Itron

ITRI

recently announced that it is collaborating with Baltimore Gas & Electric (“BGE”) to deploy 260,000 Itron smart streetlights to lower energy consumption.

Itron’s smart streetlights are designed to enhance safety of the neighborhood. These can detect lamp and lighting power supply failures at the time of occurrence and send notification to maintenance crew for inspection. Immediate inspection of problems associated with the streetlights is critical in avoiding motor accidents.

BGE can control lighting levels immediately or on a scheduled basis for these streetlights. It will also be able to regulate streetlights with on/off and dimming functionality, added Itron.

BGE will be utilizing Itron multi-purpose IIoT network to connect the smart streetlights. These streetlights will be deployed across BGE’s service territory through 2026.

Additionally, Itron’s Streetlight.Vision Central Management System solution will aid BGE to manage and monitor the smart streetlights and will also allow BGE to add other smart applications to the network going ahead.

Itron is one of the major suppliers of a broad array of standard, advanced and smart meters, and meter communication systems, including networks and communication modules, sensors, data analytics and services, and software and devices globally.

The company plans to expand its global presence in the utility sector with numerous collaborations.

At present, Itron’s performance is being affected due to unexpected supplier decommitments, inadequate component deliveries and the irregular timing of crucial components arriving at the company’s factories despite a robust customer demand environment. Also, softness across all business segments and the company’s exit from select product lines in the Device Solutions segment are headwinds.

In the last reported quarter, revenues came in at $420.9 million, which lagged the Zacks Consensus Estimate by 8.4%. The top line declined 14% (down 9% on a constant-currency basis) year over year. The company expects supply-chain constraints to continue in the fourth quarter of 2022. For the fourth quarter, the company expects revenues to be between $420 and $460 million.

Despite headwinds, the company expects increased demand for electric vehicles and distributed energy resource management to drive customer bookings. In the third quarter, the company’s bookings were $578 million. The company continues to build up its inventory to improve backlog conversion and is focusing on boosting its operational footprint through its asset-light strategy. The company is looking to lower discretionary spending, which bodes well.

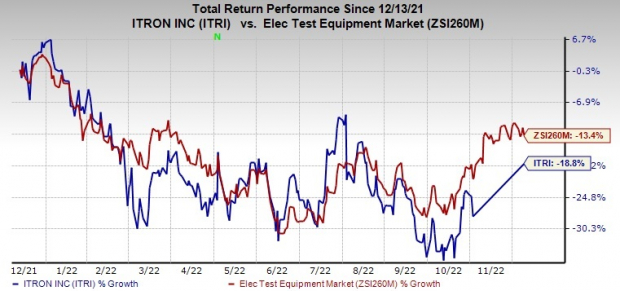

Itron currently has a Zacks Rank #3 (Hold). Shares of ITRI have lost 18.7% compared with the

sub-industry

’s decline of 13.4% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration from the broader technology space are

Arista Networks

ANET

,

Blackbaud

BLKB

and

Plexus

PLXS

. Arista Networks and Plexus currently sport a Zacks Rank #1 (Strong Buy), while Blackbaud carries a Zacks Rank #2 (Buy). You can see t

he complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated at 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have decreased 3.2% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.59 per share, up 1.6% in the past 60 days. The long-term earnings growth rate is anticipated at 4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.9%. Shares of BLKB have declined 27.7% in the past year.

The Zacks Consensus Estimate for Plexus’ fiscal 2023 earnings is pegged at $5.98 per share, up 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have increased 13.2% in the past year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report