Here Are 4 Trending Tech Stocks For Your Late November Watchlist

With the start of this short trading week,

tech stocks

appear to be gaining attention in the

stock market

. For the most part, this is understandable given the growing reliance on tech across global markets today. Thanks to the vast reach of the tech industry, investors have plenty of entry points into this ever-evolving space. For example, we could look at the likes of

Astra Space

(

NASDAQ: ASTR

). Through its tech, Astra aims to eventually provide low-cost space logistics services. Over the weekend, the company reportedly delivered a test payload into orbit for the first time. Because of this, it would not surprise me to see investors flocking to ASTR stock today.

At the same time, tech giants like

Apple

(

NASDAQ: AAPL

) are hard at work expanding their portfolios. Just last week, news broke of the company’s plans to build an autonomous vehicle (AV) by 2025. Perhaps because of that, AAPL stock is making new highs today. Meanwhile,

Vonage

(

NASDAQ: VG

), a global cloud communications firm, appears to be in focus now as well. This would be thanks to news of the company being acquired by telecom company

Ericsson

(

NASDAQ: ERIC

) for a whopping $6.2 billion. It seems like Ericsson is keen on expanding its wireless portfolio on a global scale. All in all, the tech world appears to be as busy as ever. On that note, here are four

tech stocks

making plays in the stock market today.

Top Tech Stocks To Buy [Or Sell] This Week

-

GlobalFoundries Inc.

(

NASDAQ: GFS

) -

Nvidia Corporation

(

NASDAQ: NVDA

) -

PayPal Holdings Inc.

(

NASDAQ: PYPL

) -

Datadog Inc.

(

NASDAQ: DDOG

)

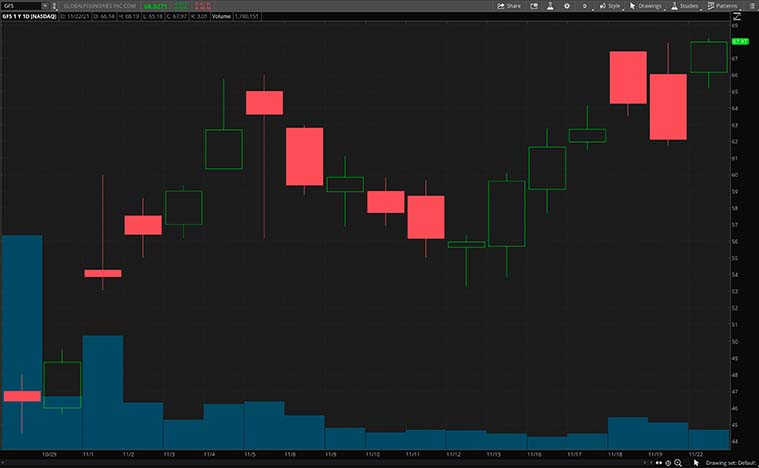

GlobalFoundries Inc.

First up, we have

GlobalFoundries

, a multinational semiconductor contract manufacturing, and design company. In fact, it is one of the world’s leading semiconductor manufacturers. The company offers a unique mix of design, development, and fabrication services. Given its talented and diverse workforce, it has an at-scale manufacturing footprint spanning across the globe. GFS stock is up by over 30% year-to-date.

Today, multiple analysts initiated coverage on the company.

Credit Suisse

(

NYSE: CS

) analyst John Pitzer initiated coverage with an Outperform rating and a price target of $75. The analyst says that the benefits of the company’s 2018 strategic pivot from “bleeding edge” to “pervasive” are just now inflecting and sees semi-cyclical and foundry secular tailwinds for GlobalFoundries. Meanwhile,

Citi

(

NYSE: C

) initiated coverage with a Buy rating and also a $75 price target for GlobalFoundries. All things considered, is GFS stock a buy?

