Zacks Research has shown that stocks within top industry groups, with high Zacks Ranks, and rising consensus estimates, tend to outperform over time.

ELF Beauty

ELF

,

Inter Parfums

IPAR

,

and

L’Oreal

LRLCY

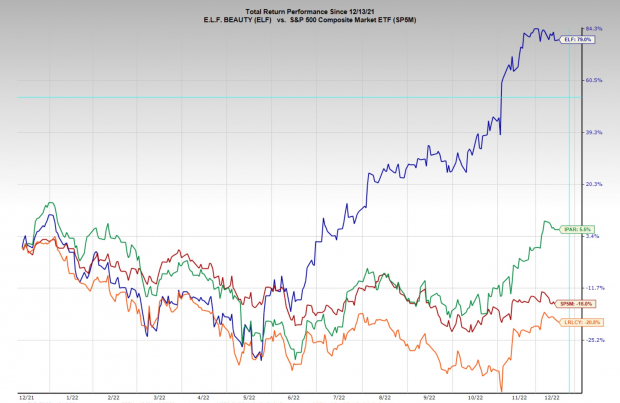

are three stocks that fit that mold. ELF, IPAR, and LRLCY are members of the Zacks Cosmetics Industry, which ranks 56 out of 249 (or top 22%) of industry groups tracked by Zacks. Zack’s studies show that, with all else equal, the top 30% of industry groups tend to outperform their peers. Thus far in 2022, this has held true.

Image Source: Zacks Investment Research

Pictured: ELF Beauty and Inter Parfums have outperformed the market.

ELF Beauty: A Growth Leader in Cosmetics

Oakland, California-based

ELF Beauty (ELF)

manufactures skin care and cosmetic products. ELF is a relatively new entrant to the cosmetics space, having launched in 2004 and having gone public in 2016. The company started with only 13 products but has since grown its offerings to more than 300 and diversified into eyeliners, lip glosses, and other cosmetic products.

Differentiated Product

The cosmetic industry is notoriously known to be a highly competitive space. To break into the market and be successful, new entrants must differentiate themselves from established brands with unique product offerings. ELF achieves this in two ways: offering a quality product at a fair price and being environmentally friendly. ELF does not test new products on animals, obtains Environmental Working Group (EWG) verification for its products, and avoids certain ingredients deemed harmful to the environment by the FDA.

The Results

ELF’s

distinctive approach is yielding results for investors. Its products can be found in discount retailers such as

Walmart (WMT)

and

Target

TGT

and have also gained shelf space in the “

Home Depot

HD

of cosmetics,”

Ulta Beauty Inc

ULTA

.

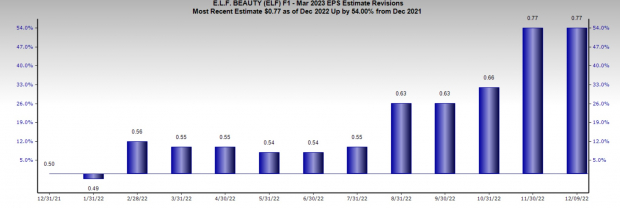

The stock is up 79% year-to-date, holds a Zacks Rank of 1, and is seeing strong (and rising) Zacks Consensus Estimates over the next year.

Image Source: Zacks Investment Research

Pictured: ELF’s EPS Estimates are on the rise for 2023.

Last quarter, EPS grew by 35% while revenues grew by 17%.

Inter Parfums: A Key Partner to Household Beauty Products

Inter Parfums Inc (IPAR)

is a New York-based cosmetic company that produces and markets licensed fragrances under various international brands. While IPAR is not a household name, many of its clients are well known, including

Abercrombie and Fitch (

ANF

),

Guess Inc (GES),

and Coach New York which is a subsidiary of the public company called

Tapestry Inc

TPR

.

Growth at a Reasonable Price?

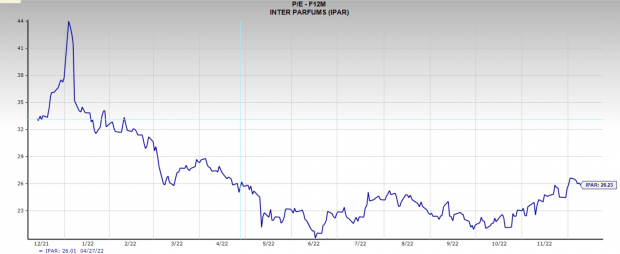

While Inter Parfums has a slower growth rate than ELF Beauty, the fundamentals compensate in other ways.

Image Source: Zacks Investment Research

Pictured: IPAR’s forward P/E expecations for 2023. The valuation is expected to be more attractive over the next 12 months.

IPAR has a forward PE of 28.48, compared to ELF which stands at 48.09. Like ELF, IPAR holds a Zacks Rank of 1 and has a solid expected EPS Growth rate for the next 3-5 years of 17%.

L’Oreal: A Low-Risk Way to Invest in Cosmetics

You can’t discuss cosmetics stocks without discussing the behemoth in the group,

L’Oreal Co (LRLCY).

French-based L’Oreal is the largest cosmetics company in the world and was founded in the early 1900s. LRLCY is a Zacks ranked 2 stock and grew EPS by 15% last quarter on a 7% increase in revenue growth.

Stability and Diversification

Because L’Oreal is a $200 billion company, investors should be realistic in their growth expectations. While it does not have the growth numbers of its smaller competitors, L’Oreal pays a healthy 1.08% dividend and has a beta of 0.77 (meaning its price tends to swing less than that of the general market).

Cosmetics has Something for Everyone

All investors have unique mandates, goals, and preferences. The highly ranked cosmetics group offers investors different options to construct their portfolios. ELF Beauty fits the bill for aggressive investors looking for a high growth, momentum type play. L’Oreal offers stability in terms of its dividend, market cap, and position in the industry. Investors can also look to diversify and gain exposure to Europe by investing in L’Oreal. Lastly, Inter Parfums is attractive for investors looking to find growth at a reasonable valuation.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report