Shares of

Novavax

NVAX

fell 26.2% on Jul 14, after the European Medicines Agency’s (EMA) Pharmacovigilance Risk Assessment Committee (“PRAC”) updated the product label of Nuvaxovid, the company’s COVID-19 vaccine, to include some potential side effects like severe allergic reactions and skin problems.

Nuvaxovid is currently authorized in the European Union for use in individuals aged 12 years and older.

Following the assessment, PRAC updated Nuvaxovid’s labeling information to include potential side effects like anaphylaxis (severe allergic reaction) and skin problems such as paraesthesia and hypoaesthesia.

As a result of this label update, PRAC has advised precaution for anaphylaxis, following the administration of the Novavax vaccine. In fact, PRAC stated that individuals who have taken the vaccine should be monitored for at least 15 minutes after receiving a dose of Nuvaxovid for an anaphylactic reaction.

Assessments are ongoing to determine whether the vaccine is responsible for causing heart inflammation diseases like myocarditis/pericarditis. The committee has also requested additional information from Novavax before issuing any final assessment.

Novavax issued a statement based on the updated label information by the EMA. Management stated that while it will update the newly identified risks of the vaccine on the product label, an allergic reaction like anaphylaxis is a common side effect of all types of vaccines. Per the statement, no severe allergic reactions were reported in the clinical study participants.

Per the safety report, as of Jun 26, 2022, about 216,000 doses of Nuvaxovid have been administered in the European Union, ever since the company secured approval in the region, last December.

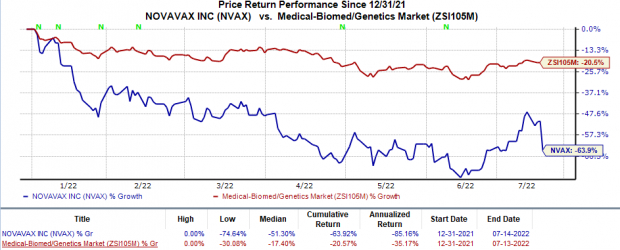

Shares of Novavax have plunged 63.9% so far this year compared with the

industry

’s 20.6% decline.

Image Source: Zacks Investment Research

The above news comes a day after the FDA

granted

emergency use authorization (EUA) to Novavax’s COVID-19 vaccine as a primary two-dose regimen for use in adults aged 18 years and older. Following the grant of EUA, Novavax’s vaccine has become the first protein-based COVID-19 vaccine authorized for use in the United States. This is also the first time that NVAX has received marketing authorization for a product in the United States.

Like the EMA, the FDA too has asked Novavax to conduct clinical studies to further assess the risks of heart inflammation diseases like myocarditis and pericarditis, which were observed in some study participants who were administered Novavax’s vaccine.

Following the EUA grant, the next step for Novavax is to procure a policy recommendation from the Centers for Disease Control and Prevention (CDC). If the CDC grants this recommendation, it will allow the company to

execute

the supply agreement with the U.S. government for 3.2 million doses of its COVID vaccine that was announced earlier this week.

Currently, the U.S. COVID-19 vaccine market is dominated by

Moderna

MRNA

and

Pfizer

PFE

/

BioNTech

BNTX

, which market mRNA-based vaccines. The EUA to Novavax for its COVID-19 vaccine will provide the unvaccinated population with an option to be vaccinated with a protein-based vaccine.

Novavax is currently lagging Moderna and Pfizer/BioNTech, whose vaccines have received full approval for use in adults in the United States. While Moderna’s vaccine is approved for use in adults aged 18 years and older, the Pfizer/BioNTech vaccine is approved for use in individuals aged 12 years and older. Both these vaccines are also authorized for use in individuals aged six months and above in the United States. A third and fourth booster dose of both Moderna and Pfizer/BioNTech vaccines have also been authorized for use in certain age groups by the FDA.

Zacks Rank

Novavax currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report