[Read More]

Best Lithium Battery Stocks To Buy Now? 4 To Know

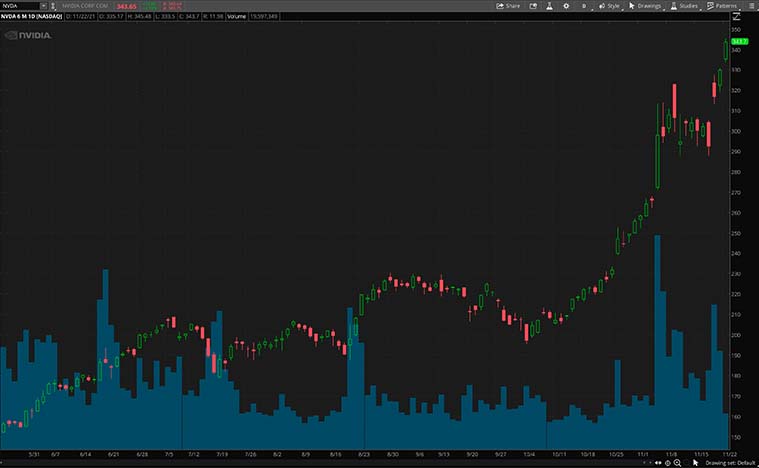

Nvidia Corporation

Nvidia Corporation

is a tech company that manufactures graphics processing units. The company has essentially redefined modern computer graphics and its products are used by billions all over the world. Its products have allowed for high-performance computing and also artificial intelligence (AI) to be widely available to all. This would include industries like health care, manufacturing, and transportation. NVDA stock has been up by over 150% in the past year alone. On Friday, CEO Jensen Huang was reported saying something that could get investors excited.

In detail, he said that the metaverse can save companies billions of dollars in the real world. In an interview on Mad Money, Huang believes that businesses can lean on the metaverse or omniverse as Nvidia prefers to call it, to reduce wastefulness and increase operational efficiency. Through the omniverse, companies will be able to simulate factories, power grids, and a wide number of other industry scenarios to predict efficiency and profitability. With that, companies will be able to buy into this artificial intelligence capability with a small investment and could ultimately save hundreds of billions of dollars. This could help further propel the demand for Nvidia’s AI products and services. With that being said, is NVDA stock worth buying right now?

PayPal Holdings Inc.

Following that, we have

PayPal Holdings

, a multinational financial technology company that owns one of the largest online payments systems in the world. Its platform is used by a majority of countries that support online money transfers. By leveraging technology to make financial services more affordable and secure, the company allows its 400 million consumers and merchants to thrive in a global economy. On November 8, 2021, the company reported its third-quarter financials.

Diving in, total payment volume for the quarter reached a whopping $310 billion, growing by 26% year-over-year. Net revenue for the quarter was $6.18 billion, increasing by 13% compared to a year earlier. PayPal also posted a GAAP earnings per share of $0.92. The company also expects its revenue to grow by approximately 18% for its full-year 2021 and it hopes to end the year with more than 430 million active accounts. Given this strong quarter, should you consider adding PYPL stock to your portfolio today?

[Read More]

5 Metaverse Stocks To Watch In November 2021

Datadog Inc.

Next up, we will be taking a look at

Datadog

. By and large, the company provides observability services for cloud-scale applications. Simply put, Datadog helps organizations monitor and secure their servers via its proprietary Software-as-a-Service (SaaS) platform. Through this platform, Datadog integrates and automates infrastructure monitoring, app performance monitoring, and log management to provide “total real-time observability”. Given the rise in cyberattacks amidst the wave of digital acceleration, SaaS firms like Datadog would be relevant. Evidently, investors appear to be aware of this, with DDOG stock looking at year-to-date gains of over 110%.

Despite its current momentum, Datadog does not appear to be slowing down anytime soon on the operational front. As of last week, the company is now working with

Confluent

(

NASDAQ: CFLT

), a cloud-based big data streaming platform. Through this partnership, Datadog will help Confluent by providing “deep visibility into the health and performance” of its Confluent Cloud platform. According to Datadog’s Senior Director of Product Management, Michael Gerstenhaber, this provides joint clients with a more comprehensive view of their tech stacks. Also, he notes that all this gives customers the “monitoring capabilities they need to deliver superior digital experiences”. As such, will you be investing in DDOG stock anytime soon?