Perrigo Company plc

PRGO

announced that its wholly owned subsidiary, HRA Pharma, has submitted an application seeking approval for the first-ever over-the-counter (“OTC”) birth control pill, Opill, from the FDA.

Upon potential approval, Opill will become the first daily birth control pill made available OTC without a prescription in the United States. The company has applied for an Rx-to-OTC switch for Opill (also known as a mini pill or non-estrogen pill), a progestin-only daily birth control pill

Opill was approved by the FDA in 1973 and has been available in the United States as a prescription birth control pill for almost five decades.

Removing the requirement of a prescription for Opill would help American women get easy access to a contraceptive method that is more effective at preventing pregnancy compared to all current methods available OTC.

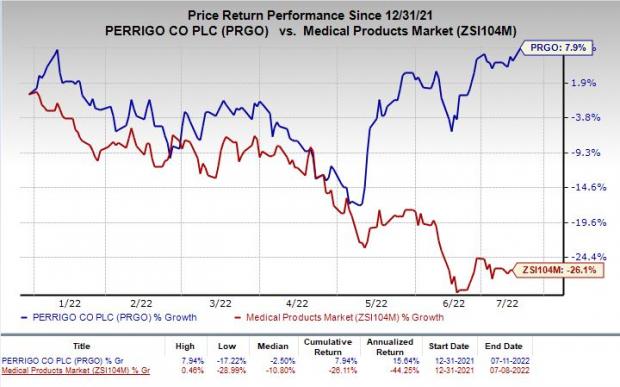

Shares of Perrigo have rallied 7.9% so far this year against the

industry

’s decline of 26.1%.

Image Source: Zacks Investment Research

The news, though not related directly, comes in the wake of the recent Roe v Wade overturning. Per a

Wall Street Journal

article

, the U.S. Supreme Court has recently overturned the 1973 Roe v. Wade decision, following which abortion became mostly illegal in many U.S. states.

Owing to this, demand for birth control pills is likely to increase in the upcoming days as these are safe for most women to use.

Increasing easy access to an OTC birth control pill is likely to provide women with better control of their reproductive life without facing unnecessary barriers. Approval of non-prescription birth control pills has been advocated by health experts for some time. They feel these pills should be available easily over the counter.

Zacks Rank & Stocks to Consider

Perrigo currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Fate Therapeutics, Inc.

FATE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Fate Therapeutics’ loss per share estimates narrowed 0.9% for 2022 and 0.5% for 2023 in the past 60 days.

Earnings of Fate Therapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. FATE delivered an earnings surprise of -0.72%, on average.

Precision BioSciences’ loss per share estimates narrowed 18.1% for 2022 and 29.5% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report