Keysight Technologies, Inc.

KEYS

recently announced that it has collaborated with

Qualcomm Incorporated

QCOM

to develop an end-to-end 5G non-terrestrial network (NTN) connection using satellite-to-ground communication facilities. The collaboration is likely to promulgate affordable broadband connectivity in rural areas to help bridge the digital divide.

5G NTN, based on satellite-to-ground infrastructure facilities, enables secure, reliable and high bandwidth communication in areas that do not possess terrestrial network coverage. Large-scale 5G NTN deployments are likely to uplift the standard of living with improved economic conditions for industrial sectors such as agriculture, energy, health and transportation.

Leveraging Keysight’s 5G base station and aerospace emulation solutions, the end-to-end 5G NTN connection was tested in Qualcomm’s San Diego laboratory with its 5G mobile test platform that acts as a proven test device for implementing and verifying the most advanced features. Based on modeling constellations of Low Earth Orbit satellites, the successful test results are likely to sow the seeds of faster development of 3GPP Release 17 compliant designs for robust wireless connectivity across a multitude of sectors.

Electronic devices form the very fulcrum of Internet of Things (IoT) services, wireless devices, data centers and 5G technologies. The rapid adoption of these devices is increasing the demand for electronic testing equipment. Further, technological advancements in mobile communications, semiconductors and automotive markets are likely to drive growth. Moreover, the rising demand for power management applications is a key catalyst for Keysight. Sturdy efforts toward modifying the Internet infrastructure and the evolution of smart cars & autonomous-driving vehicles bode well for its future growth potential.

Keysight’s efforts in emerging growth markets like IoT and high-speed data centers bode well for the top line. Particularly, management’s focus on Automotive and Energy, and Aerospace and Defense domains augurs well in the long haul. The company is expected to benefit from the growing proliferation of electronic content in vehicles, momentum in space and satellite applications and rising adoption of driver-assistance systems globally.

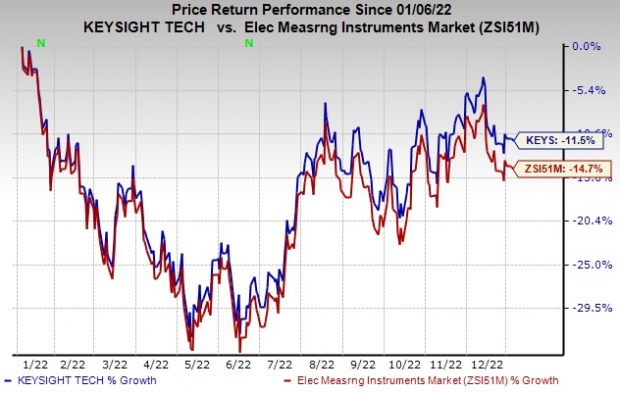

It has lost 11.5% over the past year compared with the

industry

’s decline of 14.7%.

Image Source: Zacks Investment Research

Keysight currently carries a Zacks Rank #3 (Hold).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Ooma Inc.

OOMA

, sporting a Zacks Rank #1, delivered an earnings surprise of 21.7%, on average, in the trailing four quarters. Earnings estimates for Ooma for the current year have moved up 37.8% since March 2022. It has a

VGM Score

of B.

Ooma offers communications services and related technologies for businesses and consumers in the United States and Canada. It helps to create powerful connected experiences for businesses and consumers through its smart cloud-based SaaS platform.

Arista Networks, Inc.

ANET

, sporting a Zacks Rank #1, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 17.5% and delivered an earnings surprise of 12.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200-, and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report