Keysight Technologies

KEYS

is focusing on science, technology, engineering and math (STEM) education as part of its corporate social responsibility (CSR) initiative. The program is an effective way for companies to contribute to the development of the next generation of scientists, engineers and technologists for the overall development of the society.

Per the company’s recent CSR report, it reached more than 145,000 students through STEM education outreach and delivered more than $315,000,000 in value to strengthen communities in the past year.

This demonstrates its strong commitment to CSR for supporting education and community development.

Keysight launched a local college and career readiness program called Sonoma Corps to empower students in under-resourced school districts by connecting them to career pathways in the local community. The two-year program supports students through their senior year of high school and provides paid internships at Keysight and other companies in the region after graduation.

In addition to supporting primary and secondary schools in their local communities, Keysight also has programs that engage universities and university labs around the world to support their mission of accelerating innovation and connecting and securing the world.

As a result of this social upliftment work, Keysight was recognized as a top supporter of Historically Black Colleges and Universities Engineering Schools in 2021 by U.S. Black Engineer Magazine.

Keysight has formed a strategic partnership with Technovation, a global non-profit tech education firm, to expand its STEM education efforts internationally. The company has a history of supporting girls in STEM through events like Introduce a Girl to Engineering Days, and the partnership with Technovation will allow it to reach and support girls and young women in over 120 countries.

Keysight is a provider of electronic design and test instrumentation systems. The rapid adoption of Internet of Things services, wireless devices, data centers and 5G technologies bodes well.

Further, technological advancement in mobile communications, semiconductors and automotive markets is likely to drive growth. Sturdy efforts toward the modification of the Internet infrastructure and the evolution of smart cars and autonomous-driving vehicles augur well.

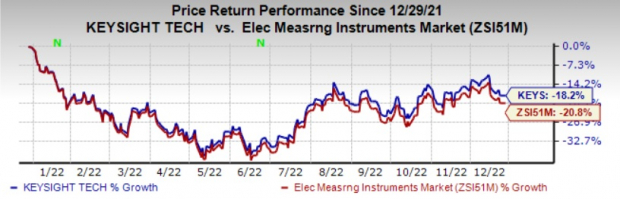

At present, KEYS carries a Zacks Rank #3 (Hold). The stock has lost 18.2% in the past year compared with the

sub-industry’s

decline of 20.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Jabil

JBL

and

Super Micro Computer

SMCI

, each presently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have declined 18.4% in the past year.

The Zacks Consensus Estimate for Jabil’s 2023 earnings is pegged at $8.31 per share, rising 1,6% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 8.9%. Shares of JBL have declined 3.6% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 19.8% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 9.4%. Shares of SMCI have soared 83.6% in the past year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report