Shares of the popular COVID-19 vaccine-maker,

Moderna

MRNA

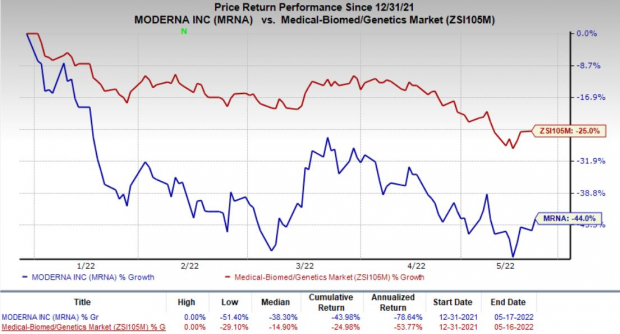

gained 4.4% on May 17 amid a 2% rise of the broader S&P 500 Index. The company’s shares also received a boost likely due to the FDA authorization of a competing COVID-19 vaccine’s booster dose for emergency use in children. However, Moderna’s shares have declined 44% so far this year compared with the

industry

’s decrease of 25%.

Image Source: Zacks Investment Research

Yesterday, pharma-giant

Pfizer

PFE

and its COVID-19 vaccine maker partner,

BioNTech

BNTX

announced that the FDA expanded their emergency use authorization (EUA) for Comirnaty to include the use of a booster dose in children aged between 5 years and 11 years, at least five months after the second dose of the two-dose primary series.

Please note Pfizer and BioNTech’s Comirnaty is also authorized as a two-dose primary vaccine for use in this age group.

Moderna’s Spikevax is currently authorized/approved for use in adults only in the United States. Although it has gained authorization for certain younger population in other countries, a EUA request for the use of Spikevax in adolescents has been under review with the FDA since late last year. Additional data related to the safety and immunogenicity of a lower dose in adolescents compared to the requested dose in the EUA is delaying the authorization. Moderna is planning to file data from a study evaluating the lower dose soon. The company is also evaluating a booster dose of Spikevax for use in adolescents.

Moderna has also filed EUA requests with the FDA for the use of Spikevax in children aged 6 months to 11 years. However, the FDA is unlikely to authorize its use in the younger population before deciding on the use of Spikevax in adolescents.

Potential authorizations to these EUA requests will likely accelerate the delivery of Moderna’s contracted doses with the U.S. government in 2022. The company has $21 billion of advance purchase agreements in place with different countries, of which it recorded more than $6 billion during the first quarter. The delay in authorizations by the FDA is pushing Moderna backward in competition to Pfizer and BioNTech. This is evident from the fact that Pfizer expects $32 billion in revenues from the sale of Comirnaty and its booster doses in 2022, almost 52% more than Moderna’s anticipated sales.

However, investors were likely buoyed by the FDA’s authorization for Comirnaty’s booster dose for children and are likely anticipating a similar regulatory decision for Moderna as soon as it files additional data from the lower-dose adolescent study.

Meanwhile, both Moderna’s Spikevax and Pfizer/BioNTech’s Comirnaty are likely to benefit from the unfavorable label update for

J&J

’s

JNJ

single-shot COVID-19 vaccine. Earlier this month, J&J updated the label of its COVID-19 vaccine to mention the risk of thrombosis with thrombocytopenia syndrome (TTS), a rare syndrome characterized by blood clots and low platelet count. This label update should limit the use of J&J’s vaccine in the United States, boosting the prospects of the only two other available COVID-19 vaccines — Spikevax and Comirnaty.

Zacks Rank

Moderna currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report