MasTec, Inc.

MTZ

is witnessing supply-chain disruption, project delays and intense inflation over the past year.

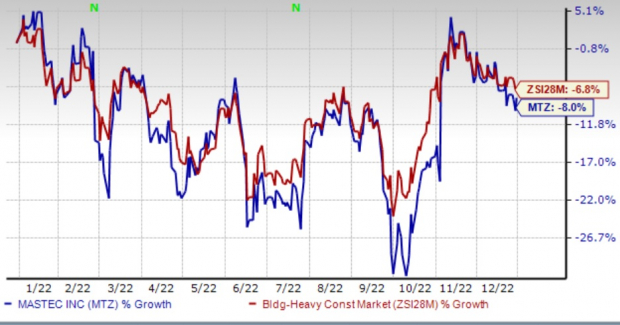

In the past year, this leading infrastructure construction company’s stock has declined 8% compared with the Zacks

Building Products – Heavy Construction

industry’s 6.8% decline.

Nonetheless, it has been benefiting from its focus on the non-oil and gas segments and acquisition synergies. Also, its substantial presence in the telecommunications market and expansion into heavy infrastructure will likely prove conducive to its growth profile.

Image Source: Zacks Investment Research

Let’s delve deeper into the factors substantiating its Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Focus on Carbon Neutrality

: With strong visibility into the clean energy market, MasTec is well poised for growth, given its persistent focus on the clean energy market, including wind, solar, biofuels, hydrogen and storage.

As one of the largest clean energy contractors in the country, MasTec’s expertise in constructing wind farms, solar farms, biomass facilities, high-voltage transmission lines, substations, battery storage and hydrogen-enabled solutions helps it take advantage of market growth. It continues to see strong demand for renewables, with improvements in solar activity and distributed generation.

As of Sep 30, backlog at Clean Energy and Infrastructure increased 23.1% from a year ago to $1.93 billion. For 2023, the company expects this segment to approximate $5 billion in revenues with an improved annual adjusted EBITDA margin rate performance in the mid-to-high single-digit range.

Strong Telecom Business

: The Communications segment continues to offer attractive upside opportunities, driven by 5G investment and accelerating spending by DISH as well as T-Mobile. Also, the Rural Digital Opportunity Fund, or RDOF — a follow-up to the Connect America Fund — will provide $20 billion in funding over the next 10 years to build and connect gigabit broadband speeds in underserved rural areas. With the recent 5G spectrum auctions now complete, it expects revenue acceleration throughout 2023. It expects growth for the current year to be driven by the persistent expansion of fiber optic networks, investments in wireless network capacity and 5G-related work.

The segment’s backlog at September-end increased 12.4% from a year ago to $5.02 billion. For 2022, it expects Communications segment revenues of $3.2 billion, indicating more than 25% growth from 2021. The 2022 adjusted EBITDA margin is expected in the low-to-mid 10% range.

Buyout Synergies

: In October 2022, MasTec completed the acquisition of Infrastructure and Energy Alternatives, Inc. (IEA), a leading utility-scale renewable energy infrastructure solutions provider in North America. MasTec believes IEA will generate revenues between $2.6 billion and $2.7 billion and adjusted EBITDA within $160-$170 million in 2023, exclusive of any post-transaction synergies. Also, it anticipates annual cost savings of approximately $10 million, owing to the combination of reduced IEA public company reporting and other costs. It expects that IEA will generate $45-$50 million of adjusted net income in 2023.

In first-half 2022, the company acquired two businesses. Earlier, in 2021, MasTec made 14 acquisitions.

Major Concerns

Project Delay

: The biggest risks to MasTec’s guidance are around governmental permitting, crew social distancing mitigation and the impact they may have on project schedules along with any potential project delays. MasTec faces execution risk, if the company fails to properly manage projects or faces project delays, it could result in additional costs or claims for the company. Notably, the MVP pipeline continues to experience delays due to permitting and judicial actions.

Its Oil & Gas pipeline segment’s top line has been witnessing a negative impact over the last few quarters due to delays in some large project activity.

Intense Inflation

: MasTec has been experiencing the general impact of inflationary pressures and labor shortages on its business, particularly for fuel, labor and material costs. Also, MasTec’s customers are facing increased costs of steel pipe, which often account for nearly 50% of project costs, owing to supply chain issues. Labor and start-up costs and acquisition-related expenses are likely to put pressure on the bottom line. The company expects labor, fuel and material costs to increase in the future and may continue to affect its profitability and cash flows.

Tepid Views

: Owing to the above-mentioned headwinds, MasTec lowered its full-year guidance. For 2022, adjusted earnings are anticipated to be $3.02 per share versus the earlier expectation of $3.09 per share. The estimated figure indicates a decrease from $5.58 reported in 2021.

For the fourth quarter of 2022, the company expects to report adjusted earnings per share of $1.00 for the quarter, down from $1.35 reported a year ago.

Key Picks

Some better-ranked stocks that warrant a look in the Zacks

Construction

sector include

EMCOR Group Inc.

EME

,

Altair Engineering Inc.

ALTR

and

ChampionX Corp.

CHX

, each carrying a Zacks Rank #2 (Buy).

EMCOR

: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

EMCOR’s 2023 earnings estimates have increased to $9.10 per share from $8.79 over the past 60 days. Earnings for 2023 are expected to grow nearly 17%.

Altair

: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair’s earnings for 2023 are expected to witness 21.5% growth from the year-ago report.

ChampionX

: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX has an expected earnings growth rate of 46.3% for the next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report