Iridium Communications Inc.

IRDM

has initiated a quarterly dividend program to maximize shareholder value. Iridium’s Board of Directors has declared a quarterly cash dividend of 13 cents per share.

The dividend will be paid out on Mar 30, 2023, to shareholders of record as of Mar 15, 2023. The company plans to pay a regular quarterly dividend, which is subject to the Board’s approval.

The company has been consistently making efforts to reward its shareholders through share repurchase programs that have totaled approximately $600 million. As of Sep 30, 2022, the company had shares worth $187.2 million under the repurchase program.

The company had repurchased about $413 million worth of shares at the end of third-quarter 2022.

The company anticipates using current and future cash earned from operations to pay further cash dividends. It has a cash ratio of 1.73, which indicates the company’s ability to repay its short-term debt with cash or cash and cash equivalents. As of Sep 30, the company had $218.8 million in cash and cash equivalents.

The company also expects a target leverage range of 2.5-3.5 times operational EBITDA at the end of 2023.

Headquartered in McLean, VA, Iridium is the only satellite communications company that offers dedicated commercial global voice and data communications. The company delivers reliable and low-latency communications services to businesses, consumers, wireline and wireless telecommunications operators and Internet service providers.

The company revised its outlook for 2022 owing to strong quarterly results. IRDM expects service revenues to increase between 8% and 9% in 2022 against the earlier guidance of 7%-9% growth in 2022

The company reported

earnings

of 2 cents per share for third-quarter 2022, in line with the Zacks Consensus Estimate. The company had incurred a loss of 2 cents in the prior-year quarter.

Quarterly revenues were $184.1 million, up 14% from the year-ago quarter’s levels. The upside can be attributed to higher demand for equipment and momentum in engineering and support projects. The top line surpassed the consensus mark by 1.8%.

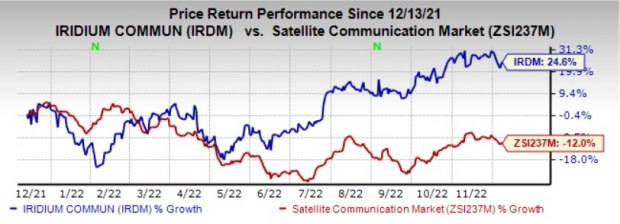

At present, Iridium carries a Zacks Rank #3 (Hold). Shares of the company have soared 24.6% in the past year against the

sub-industry’s

decline of 12%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Plexus

PLXS

and

Super Micro Computer

SMCI

, each presently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have jumped 9.2% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have gained 16.7% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 27.7% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 9.4%. Shares of SMCI have soared 95.1% in the past year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report