Novartis AG

NVS

reported mixed second-quarter 2022 results. The Sandoz business continues to recover and new drugs boosted performance.

Core earnings (excluding one-time charges) of $1.56 per share beat the Zacks Consensus Estimate of $1.51 but were down from $1.66 reported in the year-ago quarter.

However, revenues of $12.8 billion missed the Zacks Consensus Estimate of $12.9 billion. Sales were down 1% from the year-ago quarter. On a constant currency basis, sales were up 5%, driven by momentum in key brands, including Cosentyx, Entresto, Kesimpta, Zolgensma, Kisqali and Leqvio.

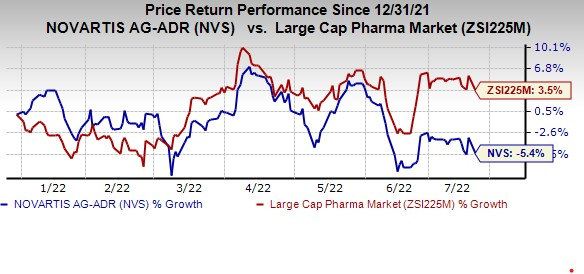

Shares of Novartis have lost 5.4% so far this year against the

industry

’s growth of 3.5%.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-over-year basis and at constant exchange rates.

Quarter in Detail

Swiss pharma giant Novartis operates under two segments — Innovative Medicines and Sandoz (generics).

The Innovative Medicines division recorded sales of $10.5 billion, up 5% year over year, driven by a continued strong performance from Entresto, Kesimpta, Cosentyx, Kisqali and Zolgensma.

Cosentyx sales increased 12% from the prior-year quarter, led by growth in Europe and United States. Entresto sales surged 33% from the year-ago quarter to $1.1 billion due to sustained strong growth with increased patient share across most markets. Increasing contribution from Zolgensma (gene therapy for spinal muscular atrophy) also boosted this business unit, with a sales surge of 26% from the prior-year period to $379 million. Kesimpta sales came in at $239 million on the back of strong sales growth, driven mainly by U.S. launch momentum. Xolair sales totaled $352 million, up 11%.

Strong performance by Kisqali (up 43% to $308 million), Jakavi (up 11% to $398 million), Promacta/Revolade (up 10% to $534 million) and Tafinlar + Mekinist (up 13% to $452 million) also boosted the top line. However, generic competition, mainly for Afinitor/Votubia (down 42% to $143 million) Gleevec/Glivec (down 22% to $194 million), Gilenya (down 19% to $555 million) and Sandostatin (down 9% to $318 million) affected sales.

Sales in the Sandoz division were $2.3 billion, up 5% year over year, benefiting from a return toward normal business dynamics, with growth across all business franchises. Sales in Europe grew 4% as the impact of the pandemic eases out. This was, however, partially offset by a 1% decline in the United States. Global sales of Biopharmaceuticals grew 11%.

The strategic review of Sandoz is on track, and the company expects to provide an update by the end of 2022.

2022 Guidance

Novartis expects net sales for 2022 to grow in the mid-single digits. While Innovative Medicines revenues are projected to grow in the mid-single digits, revenues from Sandoz are now expected to rise in the low single digits (revised upward from broadly in line).

Key Pipeline Updates

During the quarter under review, Cosentyx was approved in the EU for use in the juvenile idiopathic arthritis (JIA) categories of enthesitis-related arthritis (ERA) and juvenile psoriatic arthritis (JPsA) in patients aged six or below.

Kymriah was approved in the United States and EU for use in adult patients with relapsed or refractory follicular lymphoma, after two or more lines of systemic therapy. Jakavi was approved in the EU as the first post-steroid treatment for acute and chronic graft-versus-host disease (GvHD)

Other Updates

In April, Novartis announced a new organizational structure to accelerate growth, strengthen its pipeline and increase productivity. The changes are expected to generate SG&A savings of $1.5 billion (the previous target $1 billion) to be fully embedded by 2024.

Our Take

Novartis’ performance in the second quarter was good on improvement in the lagging Sandoz business and cardiovascular drug Entresto’s momentum. Drugs like Cosentyx, Entresto, Kesimpta, Zolgensma, Kisqali and Leqvio should continue to fuel growth and offset the impact of generic competition.

Novartis is likely looking for strategic acquisitions using the cash proceeds from its stake sale in

Roche

RHHBY

.

In 2021, Novartis sold its 33% stake in Roche for $20.7 billion. The company has been a shareholder of RHHBY since May 2001. NVS initiated a share buyback of up to $15 billion, of which $9.4 billion remains to be executed. The buyback is funded through the proceeds from the recent sale of 53.3 million shares of Roche.

Novartis currently carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks are

Alkermes

ALKS

and

Sarepta

SRPT

. While Alkermes sports a Zacks Rank #1 (Strong Buy), Sarepta has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

ALKS’ loss estimates for 2022 have narrowed to 3 cents from a loss of 14 cents in the past 60 days. Alkermes surpassed earnings in all the trailing four quarters, the average being 350.48%.

Sarepta’s loss per share estimates for 2022 have narrowed by 61 cents in the past 90 days. SRPT’s earnings have surpassed expectations in all of the trailing four quarters, the average surprise being 21.45%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report