The Kroger Co.

KR

has always been a favorite pick for investors seeking both steady income and growth. This Cincinnati, OH-based company with a strong history of dividend payments as well as sound fundamentals provides a hedge against any odd swings in the stock market. Evidently, Kroger’s strong cash flow generation capability has allowed it to raise dividends consistently over time.

The company once again rewarded investors with a hike in dividend payout. Impressively, the hike marked Kroger’s 16th successive year of dividend increase. The company’s board of directors raised the quarterly dividend by 24% to 26 cents a share, which is payable on Sep 1, 2022, to shareholders of record at the close of business on Aug 15, 2022. Last year in June, the company increased its regular quarterly dividend by 17% to 21 cents.

The latest dividend increase brings its annualized dividend to $1.04 per share compared with the prior rate of 84 cents. The quarterly dividend has increased at a 14% compounded annual growth rate since it was reinstated in 2006.

Backed by sound fundamentals and financial strength, Kroger has time and again demonstrated its commitment to enhance shareholder value. The current hike reflects a strong cash flow generation capability, driven by better execution of operating plans. We note that net cash provided by operating activities totaled $1,102 million at the end of the first quarter of fiscal 2022. Management expects to generate free cash flow between $2 billion and $2.2 billion in the current fiscal year.

We believe that such strategic steps not only drive the shareholder value but also raise the market value of the stock. In fact, companies persuade investors to either buy or hold the scrip through these dividend increases. People looking for regular income from stocks are most likely to choose companies with a track record of consistent and incremental dividend payouts.

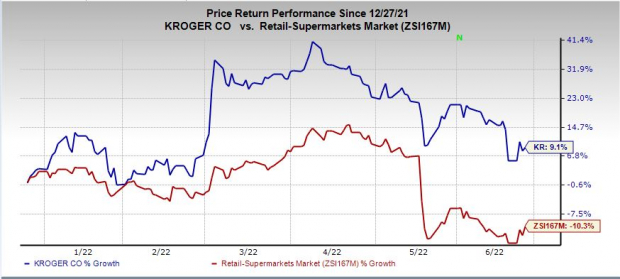

We note that shares of this Zacks Rank #1 (Strong Buy) company have advanced 9.1% in the past six months against the

industry

’s decline of 10.3%. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Image Source: Zacks Investment Research

Read on for More

Kroger, which operates in the thin-margin grocery industry, has been undergoing a complete makeover not only with respect to products but also in terms of the way consumers prefer shopping grocery. The company has been making significant investments to enhance product freshness and quality, and expand digital capabilities. Impressively, Kroger has been introducing new items under its “Our Brands” portfolio and launched 239 new items in the first quarter.

Without a doubt, Kroger’s digital business remains one of its key growth drivers. Considering the current scenario, the company has been focusing on a no-contact delivery option, low-contact pickup service and ship-to-home orders. Its ‘Kroger Delivery Now’ service provides customers with food and household staples in 30 minutes. Also, its focus on the margin-rich alternative profit business bodes well.

Management envisions identical sales without fuel to be up 2.5-3.5% in fiscal 2022 compared with 0.2% growth registered in fiscal 2021. Kroger anticipates FIFO operating profit to be $4.3-$4.4 billion compared with $4.3 billion reported in fiscal 2021. It anticipates fiscal 2022 earnings between $3.85 and $3.95 per share, suggesting an increase from adjusted earnings of $3.68 reported in fiscal 2021.

3 More Stocks Hogging the Limelight

We have highlighted three other top-ranked stocks, namely

Dollar Tree

DLTR

,

Sysco Corporation

SYY

and

United Natural Foods

UNFI

.

Dollar Tree, which operates discount variety retail stores, flaunts a Zacks Rank #1 at present. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average.

The Zacks Consensus Estimate for Dollar Tree’s current financial-year sales and EPS suggests growth of 6.7% and 40.5%, respectively, from the year-ago reported numbers. DLTR has an expected EPS growth rate of 15.5% for three-five years.

Sysco Corporation, which is engaged in the marketing and distribution of various food and related products, sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco Corporation’s current financial year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago period. SYY has an expected EPS growth rate of 11% for three-five years.

United Natural Foods, one of the premier grocery wholesalers delivering the widest variety of fresh, branded, and owned brand products, carries a Zacks Rank #1 at present. UNFI has a trailing four-quarter earnings surprise of 29.9%, on average.

The Zacks Consensus Estimate for United Natural Foods’s current financial-year sales and EPS suggests growth of 7.2% and 4.9%, respectively, from the year-ago reported numbers.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report