We expect

Johnson & Johnson

JNJ

to beat expectations when it reports second-quarter 2022 results on Jul 19, before market open. In the last-reported quarter, the company delivered an earnings surprise of 2.69%.

The healthcare bellwether’s performance has been pretty impressive, with the company exceeding earnings expectations in each of the trailing four quarters. It delivered a four-quarter earnings surprise of 5.41%, on average.

Johnson & Johnson Price and EPS Surprise

Johnson & Johnson price-eps-surprise

|

Johnson & Johnson Quote

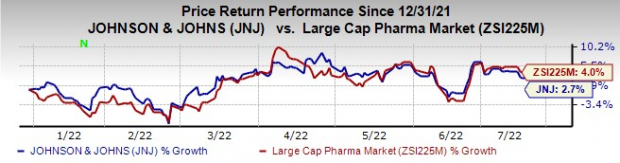

J&J’s stock has risen 2.7% this year so far compared with an increase of 4% for the

industry

.

Image Source: Zacks Investment Research

Factors to Consider

J&J’s Pharma segment is expected to have outperformed the market this time around as well led by increased penetration and share gains of key products such as Darzalex and Stelara.

The Zacks Consensus Estimate for Darzalex and Stelara is pegged at $1.83 billion and $2.63 billion, respectively.

Other core products like Invega Sustenna and new drugs, Erleada and Tremfya might have contributed significantly to sales growth. However, lower sales of key medicines, Imbruvica and Xarelto, had hurt the top line in the first quarter. It is unlikely that sales of these drugs might have improved in the second quarter. The Zacks Consensus Estimate for Invega Sustenna and Tremfya is $1.06 billion and $665 million, respectively.

Rising competitive pressure in the United States to new oral competition is likely to have hurt the sales of key drug, Imbruvica in the second quarter. The Zacks Consensus Estimate for Imbruvica is $1.06 billion. The Zacks Consensus Estimate for Xarelto is $578 million.

The contribution of J&J’s single-dose COVID-19 vaccine is likely to have been minimum to sales growth in the second quarter due to demand uncertainty. Also in May, J&J updated the label of its COVID-19 vaccine to mention the risk of thrombosis with thrombocytopenia syndrome (TTS), a rare syndrome characterized by blood clots and low platelet count. J&J’s decision to update its label came on the heels of the FDA’s announcement on May 5 to limit the authorized use of its vaccine due to the risk of TTS.

Generic/biosimilar competition for drugs like Zytiga, Procrit/Eprex and Remicade is likely to have hurt the top line.

The Zacks Consensus Estimate for J&J’s Pharmaceuticals unit is $13.24 billion.

With regard to the MedTech segment, the recovery in demand trends seen in the first quarter is likely to have continued into the second. J&J saw a steady uptick in surgical procedures in the first quarter with the easing of COVID restrictions in several countries, a trend that is likely to have continued in the second quarter. This, coupled with better commercial execution and uptake from recently launched products, is likely to have boosted sales in the segment in the second quarter. The Zacks Consensus Estimate for J&J’s Medical Devices segment is $6.87 billion.

In the Consumer Healthcare segment, external supply constraints (due to raw material availability and labor shortages) and inflationary pressure are likely to have continued to hurt sales of the skin health and beauty franchise. The OTC segment is likely to have done well this time around as well.

The Zacks Consensus Estimate for J&J’s Consumer Healthcare segment is $3.70 billion.

J&J plans to separate its Consumer Health segment into a new publicly-traded company

Management might announce key executive leadership appointments for the new Consumer Health company on the second-quarter conference call and also the new company name and headquarter location.

Earnings Whispers

Our proven model predicts an earnings beat for J&J in the to-be-reported quarter. A stock needs to have both a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely positive surprise. This is the case here, as elaborated below.

Earnings ESP:

J&J’s Earnings ESP is +0.89% as the Most Accurate Estimate of $2.61 is higher than the Zacks Consensus Estimate of $2.59. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Zacks Rank:

J&J has a Zacks Rank #3

Other Stocks to Consider

Here are some large drug stocks that also have the right combination of elements to beat on earnings this time around:

Merck

MRK

has an Earnings ESP of +7.18% and a Zacks Rank #1. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Merck’s stock has risen 22.5% this year so far. Merck topped earnings estimates in three of the last four quarters. Merk has a four-quarter earnings surprise of 13.42%, on average. MRK is scheduled to release its second-quarter 2022 results on Jul 28.

Biogen

BIIB

has an Earnings ESP of +4.41% and a Zacks Rank #3.

Biogen’s stock has declined 10.7% this year so far. Biogen topped earnings estimates in three of the last four quarters and has a four-quarter earnings surprise of 5.86%, on average. BIIB is scheduled to release its second-quarter 2022 results on Jul 20.

BioNTech

BNTX

has an Earnings ESP of +31.16% and a Zacks Rank #2.

BioNTech’s stock has plunged 40.1% in the past year. BioNTech topped earnings estimates in all the last four quarters. BioNTech has a four-quarter earnings surprise of 56.87%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research