Novartis

NVS

announced that the phase III BELINDA study evaluating Kymriah (tisagenlecleucel) in second-line non-Hodgkin lymphoma (“NHL”) fails to meet its primary endpoint of event-free survival (“EFS”) compared to treatment with the standard-of-care (“SOC”).

The BELINDA study compared the efficacy, safety and tolerability between Kymriah and SOC in patients with aggressive B-cell NHL who had primary refractory disease or those who relapsed within 12 months of first-line treatment.

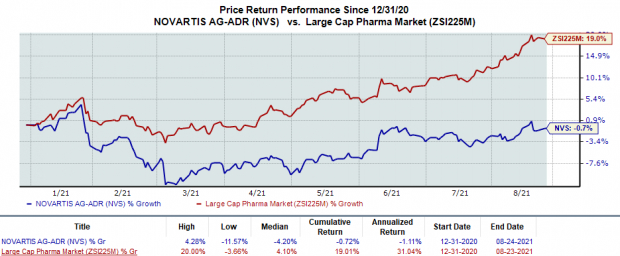

Shares of the company have declined 0.7% so far this year against the

industry

’s 19% surge.

Image Source: Zacks Investment Research

Per the study, EFS is defined as the time from the date of randomization to the date of the first documented disease progression or stable disease at or after the week 12 assessment, per blinded independent review committee, or death at any time.

Novartis will complete a full evaluation of the BELINDA study data and work alongside the study investigators for the same.

Kymriah is a CD19-directed genetically modified autologous T cell immunotherapy. It is currently approved in the United States for the treatment of patients up to 25 years of age with B-cell precursor acute lymphoblastic leukemia that is refractory or in second or later relapse. The therapy is also approved for the treatment of elapsed or refractory adult diffuse large B-cell lymphoma (“DLBCL”). Kymriah is also the first approved CAR-T therapy.

Gilead

’s

GILD

CAR-T therapy, Yescarta, is approved for the treatment of refractory aggressive NHL, which includes DLBCL, transformed follicular lymphoma and primary mediastinal B-cell lymphoma.

Zacks Rank & Stocks to Consider

Novartis currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the same sector are

Horizon Therapeutics

HZNP

and

Regeneron Pharmaceuticals

REGN

, each sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Horizon’s earnings per share estimates for 2021 have increased from $3.62 to $4.46 in the past 30 days. The same for 2022 has risen from $5.18 to $5.84 over the same period. The stock has rallied 47.6% in the year so far.

Regeneron’s earnings per share estimates for 2021 have increased from $49.96 to $54.15 in the past 30 days. The same for 2022 has risen from $40.91 to $44.11 over the same period. The stock has rallied 38.1% in the year so far.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report