Ironwood Pharmaceuticals, Inc.

IRWD

reported first-quarter 2022 adjusted earnings of 21 cents per share, missing the Zacks Consensus Estimate of 27 cents. The company had reported adjusted earnings of 24 cents per share in the year-ago quarter.

Total revenues of $97.5 million beat the Zacks Consensus Estimate of $95.49 million. Revenues were up almost 9.8% year over year.

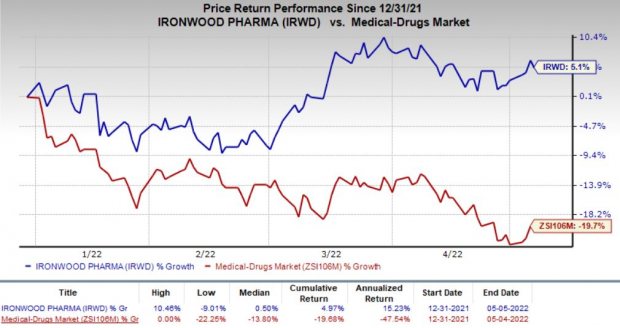

Shares of Ironwood were down 1.3% on May 5, following lower-than-expected earnings. However, the company’s shares have gained 5.1% so far this year against the

industry

’s decrease of 19.7%.

Image Source: Zacks Investment Research

Quarter in Detail

As reported by partner

AbbVie

ABBV

, Ironwood’s sole marketed product — Linzess (linaclotide) — generated net sales of almost $232.3 million in the United States, up 8% year over year. Ironwood and AbbVie equally share Linzess’ brand collaboration profits or losses. The sales growth was driven by strong demand for Linzess, partially offset by the lower net price of the drug and inventory channel fluctuations.

Ironwood’s share of net profits from the sales of Linzess in the United States (included in collaborative revenues) was $94.3 million in the first quarter, up 9.7% year over year.

Per data provided by IQVIA, the prescription volume for Linzess capsules in the first quarter increased about 11% year over year.

The company recorded $3.2 million in royalties and other revenues compared with $2.9 million in the year-ago period.

We note that Ironwood has agreements with two partners — Astellas Pharma and

AstraZeneca

AZN

— related to the development and commercialization of Linzess in Japan and China, respectively. Ironwood records royalties on sales of Linzess from Astellas and AstraZeneca in their respective territories.

Selling, general and administrative expenses were up 4.3% year over year to $28.9 million during the first quarter. Research & development expenses declined 30.3% year over year to $10.8 million.

2022 Guidance Maintained

Ironwood maintained its previously issued guidance for 2022. The company expects its total revenues to be between $420 million and $430 million. It expects U.S. sales of Linzess to grow in low single-digit percentage points.

The company expects adjusted EBITDA to be more than $250 million for the year.

Pipeline Update

Ironwood is progressing well with the development of its linaclotide clinical program for pediatric patients. The data readout from a late-stage study evaluating linaclotide in functional constipation patients aged 6 to 17 years is expected in the second half of 2022.

Ironwood’s two early-stage studies are evaluate its pipeline candidates — IW-3300 and CNP-104 — for treating visceral pain conditions and primary biliary cholangitis, respectively.

Zacks Rank & Stock to Consider

Currently, Ironwood carries a Zacks Rank #3 (Hold).

Xencor

XNCR

is a better-ranked drug stock, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss per share estimates for Xencor have narrowed from $2.96 to $2.67 for 2022 in the past 30 days. XNCR’s shares have declined 38.2% so far this year.

Xencor has a four-quarter average earnings surprise of 125.72%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report