iovance’s TIL therapies in multiple settings and for several indications, both as a monotherapy and in combination with Keytruda or

Bristol-Myers

’

BMY

Opdivo/Yervoy.

A key revenue generator for Merck, Keytruda is approved for the treatment of many cancer indications, globally. During first-quarter 2022, MRK recorded $4.8 billion worth of sales from Keytruda. MRK is also evaluating Keytruda across a wide number of indications. The studies are progressing well.

Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers. Both drugs are key top-line drivers for BMY. In first-quarter 2022, Bristol Myers generated $1.9 billion from Opdivo sales and recorded $515 million as product revenues from Yervoy.

Zacks Rank & Stocks to Consider

Iovance currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

Alkermes

ALKS

, which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 10 cents to 3 cents in the past 30 days. Shares of ALKS have risen 26.2% year to date.

Earnings of Alkermesbeat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report