Snap shares took a big hit after coming out with quarterly numbers that many in the market see as offering clues to the outlook for digital advertising spending in the current uncertain macroeconomic environment.

The shock from the Instagram rival has put the spotlight on other Tech leaders that are on deck to report June-quarter results this week. Alphabet

GOOGL

and Microsoft

MSFT

are set to report after the market’s close on Tuesday (7/26), with Instagram parent Meta Platforms’

META

ready to release its results after the closing bell on Wednesday (7/27), while Apple

(

AAPL

) and Amazon

AMZN

offer up their quarterly financial information after the close on Thursday (7/29).

Wall Street analysts have been literally falling over each other to downgrade Snap shares after the disappointing print on Thursday. The Wall Street analysts’ move brings to mind the saying about closing the barn doors after the horses have left. Another way to look at this mass rush to the exits could be the contrarian capitulation signal. Snap shares lost more than -30% of their value following the disappointing result, but they were already down more than -70% this year before the Q2 report came out.

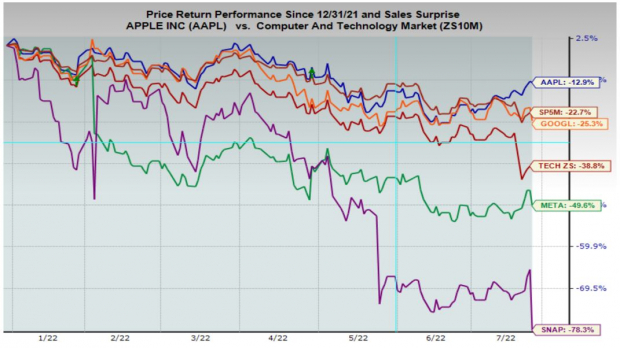

The chart below shows the year-to-date stock market performance of the Zacks Technology sector (the red line; down -38.8%), the S&P 500 index (down -22.7%), Apple (blue line; down -12.9%), Alphabet (orange line; down -25.3%), Meta (green line; down -49.6%), and Snap (purple line; down – 78.3%). I didn’t add Microsoft and Amazon to the chart to reduce clutter in the visual, but those stocks are down -22.5% and -26.6%, respectively.

Image Source: Zacks Investment Research

Snap is a relatively modest player in the digital ad space, with Alphabet and Meta as the undisputed leaders of that market. Advertising spending is cyclical and should intuitively start weakening as the aggressive Fed tightening cycle takes effect.

To that extent, Alphabet and Meta are as exposed to these macro trends as Snap and others are. That said, the bottom-up nature of Google’s search-driven ad platform likely gives it more ‘stickiness’ than a mere social media platform. You can see this in the performance variance between these operators in the above chart.

Advertisement spending by businesses is not the only category that will be under threat during an economic slowdown or a recession.

Tech giants like Microsoft, Alphabet and Amazon (through its Amazon Web Services or AWS arm) receive a ton of money from other companies for software and services. It is reasonable to expect those receipts to take a hit as customers get cautious in the face of macroeconomic challenges.

We will see what we hear from these companies in their Q2 releases, but historically software spending doesn’t get cut to the same extent as ad spending. Microsoft, Amazon (AWS), and Alphabet are the leaders in the cloud computing space.

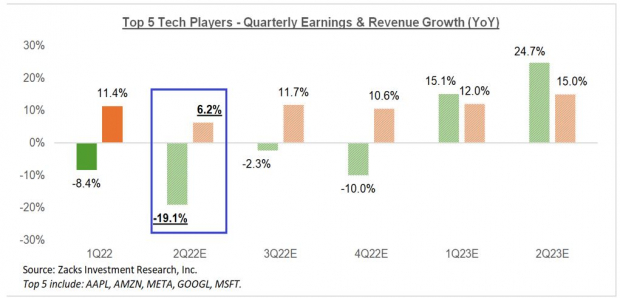

Take a look at the chart below that shows current consensus expectations for this group for the current and coming periods in the context of what they were able to achieve in 2022 Q1 and the preceding period.

We have highlighted the expected -7.3% earnings decline on +10.6% higher revenues for this group of 5 Tech leaders in 2022 Q1.

Image Source: Zacks Investment Research

As you can see here revenue growth is expected to remain strong, with cost pressures weighing on earnings expectations. Needless to add that these Tech leaders are faced with compressed margins.

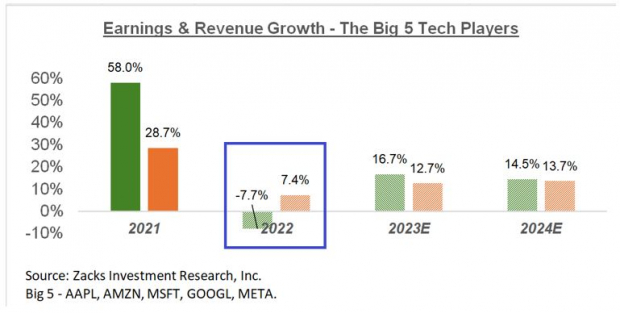

The chart below shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

Look at the chart and note the growth trend from 2022 to 2023. In other words, whether the growth trend for these companies is decelerating or not is a function of your holding horizon. These companies are impressive growth engines in the long run, even if those estimates for 2023 and 2024 come down in the days ahead.

