Lumen Technologies

LUMN

has announced the expansion of Edge Computing Solutions in Europe by investing in the global Edge network.

This expansion is a component of Lumen’s ongoing investment in cutting-edge solutions that modernize digital experiences and meet the requirements of enterprises. The company aims to transform its business operations through product evolution and digitization of customer interactions.

The edge infrastructure and services offer a wide array of solutions to support enterprise innovation and applications of the Fourth Industrial Revolution. These include Lumen Edge Bare Metal, Lumen Network Storage, Lumen Edge Private Cloud and Lumen Edge Gateway.

Businesses may now deploy data-intensive workloads and applications that require low latency at the cloud edge, thanks to edge computing. With increased capacity to power enhanced digital experience, this offers optimum performance and dependability.

Customers can now leverage the Lumen platform to concentrate their efforts on creating and launching applications instead of spending time on infrastructure deployment.

The company has also enabled an additional 100G MPLS and IP network connectivity and improved power and cooling at key edge data center locations as part of the current expansion.

Lumen Edge Computing Solutions meet approximately 70% of enterprise demand in Germany, Belgium, the U.K., France and the Netherlands within 5 milliseconds of latency. It also provides 97% of enterprise demand in the United States, per company reports.

Per a report from

markets and markets

, the edge computing market size is expected to grow from $36.5 billion in 2021 to $87.3 billion by 2026, at a CAGR of 19.0%

Customers can purchase Lumen Edge Computing Solutions online and have access to the platform in one hour.

On Jan 21, 2022, Lumen

announced

a network services contract worth more than $1.2 billion from the U.S. Department of Agriculture (“USDA”). Lumen platform’s edge computing architecture will aid USDA in collecting and analyzing data closer to the edge of the network with secure remote access. As a result, this will significantly save bandwidth and minimize latency.

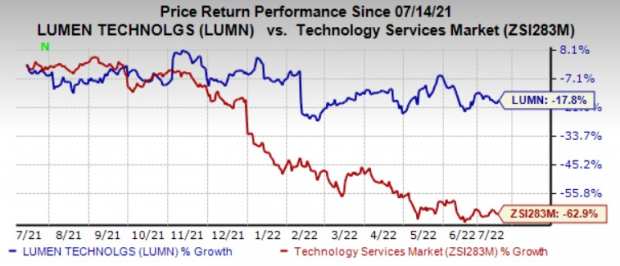

Lumen currently carries a Zacks Rank #3 (Hold). Shares of the company have lost 17.8% compared with the

industry’s

fall of 62.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

, each sporting a Zacks Rank #1 (Strong Buy).You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.50 per share, increasing 1.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.4%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 25.7% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.47 per share, rising 7.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 10.1% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have lost 0.5% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report