The semiconductor space is an ever-changing, evolving, and innovative area of business and technology. Nvidia

NVDA

and Taiwan Semiconductor

TSM

remain at the top of the semiconductor food chain in terms of diversity.

Let’s see which of these semiconductor leaders could be the better investment going into 2023.

Brief Overview

Nvidia is renowned for its invention of graphic processing units (GPUs) with its range of expertise in the data center, professional visualization, and gaming markets.

While there are not many semiconductor companies that can compete with Nvidia’s broad range of dominance, Taiwan Semiconductor is a viable opponent in this regard.

Taiwan Semiconductor is the world’s largest dedicated integrated circuit foundry. Founded in 1987, the company manufactures integrated circuits for its customers based on their proprietary designs with one of its most notable clients being Apple

AAPL

.

Taiwan Semiconductor produces the chips used In Apple’s iPhones, iPods, and Mac computers. Furthermore, Taiwan Semiconductor assists with the production of over 12,300 products for over 535 clients worldwide.

Pleasantly, Nvidia and Taiwan Semiconductor aren’t competitors. In fact, Nvidia itself is a customer of Taiwan Semiconductor and has collaborated with the company in manufacturing the graphic chips it designs.

Performance & Valuation

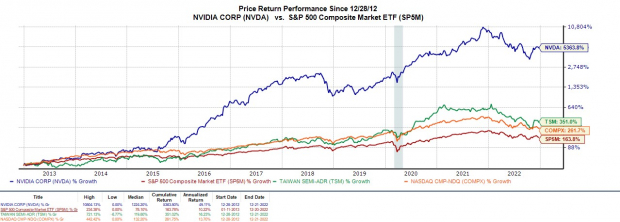

Taiwan Semiconductor is down -36% in 2022 vs. Nvidia’s -44%. Both stocks have underperformed the S&P 500’s -21% and the Nasdaq’s -31% performances. Over the last decade, NVDA’s total return including dividends is a staggering +5,364% to easily beat TSM and the broader indexes.

Image Source: Zacks Investment Research

Trading around $165 per share, NVDA currently trades at 72X earnings. In contrast, TSM trades at $77 a share and just 11.9X earnings.

Image Source: Zacks Investment Research

Even better, TSM trades 65% below its decade-long high of 34.4X and at a 25% discount to the median of 15.9X. NVDA is 23% below its decade high of 93.5X but 92% above the median of 37.4X.

Taiwan Semiconductor definitely looks like the better investment from a valuation standpoint going into the new year. Looking at the growth of both companies will be essential with the economy still very challenging for semiconductors and the broader technology sector.

Growth

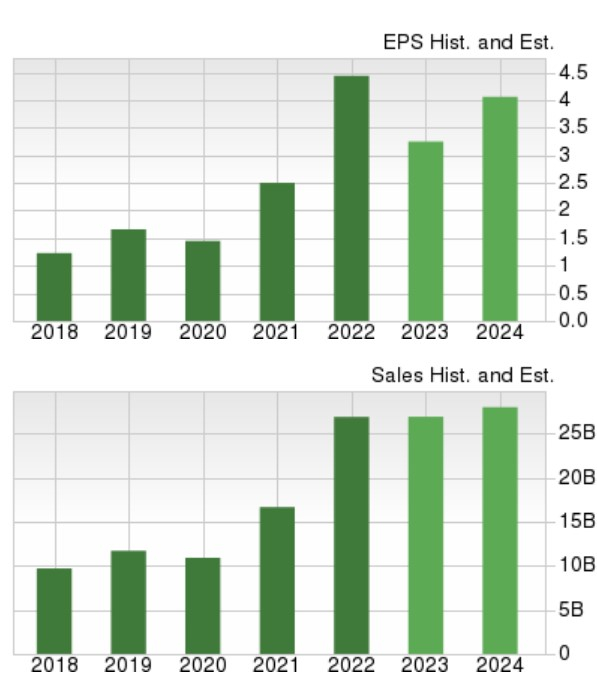

Nvidia earnings are now expected to drop -26% in its current fiscal 2023 at $3.27 per share. This is down from $4.44 a share in 2021. However, FY24 earnings are projected to rebound 34% at $4.37 a share. Earnings estimate revisions have declined for both FY23 and FY24 over the last 90 days.

Image Source: Zacks Investment Research

Sales are forecasted to be virtually flat in FY23 and rise 9% in FY24 to $29.42 billion. Fiscal 2024 would be an impressive 151% increase from pre-pandemic sales of $11.71 billion in 2019.

Looking at Taiwan Semiconductor, earnings are anticipated to climb an impressive 54% this year and then decline -9% in FY23 at $5.76 per share. Earnings estimates have gone up for FY22 but have trended down for FY23 over the last quarter.

Image Source: Zacks Investment Research

On the top line, sales are projected to jump 27% in 2022 and rise another 7% in FY23 at $77.31 billion. FY23 would represent 129% growth from pre-pandemic levels with 2019 sales at $35.77 billion. This is very impressive for a company that has been around for over a quarter century.

Image Source: Zacks Investment Research

Bottom Line

Going into 2023, Taiwan Semiconductor appears to be the better investment at the moment. TSM sports a Zacks Rank #2 (Buy) in correlation with rising earnings estimate revisions for its current fiscal 2022 with stellar bottom line growth expected.

On the other hand, Nvidia stock lands a Zack Rank #4 (Sell) at the moment with earnings estimates declining for its current fiscal 2023 which is already expected to be a down year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report