Merck

MRK

entered into an exclusive license and collaboration agreement with Kelun-Biotech, a clinical-stage biotech company, to develop seven antibody-drug conjugates (ADC) for treating cancer.

Per the terms of the agreement, Kelun-Biotech will grant exclusive rights to research, develop, manufacture and market multiple ADC therapies, including exclusive options to obtain additional licenses to these ADC candidates. In consideration of entering into the agreement, Merck will make an upfront payment of $175 million to Kelun-Biotech. Merck also intends to make an equity investment in Kelun-Biotech.

In addition, Kelun-Biotech will also be eligible to receive potential milestone payments totaling up to $9.3 billion. Kelun-Biotech will have an option to retain these rights for the ADC candidates in mainland China, Hong Kong and Macau. If this option is exercised by Kelun-Biotech, these milestone payments are likely to lessen. Kelun-Biotech will also be eligible to receive single-digit royalties on the future sales of these ADC candidates.

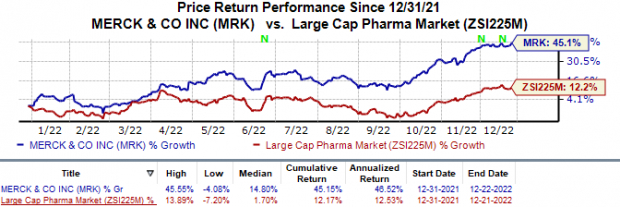

Shares of Merck have risen 45.2% this year so far compared with the

industry

’s 12.2% increase.

Image Source: Zacks Investment Research

This agreement between Merck and Kelun-Biotech extends previously-entered collaborations between the companies. Apart from this agreement, the companies are already developing two ADC candidates for treating cancer indications. This includes the development of MK-2870/SKB-264, an investigational TROP2 targeting ADC, which is being evaluated in clinical studies targeting solid tumor indications, including breast and lung cancers.

A holding subsidiary of Sichuan Kelun Pharmaceutical Co., Ltd, Kelun-Biotech developed multi-modal drug discovery platforms to develop therapeutic pipeline antibody candidates targeting oncology indications.

With the signing of this deal, Merck aims to boost its oncology portfolio, which is currently being dominated by its blockbuster PD-L inhibitor Keytruda, currently approved for treating multiple cancers across the globe. During the first nine months of 2022, Merck generated $15.5 billion from Keytruda sales. However, the drug faces the loss of patent exclusivity later in the decade.

Apart from Keytruda, Merck also markets Lynparza in partnership with

AstraZeneca

AZN

. Merck/AstraZeneca’s Lynparza is approved for four cancer types, namely ovarian, breast, prostate and pancreatic. In the first nine months of 2022, Lynparza generated product sales of $1.95 billion for AstraZeneca and alliance revenues of $825 million for Merck.

The profit-sharing deal between AstraZeneca and Merck was inked in 2017. In addition to Lynparza, the deal included Koselugo.

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold).A couple of better-ranked stocks in the overall healthcare sector include

Kamada

KMDA

and

Sanofi

SNY

. While Kamada sports a Zacks Rank #1 (Strong Buy), Sanofi carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 60 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 40.3% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

In the past 60 days, estimates for Sanofi’s 2022 earnings per share have risen from $4.02 to $4.27. During the same period, the earnings estimates per share for 2023 have risen from $4.22 to $4.31. Shares of Sanofi have declined 3.8% in the year-to-date period.

The earnings of Sanofi beat estimates in each of the last four quarters, witnessing an earnings surprise of 9.50%, on average. In the last reported quarter, Sanofi’s earnings beat estimates by 9.85%.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report