Medtronic plc

MDT

announced the receipt of the FDA approval for the Onyx Frontier drug-eluting stent (DES). The Onyx Frontier DES is utilized for treating patients with coronary artery disease (CAD).

The recent FDA approval is likely to fortify Medtronic’s Coronary & Renal Denervation business, which is part of the company’s Cardiovascular portfolio.

For investors’ note, the Onyx Frontier DES is now approved in the United States and is pending the CE Mark.

More on Onyx Frontier DES

The Onyx Frontier drug-eluting stent utilizes the same stent platform as Resolute Onyx DES, with an improved delivery system developed to boost deliverability and increase acute performance in even the most complex cases.

The Onyx Frontier also offers a broad size matrix to treat more patients and is the only 2.0 mm DES available in the United States (similar to Resolute Onyx). Apart from this, Onyx Frontier continues to provide 4.50-5.00 mm sizes that can be expanded to 6.00 mm, particularly developed to support extra-large vessels.

Benefits of the Onyx Frontier DES

Per Medtronic’s management, the Onyx Frontier DES FDA approval marks a significant milestone for Medtronic’s Coronary business and represents the company’s commitment to interventional cardiologists through the availability of best-in-class products. With its advanced deliverability, the Onyx Frontier DES will continue to support interventional cardiologists to treat complex coronary cases and larger ranges of vessel sizes efficiently.

Image Source: Zacks Investment Research

Notably, in the United States, CAD is the leading cause of death for men and women. In order to restore blood flow caused by CAD, physicians may use a stent that is delivered during a minimally invasive procedure to prop open the artery. Notably, a drug-eluting stent is the most common type used to treat a blockage of the heart arteries.

Industry Prospects

Per a report by Grand View Research

, the global coronary stent market size was estimated at $7.7 billion in 2019 and is expected to witness a CAGR of 4.7% by 2027. The rising prevalence of cardiovascular diseases such as stroke and heart attack, along with the growing geriatric population at higher risk of these cardiac diseases, is driving the market.

Recent Developments

In February 2022, Medtronic announced the receipt of the FDA’s expanded approval for Freezor and Freezor Xtra Cardiac Cryoablation. Cryoablation catheters can minimize the risk of permanent AV block, a complication of AVNRT procedures performed with radiofrequency ablations that lead to the partial or complete interruption of the heart’s electrical signals, which dangerously disrupt the heart rhythm.

In January 2022, Medtronic announced that the Micra AV Transcatheter Pacing System had been approved for the sale and reimbursement by Japan’s Ministry of Health, Labor and Welfare. The company is set to launch the product this month. The Micra AV is used to treat patients who have atrioventricular (AV) block. It delivers the benefits of leadless pacing to a greater number of patients.

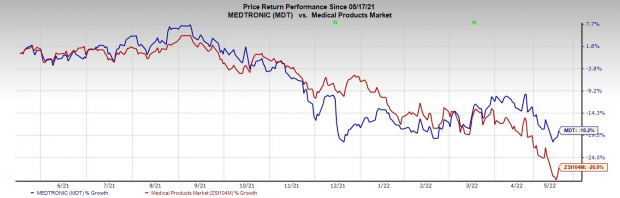

Price Performance

Shares of the company have lost 18.2% in a year compared with the

industry

‘s rise of 26%.

Zacks Rank and Key Picks

Medtronic currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical space are

UnitedHealth Group Incorporated

UNH

,

Medpace Holdings, Inc.

MEDP

and

Alkermes plc

ALKS

.

UnitedHealth, having a Zacks Rank #2 (Buy), reported first-quarter 2022 earnings per share (EPS) of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 14.2%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. ALKS currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report