This week, biotech company

Roivant Sciences

ROIV

formed a new Vant company or a Roivant subsidiary with

Pfizer

PFE

to develop an inflammatory disease drug.

AstraZeneca

AZN

is set to acquire private biotech, Neogene Therapeutics to get access to the latter’s next-generation T-cell receptor therapies.

Eli Lilly

’s

LLY

phase III data showed its Alzheimer’s disease candidate, donanemab leads to a significant reduction of amyloid buildup in the brain compared to

Biogen

’s

BIIB

approved Alzheimer’s drug, Aduhelm.

Recap of the Week’s Most Important Stories

AstraZeneca to Build Cell Therapies Pipeline With New Acquisition:

AstraZeneca announced an

agreement to acquire private biotech, Neogene Therapeutics

that will give it access to the latter’s next-generation T-cell receptor therapies and thereby build its pipeline of cell-based cancer medicines. AstraZeneca will pay $320 million to acquire all outstanding equity of Neogene, which will include an initial payment of $200 million on deal closing. The remaining $120 million is contingent upon the achievement of certain milestones. The transaction is expected to close in the first quarter of 2023, subject to regulatory clearances.

Lilly’s Alzheimer’s Study on Donanemab Meets Goal :

Lilly presented data from a phase III early symptomatic Alzheimer’s disease study called TRAILBLAZER-ALZ 4 study, which showed that its pipeline candidate

donanemab produced a significant reduction of amyloid buildup in the brain

and P-tau in the blood after six months compared to Biogen’s Aduhelm. Amyloid plaque and P-tau are key biomarkers of Alzheimer’s disease and their reduction is likely to predict clinical benefit in the treatment of early Alzheimer’s disease.

In the study, which assessed donanemab’s superiority over Biogen’s Aduhelm on amyloid plaque reduction, donanemab met all primary and secondary endpoints for the six-month primary outcome analysis. The data were presented at the 15th Clinical Trials on Alzheimer’s Disease conference. The data showed that 37.9% of donanemab-treated participants experienced brain amyloid clearance compared with 1.6% of Aduhelm-treated patients at six months.

Donanemab reduced brain amyloid plaque levels versus baseline by 65.2% compared with 17.0% for Aduhelm at six months, thereby meeting a key secondary outcome. As far as the safety profile of the candidates is concerned, the incidence of total amyloid-related imaging abnormalities (ARIA), a brain swelling side effect associated with anti-amyloid antibodies, was 26.1% in Aduhelm arm compared with 25.4% in the donanemab arm. Importantly, though treatment with donanemab led to much greater amyloid clearance than Aduhelm, it was not associated with a higher rate of ARIA.

Eli Lilly’s biologics license application seeking accelerated approval of donanemab, based on data from the TRAILBLAZER-ALZ study, is already under priority review with the FDA. A decision is expected in early 2023.

Pfizer & Roivant Sciences Form New Vant Company:

Pfizer and Roivant Sciences announced the formation of a new Vant company to advance the development of PF-06480605, a TL1A-directed antibody originally developed by Pfizer for treating inflammatory and fibrotic diseases. TL1A is a cytokine believed to play a key role in inflammation and fibrosis. PF-06480605, now RVT-3101, is being developed in phase IIb for ulcerative colitis (UC). The data from the study is expected in the first half of 2023. The new Vant or Roivant subsidiary will take care of funding the global development of RVT-3101 in UC and additional inflammatory and fibrotic diseases. The Vant company holds commercial rights to the candidate in the United States and Japan. Pfizer has a 25% equity stake in the Vant company as well as commercial rights outside of the United States and Japan. The Vant also has an exclusive option to collaborate with Pfizer on a next-generation TL1A-directed antibody, which recently entered early-stage development.

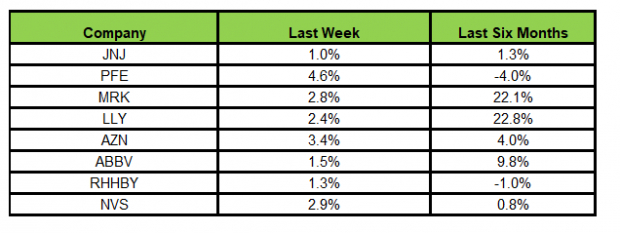

The NYSE ARCA Pharmaceutical Index rose 2.98% in the last five trading sessions.

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

All the stocks were in the green in the last five trading sessions, with Pfizer gaining the most (4.6%).

In the past six months, Merck has gained the highest (22.1%), while Pfizer declined the most (4%).

(See the last pharma stock roundup here:

MRK to Buy IMGO, ABBV’s Skyrizi Gets EU Nod for New Indication

)

What’s Next in the Pharma World?

Watch out for regular pipeline and regulatory updates next week.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report