Eli Lilly and Company

LLY

announced positive data from a phase III early symptomatic Alzheimer’s disease study called TRAILBLAZER-ALZ 4, comparing its pipeline candidate donanemab head-to-head with active comparator,

Biogen

’s

BIIB

approved Alzheimer’s drug, Aduhelm.

Overall, the data showed that donanemab produced a significant reduction of amyloid buildup in the brain and plasma phosphorylated tau (P-tau) in the blood after six months. Amyloid plaque and P-tau are key biomarkers of Alzheimer’s disease and their reduction is likely to predict clinical benefit in the treatment of early Alzheimer’s disease.

In the study, which assessed donanemab’s superiority over Aduhelm on amyloid plaque reduction, donanemab met all primary and secondary endpoints for the six-month primary outcome analysis. The data were presented at the 15th Clinical Trials on Alzheimer’s Disease conference. The data represented the first active comparator data on amyloid plaque clearance in patients with early symptomatic Alzheimer’s disease treated with amyloid-targeting therapies.

The data showed that 37.9% of donanemab-treated participants experienced brain amyloid clearance compared with 1.6% of Aduhelm-treated patients at six months. Brain amyloid plaque clearance was defined as achieving brain amyloid plaque levels of <24.1 Centiloids. Donanemab reduced brain amyloid plaque levels versus baseline by 65.2% compared with 17.0% for Aduhelm at six months, thereby meeting a key secondary outcome. In an exploratory outcome, donanemab treatment significantly reduced plasma P-tau217 at six months compared to baseline.

As far as the safety profile of the candidates is concerned, the incidence of total amyloid-related imaging abnormalities (ARIA), a brain swelling side effect associated with anti-amyloid antibodies, was 26.1% in the Aduhelm arm compared to 25.4% in the donanemab arm. Importantly, though treatment with donanemab led to much greater amyloid clearance than Aduhelm, it was not associated with a higher rate of ARIA.

Eli Lilly’s biologics license application (BLA) seeking accelerated approval of donanemab, based on data from the TRAILBLAZER-ALZ study, is already under priority review with the FDA. A decision is expected in early 2023.

Lilly also expects a data readout from the pivotal phase III TRAILBLAZER-ALZ 2 by mid-2023, which, if positive, will form the basis of its application for traditional regulatory approval for donanemab.

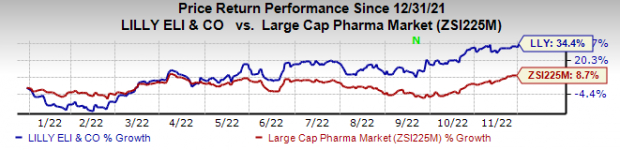

Lilly’s stock has risen 34.4% this year so far compared with an increase of 8.7% for the

industry

.

Image Source: Zacks Investment Research

Biogen Aduhelm’s FDA approval in June 2021 faced a lot of criticism about its mixed efficacy results, the FDA selection of the accelerated approval path and the regulatory process in general. The FDA approved Aduhelm despite an FDA advisory committee voting against its approval due to mixed outcomes data from ENGAGE and EMERGE phase III studies. All these issues affected demand, patient access and reimbursement for Aduhelm, which resulted in the slow launch. Eventually, Biogen decided to substantially wind down commercial operations of Aduhelm after Medicare limited the coverage for Aduhelm to only for patients enrolled in CMS-approved studies as its efficacy was under question.

Earlier this week, Biogen’s Japanese partner, Eisai presented detailed data from their large phase III confirmatory study, Clarity AD, on another anti-amyloid beta protofibril antibody candidate lecanemab to treat early Alzheimer’s disease at the CTAD conference. The data showed that Biogen’s candidate did reduce markers of amyloid in early Alzheimer’s disease and led to moderately less decline in measures of cognition and function than placebo at 18 months. However, the treatment with lecanemab was associated with adverse events.

Biogen/Eisai have already filed their BLA seeking accelerated approval for lecanemab with the FDA. The BLA was supported by data from a phase II study (Study 201). The FDA accepted the BLA and granted priority review to the same. The FDA’s decision is expected on Jan 6, 2023.

Eisai plans to file for traditional approval of lecanemab in the United States and submit regulatory applications in the EU and Japan by the end of the first quarter of 2023 based on data from the Clarity AD study

Biogen has developed lecanemab in collaboration with Eisai, with the latter leading the clinical development and regulatory submissions

Roche’

s

RHHBY

phase III GRADUATE I and II studies on gantenerumab, also an anti-amyloid beta antibody,

failed to meet the primary endpoint

of slowing clinical decline in people with early Alzheimer’s disease earlier this month. In the study, participants treated with gantenerumab showed a slowing of the clinical decline of -0.31 and -0.19, respectively in the GRADUATE I and GRADUATE II studies from the baseline score on the Clinical Dementia Rating-Sum of Boxes scale. However, this decline was not statistically significant in either of the studies. This represented a relative reduction in the clinical decline of 8% in GRADUATE I and 6% in GRADUATE II compared with placebo. The level of beta-amyloid removal by gantenerumab was less than expected. Roche was developing the candidate in collaboration with MorphoSys.

Zacks Rank & Stock to Consider

Eli Lilly has a Zacks Rank #3 (Hold) currently. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

A better-ranked large drugmaker is

Vertex Pharmaceuticals

VRTX

, which has a Zacks Rank #2 (Buy) at present.

Vertex Pharmaceuticals’ stock has risen 44.1% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.52 to $14.61 per share, while that for 2023 have increased from $15.50 to $15.60 per share over the past 30 days.

Vertex has a four-quarter earnings surprise of 3.16%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report