Alkermes plc

ALKS

is expected to surpass expectations when it reports

second-quarter 2022 results

on Jul 27, before the market opens.

Alkermes’ earnings surprise history has been excellent so far, having surpassed expectations in each of the trailing four quarters, with an average beat of 350.48%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

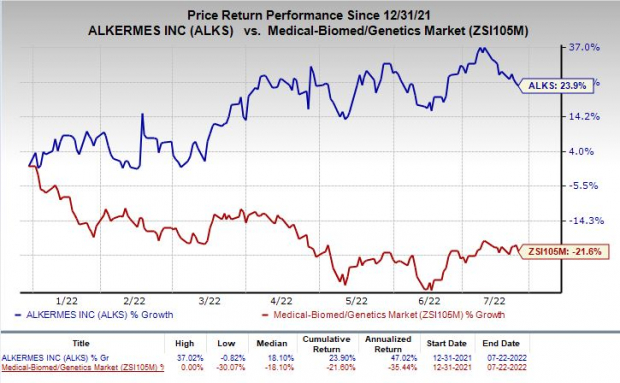

Shares of Alkermes have rallied 23.9% so far this year against the

industry

’s 21.6% decline.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

Factors to Consider

Alkermes’ revenues in the last-reported quarter increased year over year, a trend that is likely to have continued in the second quarter as well.

Sales of proprietary drug Vivitrol (for alcohol and opioid dependence) and Aristada (for schizophrenia) increased approximately 14% and 31%, respectively, year over year. These increases were driven by the underlying unit growth and volume growth, a trend that will most likely continue in the upcoming quarter as well.

Vumerity revenues also surged year-over-year, a trend that is expected to have continued in the to-be-reported quarter.

Sale of the newly approved drug, Lybalvi increased sequentially in the last reported quarter, a trend that is expected to have continued in the second quarter.

However, total manufacturing and royalty revenues were down year-over-year in the last reported quarter, a trend that will most likely continue in the upcoming quarter as well.

Activities related to the development of the company’s pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Alkermes this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Alkermes has an Earnings ESP of +300.00%. The Zacks Consensus Estimate for earnings stands at 4 cents per share while the Most Accurate Estimate is pegged at 16 cents per share.

Zacks Rank:

Alkermes has a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Other Stocks to Consider

Here are a few other stocks you may want to consider as our model shows that these too have the right combination of elements to beat on earnings this reporting cycle.

Precision BioSciences, Inc.

DTIL

has an Earnings ESP of +13.45% and a Zacks Rank #1 at present.

Precision BioSciences’ stock has plunged 78.6% in the year so far. Earnings of Precision BioSciences beat estimates in each of the trailing four quarters. DTIL has a four-quarter earnings surprise of 76.15%, on average.

Seagen Inc.

SGEN

has an Earnings ESP of +3.31% and a Zacks Rank #1.

Seagen stock has risen 11% this year so far. Seagen topped earnings estimates in two of the last four quarters. SGEN has a four-quarter earnings surprise of -40.08%, on average. SGEN is scheduled to release its second-quarter 2022 results on Jul 28.

BioNTech SE

BNTX

has an Earnings ESP of +1.99% and a Zacks Rank #2.

BioNTech’s stock has plunged 37.9% year to date. BioNTech topped earnings estimates in all the last four quarters. BNTX has a four-quarter earnings surprise of 56.87%, on average. BNTX is scheduled to release its second-quarter 2022 results on Aug 8.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report