Shares of

Magenta Therapeutics

MGTA

slumped 52.7% on Tuesday after management announced that it has stopped dosing participants in a phase I/II study cohort, evaluating MGTA-117, its investigational leukemia drug.

The dosing in cohort 4 of the study, which evaluated an 0.13 mg/kg dose of MGTA-117, was stopped after dose-limiting toxicities (DLTs) were observed in study participants. Per management, three participants had been dosed in this cohort, out of which DLTs were observed in two. While the first participant did not report any DLT, the second and third participants experienced a respiratory serious adverse event (SAE) related to treatment with MGTA-117. The discovery of these DLTs prompted the stopping rules for dosing in cohort 4. As of Dec 20, both participants have demonstrated improvement in respiratory status.

Magenta has already reported this data to the FDA. Based on the recommendation of the study’s safety Cohort Review Committee, management intends to continue enrolment in cohort 3 of the study, which is evaluating an 0.08 mg/kg dose of MGTA-117. The decision was taken because the company believes this lower drug dose’s benefit/risk profile is tolerable.

A dose escalation clinical trial, the phase I/II study is evaluating MGTA-117 in relapsed/refractory (r/r) acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). The study consists of different cohorts which evaluated different dosing levels of MGTA-117.

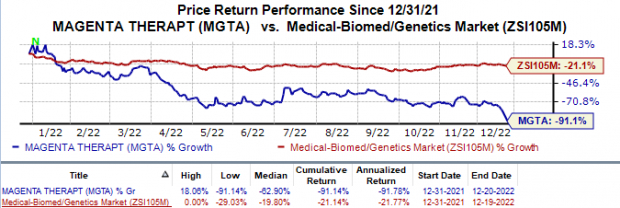

Shares of Magenta were down as investors were concerned with regard to the drug’s safety issues. In the year so far, the stock has plunged 91.1% in the year compared with the

industry

’s 21.1% decline.

Image Source: Zacks Investment Research

Earlier this month, Magenta presented data from the first three cohorts of the study at the 2022 ASH meeting. Data from the three cohorts did not report any DLTs in study participants who completed dosing with MGTA-117. In fact, a majority of the participants who were dosed in cohort 3 reported depletion of cancer blast cells in both blood and bone marrow following dosing with MGTA-117.

Last year in July, the FDA placed a clinical hold on MGTA-117 as the regulatory authority wanted the company to run additional tests on the drug to inform about dose escalation decisions and safety monitoring in clinical studies. Although this clinical hold was subsequently withdrawn in September 2021, it delayed the study’s initiation.

Zacks Rank & Stocks to Consider

Magenta Therapeutics currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include

Amarin

AMRN

,

Kamada

KMDA

and

Pharming Group

PHAR

. While Kamada and Pharming Group sport a Zacks Rank #1 (Strong Buy), Amarin carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 60 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 37.4% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

In the past 60 days, estimates for Pharma Group’s 2022 earnings per share have risen from 3 cents to 5 cents. During the same period, the earnings estimates per share for 2023 have risen from 2 cents to 3 cents. Shares of Pharma Group have risen 18.1% in the year-to-date period.

Earnings of Pharma Group beat estimates in three of the last four quarters while meeting the mark on one occasion, witnessing an earnings surprise of 283.33%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 550.00%.

In the past 60 days, estimates for Amarin’s 2022 loss per share have narrowed from 19 cents to 13 cents. During the same period, the loss estimates per share for 2023 have narrowed from 16 cents to 8 cents. Shares of Amarin have plunged 62.9% in the year-to-date period.

Earnings of Amarin beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 14.29%, on average. In the last reported quarter, Amarin’s earnings beat estimates by 200.00%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report