Novo Nordisk A/S

NVO

reported first-quarter 2022 earnings of 94 cents per American Depositary Receipt (“ADR”), which surpassed the Zacks Consensus Estimate of 85 cents. The company had reported earnings of 88 cents in the year-ago quarter.

Revenues of $6.34 billion increased 24% in Danish kroner and were up 18% at constant exchange rate (“CER”) in the reported quarter. Revenues surpassed the Zacks Consensus Estimate of $5.82 billion. Year over year, sales were driven by higher Diabetes and Obesity care sales as GLP-1 sales increased.

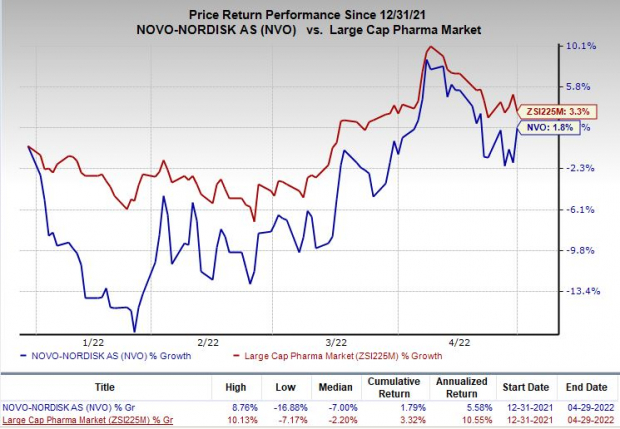

Shares of Novo Nordisk have gained 1.8% so far this year compared with the

industry

’s rise of 3.3%.

Image Source: Zacks Investment Research

All growth rates mentioned below are on a year-over-year basis.

Quarter in Detail

Novo Nordisk operates under two segments — Diabetes and Obesity Care, and Biopharmaceuticals.

The Diabetes and Obesity Care segment sales grew 20% at CER. In Diabetes Care, fast-acting insulin, Fiasp’s revenues rose 20% at CER. NovoRapid revenues remained flat at CER, while Human insulin revenues were down 14% at CER. Premix insulin (Ryzodeg and NovoMix) revenues declined 3% at CER. Sales of long-acting insulins (Tresiba, Xultophy and Levemir) decreased 4% at CER. Ozempic had witnessed a strong launch and recorded sales of DKK 12.03 billion for the quarter, up 70% at CER.

Obesity Care (Saxenda and Wegovy) sales were up 107% at CER year over year.

Per the company, the contract manufacturer filling syringes for Wegovy has reinitiated commercial production, and Novo Nordisk expects to make all Wegovy dose strengths available in the United States in the second half of 2022.

In December 2021, Novo Nordisk announced that a contract manufacturer in the United States, which was filling syringes for Wegovy pens, has temporarily stopped deliveries and manufacturing after issues with goods-manufacturing practices.

Sales in the Rare disease segment were up 3% at CER year over year to DKK 5,363 million. Sales of rare blood disorder products were DKK 3,077 million, up 9% at CER. Sales of hemophilia A products increased 10% at CER. Also, Hemophilia B products’ sales rose 18% at CER. Sales of NovoSeven were up 8% at CER to DKK 2,271 million.

Sales and distribution costs climbed 23% in Danish kroner and increased 18% at CER year over year. This increase was due to International Operations and North America Operations reflecting the launch of Rybelsus and promotional activities related to Ozempic.

Research and development costs were up 32% in Danish kroner and increased 29% at CER from the year-ago quarter’s level. Higher costs were driven by clinical activity for late-stage studies.

Administrative costs increased 4% in Danish kroner and were up 2% at CER from the year-ago quarter’s level.

2022 Outlook

Novo Nordisk now expects 10-14% sales growth at CER, which was previously expected to be 6-10%. The guidance indicates steady sales growth in North America Operations and International Operations, primarily driven by Diabetes and Obesity Care. The guidance also reflects the expectation of meeting the demand for Wegovy in the United States. This apart, the outlook implies intensifying competition in both Diabetes Care and Rare disease units.

Persistent pricing pressure within Diabetes Care, especially in the United States, might also negatively impact sales.

Our Take

Novo Nordisk’s revenues and earnings beat estimates in the first quarter of 2022. Ozempic is off to a solid start and the launch of Rybelsus looks encouraging. Saxenda, too, has witnessed strong uptake so far. Also, the approval for Wegovy in the EU for the treatment of obesity in January 2022 is likely to boost sales of the drug in the days ahead.

Zacks Rank & Stocks to Consider

Novo Nordisk currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the healthcare sector include

BioMarin Pharmaceutical Inc.

BMRN

,

Voyager Therapeutics, Inc.

VYGR

and

Vertex Pharmaceuticals Incorporated

VRTX

. While BioMarin sports a Zacks Rank #1 (Strong Buy), Voyager Therapeutics and Vertex carrys a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

BioMarin’s earnings estimates have been revised 1.6% upward for 2022 and 1.5% for 2023 over the past 60 days.

Earnings of BMRN surpassed estimates in each of the trailing four quarters.

Loss per share estimates for Voyager Therapeutics have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The stock has skyrocketed 170.5% year to date.

Earnings of VYGR surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Vertex’s earnings estimates have been revised 0.3% upward for 2022 and 0.2% upward for 2023 over the past 60 days. The stock has rallied 24.4% year to date.

Earnings of VRTX surpassed estimates in each of the trailing four quarters.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report