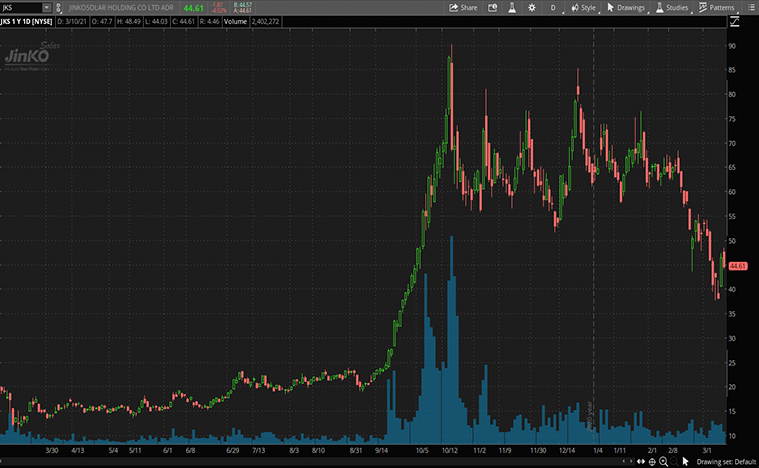

Should Investors Consider JinkoSolar (JKS) Stock?

Solar stocks

bounced back strongly on Tuesday’s trading session as investors pile back into companies with strong growth. The stock market’s rise certainly helped lift some of the

top solar stocks

. But there was news specific to the industry that also helped. Of course, the biggest news was that the bond yields were dropping. Although the drop wasn’t significant, many are optimistic about the way rates are doing after the recent increase. And it appears that is enough to reinvigorate solar stocks in the

stock market today

.

Why does the movement in interest rate matter, you ask? That’s simply because solar installations require huge cash upfront and take decades of small cash flows to pay back. In a way, you can say it behaves more like a bond. At higher rates, those future cash flows become less valuable today. Conversely, lower rates make the cash flows worth more. Therefore, solar stocks are benefitting from a decrease in rates.

Leading solar panel manufacturer, JinkoSolar’s (

NYSE: JKS

) stock has had a good run in 2020. The company is one of the world’s largest solar panel manufacturers and a big player in the solar industry. JinkoSolar distributes its solar products and offers its services to a diversified international utility, commercial, and residential customer base. The question here is, can JKS stock continue to outperform after such a huge run-up in its stock price? Let’s take a deeper dive to find out.

Read More

-

Looking For The Best Tech Stocks To Buy Now? 4 In Focus

-

Making A List Of Top Entertainment Stocks To Watch Right Now? 4 To Know

China’s Thriving Photovoltaic Market Makes A Bullish Case For JKS Stock

JinkoSolar is one of the world’s largest solar panel manufacturers. It has seven production facilities in China and one each in the U.S. and Malaysia. Having the majority of the productions in China gives the company an edge in terms of lower production costs compared to its U.S.-based peers. Looking at China’s Thirteenth Five-Year Plan results, the country has improved its competitiveness in the photovoltaic space. It achieved its highest additional module shipment and cumulative shipment.

For those unfamiliar, JinkoSolar is reportedly building a 20GW manufacturing base for large battery pieces in Yunnan provinces. This will become the company’s largest manufacturing base for battery pieces upon completion. Admittedly, the intense price competition among other solar firms led to the decrease in solar module price. That has undoubtedly dragged JinkoSolar’s operating margin over the past few years. While that could spell trouble for the company and the industry in general, the company has managed to navigate the increasingly competitive field and came out stronger. Here’s how.

Technological Superiority & Production Capabilities

Even the biggest skeptics can’t deny that JinkoSolar is on solid financial ground. But the company didn’t get here doing the same with any of its competitors. Its technological advantages and production capability play an essential role in its strong growth in recent years. If one feels skeptical, just look at the company’s past quarters in 2020.

Bear in mind that the company continued to post strong growth amid the global pandemic. Even in the most challenging times, JinkoSolar was able to execute. As photovoltaic power generation has a lower cost compared with coal power generation, it will become the primary power source in the future. With the company’s technological advantages in the efficiency of its components and new innovation in the products. It’s safe to say that the growth runway is far from over.

According to the president of LONGi Solar, 69% of energy will derive from photovoltaic power generation in the future. Considering the global shifts towards green energy, it’s natural that solar firms like JinkoSolar and the broader industry won’t be able to fully meet its demand. As a result, these photovoltaic firms will have to expand their productions in succession. Among these firms, JinkoSolar’s production capability was ranked in the top three in 2020. And there is a good chance the company can maintain its leading position in the future.

[Read More]

Best Stocks To Buy Now? 4 Health Care Stocks To Watch

Rapid Growth & Increasing Profitability

Investors love JinkoSolar because it is one of the fastest-growing solar stocks over the years. For comparison purposes, the company’s sales growth exceeds some of its industry peers including First Solar (

NASDAQ: FSLR

). From 2010 to 2019, JinkoSolar grew its sales by an average of 22% a year, handily beating First Solar’s 2% growth. This is certainly a testament to JinkoSolar’s capabilities. JinkoSolar’s strategy to expand sales, even at a slightly lower margin, may bode well for it.

JinkoSolar is currently scheduled to report its fourth-quarter earnings before the opening bell on Thursday, March 11. For the uninitiated, JinkoSolar has outperformed earnings expectations in three of its last four earnings reports. According to the International Renewable Energy Agency (IRENA), the global accumulative module shipment volume has maintained a rising trend since 2015 and is expected to reach 1722.14GW by 2025.

When compared with other players globally, JinkoSolar’s shipments were still in the leading position. Although LONGi Solar was ranked 1st in 2020 with 20GW shipment, JinkoSolar followed closely with only 18.75GW. With the higher pace of average annual growth in the past decade, I won’t be surprised if it could overtake LONGi Solar in the near term.

[Read More]

Best Software Stocks To Watch Before Friday

Bottom Line On JKS Stock

All in all, the company’s growth prospects remain very impressive, as does the outlook for the overall solar-energy sector. At a time where more people and organizations advocate for sustainable development, the photovoltaic industry is becoming more promising indeed.

If we are to value JKS stock compared to its industry peers, you would find out that it’s trading more cheaply than its peers. Perhaps, it may be because the Chinese company has different reporting requirements and accounting standards. It would be no surprise if investors believe JKS stock should trade at a discount in comparison with its U.S. peers.

JinkoSolar is growing its emphasis on its domestic market, thanks to support from the Chinese government. Nevertheless, it is not all smooth-sailing for the solar market. As a result of the pandemic, governments and businesses may be reassessing their capital spending. Perhaps, some of that will impact renewable energy firms. Nevertheless, JinkoSolar’s track record of strong growth may alleviate some fears of its ability to stay resilient amid a tough economic environment. Considering that, is JKS stock a top solar stock to buy for the years to come?