Merck

MRK

announced that the Food and Drug Administration (“FDA”) approved the label expansion of its blockbuster drug, Keytruda, for treating certain patients with advanced endometrial carcinoma.

The FDA approved Keytruda, a PD-1 inhibitor, as a single therapy for treating patients with advanced endometrial carcinoma, which has been determined as microsatellite instability-high (“MSI-H”) or mismatch repair deficient (“dMMR”), and who have disease progression following prior systemic therapy in any setting and are not candidates for curative surgery or radiation.

The approval is based on the data from two cohorts of the KEYNOTE-158 study, which evaluated Keytruda in 90 patients with unresectable or metastatic MSI-H or dMMR endometrial carcinoma. 41 participants responded to the treatment, with the study achieving an objective response rate of 46% at a median follow-up time of 16 months. Out of the 41 participants, 68% achieved responses, which lasted for at least 12 months, while 44% achieved responses, which lasted for at least 24 months.

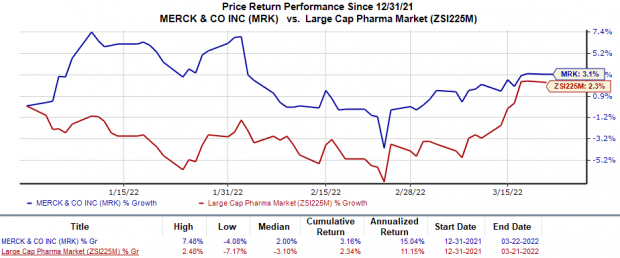

Merck stock has risen 3.2% this year so far in comparison with the

industry

’s 2.3% rise.

Image Source: Zacks Investment Research

Endometrial carcinoma is the most common form of uterus cancer. In 2022, management estimates that more than 65,000 patients will be diagnosed with uterine body cancer in the United States.

We remind investors that this is the second indication for Keytruda in endometrial carcinoma. Keytruda is already approved in combination with partner Eisai’s Lenvima for treating advanced endometrial carcinoma, which has not been determined MSI-H or dMMR in patients who have disease progression following prior systemic therapy in any setting and are not candidates for curative surgery or radiation.

The FDA approval is also Keytruda’s fourth approval in a gynecologic cancer indication. While the drug is now approved for two endometrial cancer indications, it is also approved for two cervical cancer indications.

Keytruda, which is the key revenue generator for Merck, is already approved for the treatment of many cancers globally. For the full year 2021, MRK recorded $17.2 billion as product revenues from Keytruda. Keytruda sales are gaining from the continued uptake in treating lung cancer and increasing usage in other cancer indications. Keytruda is continuously growing and expanding into new indications and markets globally.

Merck is also evaluating Keytruda across several indications that are progressing well. Keytruda is being studied for more than 30 types of cancer indications in more than 1700 studies, including combination studies.

Merck is aiming to establish a broad portfolio of therapies in gynecologic and breast cancer indications. To achieve this goal, the company is not only engaged in an extensive clinical program for Keytruda but also evaluating other drugs.

Lynparza, a PARP inhibitor, is being developed and commercialized by Merck in collaboration with

AstraZeneca

AZN

. Merck/AstraZeneca’s Lynparza is already approved for two indications in breast cancer.

Lynparza is approved for four cancer types — ovarian, breast, prostate and pancreatic — in various patient populations. Both Merck and AstraZeneca are also evaluating Lynparza in a range of tumor types. The drug generated product sales of $2.35 billion for AstraZeneca in 2021 and alliance revenues of $989 million for MRK.

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include

BioDelivery Sciences

BDSI

and

Vertex Pharmaceuticals

VRTX

, each carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

BioDelivery Sciences’ earnings per share estimates for 2022 have increased from 33 cents to 38 cents in the past 30 days. Shares of BDSI have surged 80.5% year to date.

Earnings of BioDelivery Sciences beat estimates in three of the last four quarters and missed the mark once, the average surprise being 33.7%.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $14.33 to $14.52 in the past 30 days. Shares of VRTX have risen 14% year to date.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report