Ad spending may be coming down as this week’s reports from Meta and Alphabet will reconfirm, but no one is suggesting that they are expected to lose share to your local newspaper’s classified section. As the macroeconomic clouds clear, as they eventually will, these digital platforms will be there to capture those spending dollars.

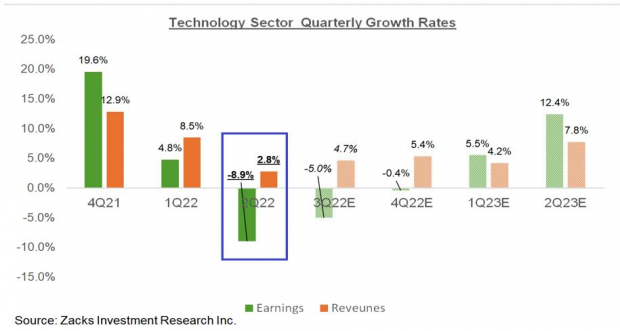

Beyond the big 5 Tech players, total Q2 earnings for the Technology sector as a whole are expected to be down -8.9% from the same period last year on +2.8% higher revenues.

The dramatic looking chart below shows the sector’s Q2 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming four periods.

Image Source: Zacks Investment Research

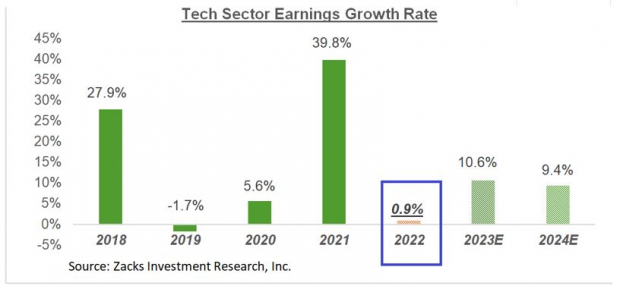

This big picture view of the ‘Big 5’ players, as well as the sector as a whole shows a decelerating growth trend. That said, unlike this ‘quarterly view’, the annual picture shows a lot more stability, as the chart below shows.

Image Source: Zacks Investment Research

Q2 Earnings Season Scorecard

Through Friday, July 22

nd

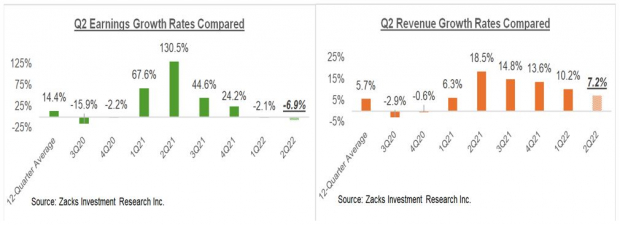

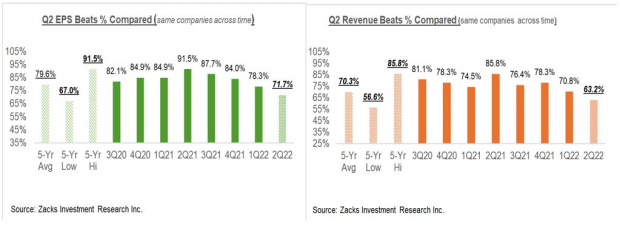

, we have seen Q2 results from 106 S&P 500 members or 21.2% of the index’s total membership. Total earnings for these companies are down -6.9% on +7.2% higher revenues, with 71.7% beating EPS estimates and 63.2% beating revenue estimates.

The comparison charts below put the Q2 earnings and revenue growth rates for these index members in a historical context.

Image Source: Zacks Investment Research

The Finance sector has been a big drag on the ‘headline’ year-over-year growth rate for the companies that have reported already. Second quarter earnings growth for the Finance sector companies that have reported already are down -26.3% from the same period last year.

Excluding this Finance sector’s drag, Q2 earnings growth for the rest of the index improves to +12.2%.

The comparison charts below put the Q2 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The EPS and revenue beats percentages are still tracking on the low side relative to historical periods, as you can see above.

This Week’s Docket

We get into the heart of the Q2 reporting cycle this week, with almost 800 companies on deck to report quarterly results, including 171 S&P 500 members. In addition to the aforementioned Tech giants, this week’s line-up includes a who’s who of America Inc., ranging from Boeing and Pfizer to Coke, GM, and a host of other marquee players.

By this time next week, we will have seen Q2 results from 55% of the S&P 500 members and will have a reasonably good sense of the earnings lay of the land.

The Current Earnings Backdrop

The chart below shows current expectations (and actuals) on a quarterly basis.

Image Source: Zacks Investment Research

Please note that the +3.7% earnings growth expected in 2022 Q2 is solely due to strong gains in the Energy sector. On an ex-Energy basis, Q2 earnings growth drops to a decline of -5%.

The chart below presents the earnings picture on an annual basis.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>

Q2 Earnings Season Off to a Solid Start Despite Recession Fears

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report