Stock splits have gained serious traction over the last several years. Generally, a company performs a stock split for a practical reason – the stock price has become too expensive, causing a barrier to entry for potential investors, grinding down overall trading volume.

So far in 2022, we’ve seen Amazon

AMZN

perform a 20-for-1 split, and there are a few more worth noting that are scheduled to take place this year.

Two companies with upcoming stock splits in 2022 include Nintendo

NTDOY

and Alphabet

GOOGL

. Nintendo is slated for a 10-for-1 split, and Alphabet will be performing a 20-for-1 split.

While investors have welcomed both splits, it raises a valid question: Which company looks like a better buy pre-split? Let’s examine each company a little closer to get a more precise answer.

Nintendo

Nintendo

NTDOY

is responsible for many legendary franchises in interactive entertainment, including

The Legend of Zelda

,

Super Mario Brothers

,

Donkey Kong

, and

Pokémon

.

Year-to-date, Nintendo shares have been noticeably stronger than the S&P 500, declining approximately 9% in value.

Image Source: Zacks Investment Research

When extending the time frame to encompass a year’s worth of price action, we can see that NTDOY shares have struggled quite noticeably, declining nearly 30% in value and extensively underperforming the general market.

Image Source: Zacks Investment Research

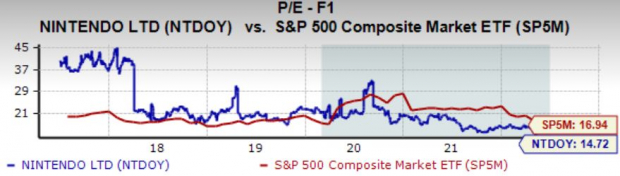

Valuation levels have retraced extensively over the last five years. Nintendo’s current forward earnings multiple resides at 14.7X, a fraction of its 2018 high of 45.3X and nicely below its five-year median value of 20.4X. Additionally, shares trade at an enticing 13% discount relative to the S&P 500.

Image Source: Zacks Investment Research

NTDOY has been on a blazing hot earnings streak, exceeding bottom-line expectations in ten consecutive quarters dating back to late 2019. In its latest quarter, the digital entertainment giant crushed the $0.48 Zacks Consensus Estimate by a triple-digit 110% and reported EPS of $1.01.

However, FY23 earnings are forecasted to decrease by 18% year-over-year. Although this does appear as a red flag, let’s look at a little backdrop.

During the pandemic, when lockdowns were widespread and the outside world was shut down, many people turned to digital entertainment, which heavily aided the top and bottom lines. Now that we’re inching out of the pandemic, the demand for such entertainment has significantly cooled off.

In FY24, the earnings picture turns positive, with the $3.71 per share estimate reflecting a 1.5% growth in earnings year-over-year.

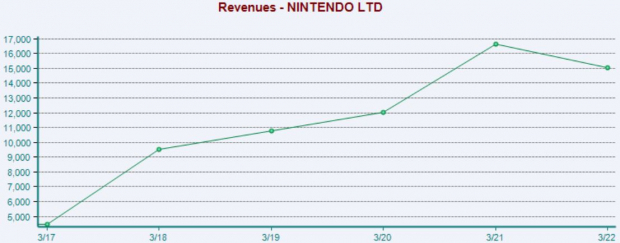

Annual revenue is also forecasted to take a minor hit, with the $14.9 billion sales estimate reflecting a marginal 1.1% decrease in the top line.

Image Source: Zacks Investment Research

Alphabet

Alphabet

GOOGL

has evolved from primarily being a search engine into a company with operations in cloud computing, ad-based video and music streaming, autonomous vehicles, and more.

GOOGL shares have tumbled year-to-date, decreasing approximately 26% in value and underperforming the S&P 500 by a decent margin.

Image Source: Zacks Investment Research

Upon extending the time frame over the last year, the story remains the same – GOOGL shares have struggled, decreasing nearly 15% in value and underperforming the S&P 500 marginally.

Image Source: Zacks Investment Research

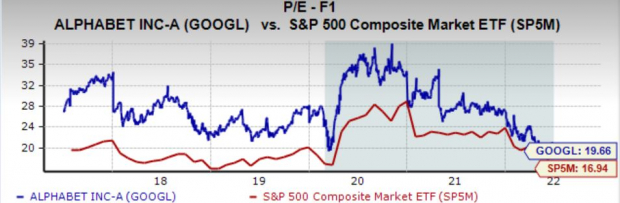

Alphabet’s 19.6X forward earnings multiple appears a bit pricey. However, it’s comfortably below its five-year median value of 27.1X and nowhere near 2020 highs of 39.1X. Additionally, shares trade at a 16% premium relative to the S&P 500’s forward earnings multiple of 16.9X.

Image Source: Zacks Investment Research

Alphabet has consistently reported strong bottom line results, exceeding expectations in eight of its last ten quarterly reports. However, in its latest quarter, the tech titan shocked the world and missed on the bottom line by 4.2%.

Additionally, for FY22, the $110.62 per share estimate reflects a marginal 1.4% decrease in earnings year-over-year, which could be seen as a bit concerning. However, in FY23, the earnings picture turns positive again, with the $129.98 per share estimate reflecting a robust 17% expansion within the bottom line.

Image Source: Zacks Investment Research

The top line forecast appears robust, with the $245 billion FY22 revenue estimate penciling in a substantial 16% expansion in the top line year-over-year.

Image Source: Zacks Investment Research

Bottom Line

Nintendo is an excellent company that provides solid exposure to the rapidly growing gaming industry. In addition to video games, the company can produce diverse revenue streams via content merchandise in the physical world.

However, the company’s flagship console, the Nintendo Switch, is increasingly becoming old relative to the next-gen Xbox Series S|X deployed by Microsoft

MSFT

and Sony’s

SONY

PS5.

On the other hand, Alphabet is another stellar company that provides exposure to another rapidly growing industry – cloud computing. Cloud revenue has been multiplying for the company; cloud revenue saw a 47% year-over-year increase from 2020 to 2021.

It’s challenging to pick a winner. However, I think the winner here is Alphabet, and here’s why – it’s one of the most innovative tech companies in the world and has intertwined itself so profoundly within the internet that it feels unstoppable. Additionally, top and bottom line growth rates are much stronger than Nintendo’s, and Alphabet’s exposure to the booming cloud industry is undoubtedly a major positive that will continue to aid the company extensively.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report