McKesson Corporation

MCK

recently announced that its independent specialty pharmacy specializing in oncology and rare disease areas, Biologics by McKesson, was selected by Aadi Bioscience as a specialty pharmacy provider for FYARRO (sirolimus protein-bound particles for injectable suspension) (albumin-bound). The therapy is a mTOR inhibitor indicated for the treatment of adult patients with locally advanced unresectable or metastatic malignant perivascular epithelioid cell tumor (PEComa).

FYARRO was approved by the FDA in November for the treatment of PEComa.

The availability of FDA-approved drug is expected to significantly solidify McKesson’s foothold in the global cancer treatment space and boost its U.S. Pharmaceutical business.

Significance of the Availability

Per management, patients with advanced malignant PEComa have limited treatment options and face a poor prognosis. Management also feels that the availability of the drug via its Biologics specialty pharmacy will likely provide a treatment option to these patients.

Industry Prospects

Per a report by Straits Research

, the global oncology cancer drugs market was valued at $148,050.6 million in 2021 and is anticipated to reach $288,636.6 million by 2030 at a CAGR of 7.7%. Factors like the rise in the incidence of various cancer conditions and the growing popularity of advanced therapies (such as biological and targeted drug therapies) are expected to drive the market.

Given the market potential, the recent drug availability is expected to strengthen McKesson’s position in the global oncology care space.

Recent Developments

This month, McKesson announced that Biologics by McKesson has been selected by Rigel Pharmaceuticals as one of two specialty pharmacies in a limited distribution network for REZLIDHIATM (olutasidenib).

Also, this month, Biologics by McKesson was selected by Mirati therapeutics as one of two specialty pharmacies in a limited distribution network for KRAZATI (adagrasib).

Last month, McKesson announced its second-quarter fiscal 2023 results, where it recorded a solid uptick in the overall top line. This was primarily driven by growth in the U.S. Pharmaceutical segment resulting from increased specialty product volumes (including retail national account customers) and market growth.

Price Performance

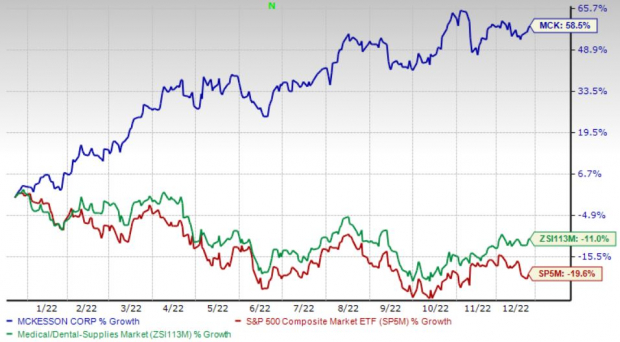

Shares of the company have gained 58.6% in the past year against the

industry

’s 11% decline and the S&P 500’s 19.5% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, McKesson carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are

Exact Sciences Corporation

EXAS

,

ShockWave Medical, Inc.

SWAV

and

Merit Medical Systems, Inc.

MMSI

.

Exact Sciences, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 27.5%. EXAS’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, the average beat being 0.6%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exact Sciences has lost 31.9% compared with the

industry

’s 22.5% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 22.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 17.4% against the

industry

’s 28.7% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 11.2% against the industry’s 11% decline over the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report