Marijuana laws in the United States differ from state to state. A growing number of states have legalized marijuana for medical and recreational use, while others have only legalized it for medical use. Additionally, various states have decriminalized the possession of small amounts of marijuana, which means that it is not a criminal offense. On the other hand, federally, marijuana remains an illegal, controlled substance.

Following the Covid crash and the subsequent market recovery, marijuana stocks trended higher for months. In fact, during the meme-stock craze, Canadian-based cannabis company

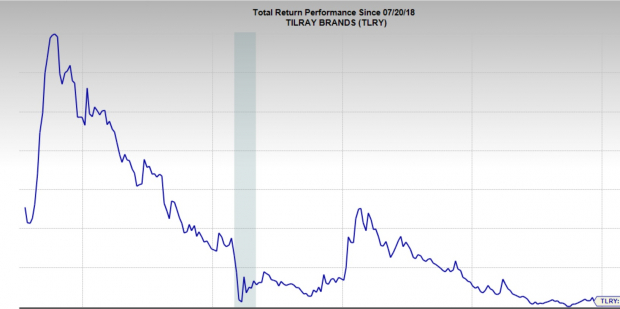

Tilray Brands

TLRY

doubled in under a week on two separate occasions.

Image Source: Zacks Investment Research

Pictured: 5 year TLRY chart. Outside of some brief stock pumps, pot stocks have suffered.

Unfortunately, the story is a familiar one for marijuana investors. The story of the marijuana industry in the past few years is a brief “high”, followed by a nasty come down. Since the meme era ended in early 2021, the industry group has sustained persistent selling. For example, the

Advisor Shares U.S Cannabis ETF

MSOS

debuted in late 2020 in the $20s and was trading in the mid $50s in under six months time. Currently, shares of MSOS are trading at $10.05.

Image Source: Zacks Investment Research

Pictured: The marijuana group has drastically underformed in recent years.

Hope Burns Out

Earlier this month, publicly traded marijuana companies such as

Canopy Growth Corp

CGC

and

Cronos Group

CRON

spiked higher on news that President Joe Biden signed a bill to expand medical marijuana research. After the bi-partisan Medical Marijuana Research Act was passed, the next item on the agenda for cannabis advocates to look to is the SAFE Banking Act. If passed, the SAFE Banking Act would allow banks to provide marijuana companies with financial services such as bank loans. The bill is a key next step to fully transforming the United States into a haven for marijuana producers.

Earlier in the week, cracks in support for the bill began to appear. While a handful of Republicans were on board the Medical Marijuana Research Act, and are even sponsoring it, key figures necessary to getting SAFE Banking Act passed voiced concerns. In response, marijuana stocks squandered earlier gains from the medical marijuana bill and fell even more in a brutal reversal. The marijuana ETF MSOS traded as high as $14.60 intra-week before plummeting to $10 on Thursday. While the SAFE Banking Act is technically still in play, investors are clearly discounting the rhetoric from key members of the vote.

What does the future hold for marijuana stocks?

While it is never easy to make predictions, the future looks clouded for marijuana stocks. Using the data we have today, we will take a look at 3 reasons why you should avoid weed stocks currently:

1.

Lackluster Fundamentals:

Investors can use

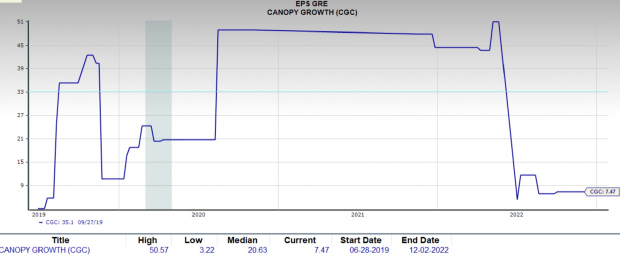

Canopy Growth

CGC

,

one of the most liquid public weed stocks, as a model. Not only has Canopy Growth failed to turn an annual profit as a public company, but growth estimates have stagnated as well:

Image Source: Zacks Investment Research

Pictured: EPS growth in the group is stagnnant, as can be illustrated by CGC’s EPS growth expectations.

2.

Uncertain Legal Framework:

The SAFE Banking Act is possibly the last chance marijuana advocates have for some time to push their agenda forward. Following the midterm elections and the conservative win in the house of representatives, the government will once again be stuck in gridlock. Though some republicans support moving the pro-marijuana agenda forward, most do not.

3.

Overhead Resistance:

Most marijuana stocks got smacked down at their 200-day moving averages this week. The 200-day moving average is a key level used by investors to size up the long-term trend. When loads of investors are offside on a position, rally attempts can be feeble because investors use them as an opportunity to exit the losing stock. If you’ve purchased marijuana stocks within the past three years, chances are you are deep in the red on your position.

Conclusion

Investors should avoid marijuana stocks until there are further regulatory changes and clarity. While the American public seems to be more open minded to a regulated marijuana industry recently, the necessary changes to turn around the marijuana group will likely take time to play out. To turn things around, stocks within the lowly rated industry should re-take their 200-day moving averages and move back into uptrends. Fundamentals in these stocks need to pull off a 360-degree reversal in terms of Zacks Consensus Estimates before they should be seriously considered.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.

>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report