Once widely hailed and a staple in many portfolios, the tide has shifted significantly for Netflix

NFLX

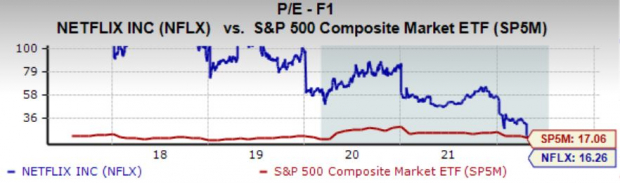

throughout 2022. The chart below shows the year-to-date performance of NFLX shares while blending in the S&P 500.

Image Source: Zacks Investment Research

As we can see, it’s been quite the fall from glory in 2022 for Netflix shares, down close to 70%. It’s been one of the deeper valuation slashes we’ve seen year-to-date, but why?

Subscribers have bailed.

In 2021 Q4, the company provided disappointing guidance that it expected new subscriber adds of 2.5 million in 2022 Q1, well below the consensus of seven million expected.

Fast-forward to 2022 Q1, and the company reported that it had actually lost more than 200,000 subscribers in the quarter – the company’s first subscriber loss in a decade. Following the Q1 report, shares plummeted 35%.

NFLX also provided disheartening guidance again, expecting another drop of two million subscribers for the upcoming quarter to be reported on Tuesday.

Let’s take a closer look at the company to see where it stands heading into the report.

Subscriber Estimates

For the upcoming quarterly release, the Zacks Consensus Estimate for total paid subscribers at the end of the period resides at 220 million, penciling in a 1.8% decrease from 2022 Q1 total paid subscribers of 224.2 million. Clearly, investors would like to see this number grow each quarter consistently.

However, the Zacks Consensus Estimate for the company’s subscriber loss sits at 1.7 million, which is notably better than the company’s guidance of two million.

The company has utilized its pricing power to offset subscriber losses; the Zacks Consensus Estimate for average monthly revenue per paid membership for the quarter sits at $12.11, a 3% increase compared to $11.78 in 2022 Q1.

Subscriber numbers will undoubtedly be the main focus of the quarterly report, and estimates indicate that NFLX hasn’t lost as many subscribers as previously thought.

Growth Estimates

For the upcoming quarter, the Zacks Consensus EPS Estimate resides at $2.90, indicating a marginal 2.3% decrease in quarterly earnings year-over-year. In addition, four analysts have revised their earnings outlook downwards over the last 60 days.

Image Source: Zacks Investment Research

However, the top-line is forecasted to expand – the $8 billion quarterly revenue estimate reflects a 9% uptick in quarterly revenue from the year-ago quarter.

Image Source: Zacks Investment Research

Valuation

Netflix’s valuation levels have come back down to earth following the double-digit valuation slash. Its 16.3X forward earnings multiple is nowhere near its five-year median of 82.9X and a fraction of its unbelievable high of 174.5X.

In addition, shares now trade at a slight 5% premium relative to the S&P 500.

Image Source: Zacks Investment Research

Quarterly Performance

Netflix’s bottom-line results have been mixed over its last ten quarters; the company has exceeded the Zacks Consensus EPS Estimate just five times in this timeframe. In its latest quarter, the streaming giant posted a substantial 20% bottom-line beat, but the focus was on subscriber guidance, and shares plummeted.

However, top-line results have been reported above expectations primarily, with Netflix exceeding quarterly revenue estimates in eight of its previous ten quarters.

Bottom Line

The key metric to watch out for in the quarterly report will be subscriber adds for the quarter. If the company provides further disheartening guidance, shares will most likely suffer, just as they did following the company’s previous quarterly report.

Currently, Netflix

NFLX

is a Zacks Rank #4 (Sell) with an overall VGM Score of a C.

Valuation levels have fallen extensively, but it will be beneficial for investors to have a high level of defense heading into the quarterly report – Netflix’s subscriber issues will be a long-term factor impacting the stock.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report