Motorola Solutions, Inc.

MSI

has acquired TETRA Ireland Communications Limited, Ireland’s National Digital Radio Service provider, for an undisclosed amount.

TETRA Ireland offers voice and data land mobile radio (LMR) communications to first responders and frontline workers from national security and enforcement agencies, health and emergency services and state utilities. The network is powered by Motorola’s TETRA digital radio technology.

The acquisition underscores Motorola’s plan to expand its Managed & Support Services business globally. Motorola aims to continue providing interoperable communications for Ireland’s emergency and public service agencies.

The Chicago, IL-based company operates networks and security operations centers worldwide. It helps customers to work more effectively across industries. It is likely to benefit from organic growth and acquisitions by entering into alliances with other players in the ecosystem.

The company is witnessing healthy demand trends in video security, command center software and land mobile radio services, while the demand for professional and commercial radio is also on the rise.

As a leading provider of mission-critical communication products and services, Motorola has ensured a steady revenue stream from this niche market.

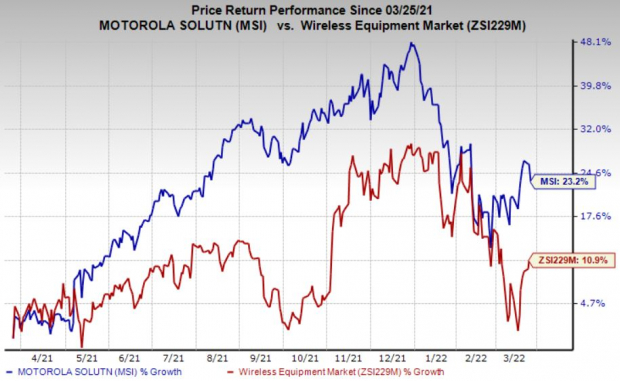

The stock has gained 23.2% in the past year compared with the

industry

’s growth of 10.9%.

Image Source: Zacks Investment Research

The company is well-positioned to benefit from solid order trends, holistic growth initiatives and disciplined capital deployment.

MSI currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Clearfield, Inc.

CLFD

is a better-ranked stock in the broader Zacks

Computer and Technology

sector, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised upward by 20.5% over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has gained 115% in the past year.

Qualcomm, Inc.

QCOM

, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.2% over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 12.2%, on average. It has appreciated 20.1% in the past year.

Sierra Wireless, Inc.

SWIR

carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 237.5% over the past 60 days.

Sierra Wireless pulled off a trailing four-quarter earnings surprise of 58%, on average. The stock has returned 22.1% in the past year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report