Merck

MRK

announced that the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) has recommended the label expansion of its blockbuster cancer drug, Keytruda, as monotherapy for the adjuvant treatment of patients aged 12 years and older with stage IIB or IIC melanoma and who have undergone complete resection.

The European Commission (EC) generally considers the CHMP recommendation while approving a marketing authorization application (MAA) for a particular drug in Europe. The positive opinion from the CHMP regarding Keytruda’s MAA for monotherapy for the adjuvant treatment in melanoma patients will likely be followed by an approval by the EC. Apart from stage IIB or IIC melanoma, the CHMP has also recommended the label expansion of Keytruda to include adolescent patients aged 12 years and older with advanced melanoma and stage III melanoma. The drug is already approved for these advanced disease stages in adults.

Potential approvals to the aforementioned label expansions of Keytruda will make the drug the first anti-PD-1 immunotherapy treatment option for adults and adolescents in Europe for treating melanoma across different stages of the diseases — stage IIB, IIC and III melanoma — following complete resection.

The positive CHMP opinion in stage IIB and IIC melanoma is based on data from the phase III KEYNOTE-716 study that evaluated Keytruda in combination with placebo for up to one year in patients with completely resected stage IIB or IIC melanoma. In the study, Keytruda demonstrated a statistically significant improvement in recurrence-free survival, thereby reducing the risk of disease recurrence or death by 35% compared to placebo.

In December last year, the FDA approved Keytruda as an adjuvant treatment for adults and adolescents with stage IIB or IIC melanoma following complete resection. The FDA also approved the label expansion of the drug to include adolescents with stage III melanoma following complete resection.

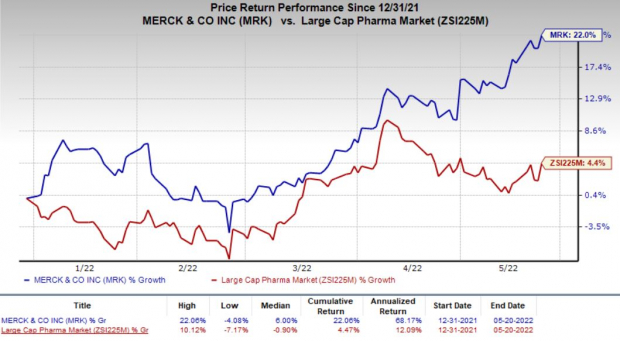

Merck’s stock has gained 22% this year so far compared with the

industry

’s 4.4% rise.

Image Source: Zacks Investment Research

Merck has seen robust success with Keytruda. The company recorded $4.8 billion in sales of Keytruda during the first quarter of 2022. The company has been consistently expanding the label of the drug to include lucrative indications as well as cancer indications with limited treatment options. These label expansions have helped the company to drive sales growth in the past years and are likely to continue to do so in the future.

Undoubtedly, Keytruda has strong growth prospects based on increased utilization, approval for new indications, and the expectation of additional approvals worldwide. Though Keytruda is perhaps Merck’s biggest strength and a solid reason to own the stock, it can also be argued that the company is excessively dependent on the drug and should look for ways to diversify its product lineup.

Merck is also evaluating Keytruda across a wide number of indications that are progressing well. In fact, Keytruda is being studied for more than 30 types of cancer indications in more than 1700 studies, including combination studies. Label expansions for new cancer indications, if approved, can further boost sales.

Bristol Myers

BMY

markets its immuno-oncology drug, Opdivo, which is approved for various oncology indications and poses stiff competition to Keytruda in many targeted indications. Bristol Myers’ Opdivo is approved as both monotherapy and in combination with marketed drugs, Yervoy and Cabometyx for the treatment of adults with advanced RCC.

For the first quarter, Bristol Myers recorded $2 billion in revenues from the sales of Opdivo.

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold).

Some better-ranked biotech stocks are

Alkermes

ALKS

and

Sesen Bio

SESN

, both sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Alkermes’ 2022 loss per share has narrowed from 13 cents to 3 cents in the past 30 days. Shares of ALKS have risen 29% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%.

The Zacks Consensus Estimate for Sesen Bio’s 2022 loss has declined from 33 cents to 32 cents per share in the past 30 days. Shares of SESN have declined 39.4% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report