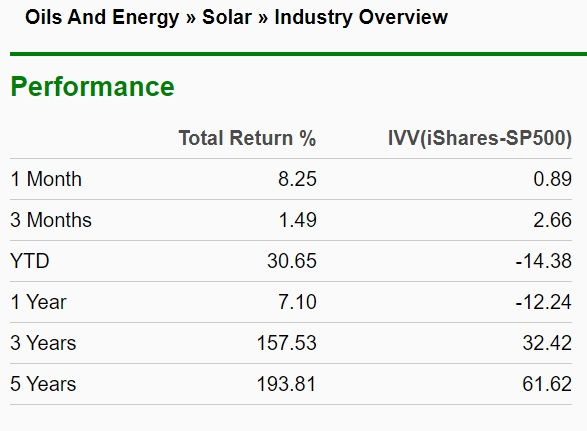

The Zack’s Solar industry has been flourishing in recent years, and there is a high chance the momentum will continue. A few key reasons for this include cost, environmental awareness, and government incentives.

Image Source: Zacks Investment Research

Pictured: The Solar Industry is one of the leading industries in the entire stock market.

Cost

Solar technology costs continue to drop as the industry attracts more investment capital, entrants, and innovation. With the price decrease, more consumers can afford to install panels and generate their own power. On a relative basis, the lower cost makes solar more enticing than ever compared to fossil fuels.

Environmental Awareness

In recent years, consumers have been looking to limit their carbon footprint and switch to clean energy sources. While installing solar is usually more expensive than using traditional sources of electricity (in the short term), many consumers are opting to pay more for solar to reduce their environmental impact.

Government Incentive

The Inflation Reduction Act (IRA) was signed into law by U.S. President Joe Biden in August 2022. The largest beneficiary of the bill is clean energy and solar space. The IRA bill includes $369 billion allocated to advancing renewable energy over the next ten years, amounting to the most extensive spending plan of its kind in U.S. history! What is included in the bill?

· Community Solar Stimulus: Entities buying a piece of a solar project can take advantage of credits based on the amount of electricity their portion produces

· Residential Tax Credits: The IRA extends the 30% federal tax credit on residential solar for 10 years.

· Non-profit Incentives: Tax-exempt organizations such as schools, churches, and other not-for-profit organizations

Government incentives are not limited to the United States. Several European nations have made the push for solar and renewable energy through tax credits and other incentives.

3 Solar Stocks Showing Relative Strength

The best time to look for relative strength is during down markets. Yesterday’s fed-induced drop showed that these three stocks have leadership potential:

Array Technologies Inc

ARRY

Array manufactures ground-mounting systems used in solar energy projects. On Wednesday, shares broke out and zoomed higher by 8.28% on volume 60% above the 50-day average. The stock holds a Zacks Ranking of 3 but sports impressive revenue growth. Last quarter, revenue grew by 173% year-over-year.

Image Source: Zacks Investment Research

Pictured: ARRY staged an impressive break out during a red market session.

First Solar

FSLR

First Solar is a leading global provider of solar energy solutions. The company’s solar modules include a proprietary thin-fil semiconductor technology. First Solar has a strong foothold in Germany, where solar adoption is further ahead than most countries. While First Solar’s earnings have been spotty in recent quarters, its stock performance has not been. FSLR is up 83.6%, while the major indices are red on the year. Yesterday, the stock rose nearly 2% in a red tape.

Image Source: Zacks Investment Research

Pictured: FSLR continues to be unbothered by market conditions.

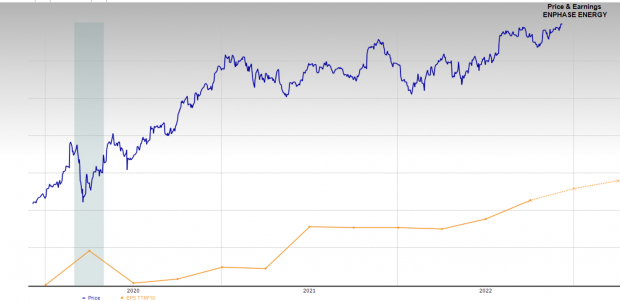

Enphase Energy

ENPH

Fremont, California-based

Enphase Energy (ENPH)

isa solar technology company that manufactures solar micro-inverters, energy storage solutions, and electronic vehicle (EV) charging stations. Enphase’s marquee product is the unique Enphase solar micro-inverter, which differs and improves on the central inverters used by most in the industry. The biggest qualm that most prospective clients have with solar panels is cost, which is directly linked to efficiency. By addressing this problem with its unique solution, Enphase has captured nearly 50% of the global market share for residential micro-inverters. The $45 billion is up 81.9% year-to-date and is breaking out yet again.

Image Source: Zacks Investment Research

Pictured: ENPH is a top performer and breaking out yet again.

Other strong performers include

Shoals Tech

SHLS

, Sun Run

RUN

,

and

Maxeon Solar

MAXN

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report