Let me tell you a little story. It involves a man from Japan named Taiichi Ohno who worked at Toyota. Ohno was an industrial engineer at Toyota, and is famous for developing something that revolutionized manufacturing efficiency forever.

It’s called Kanban. In Japanese it means signboard. In business, Ohno’s aptly-named methodology has become the premier lean manufacturing scheduling system for just-in-time manufacturing. Some argue that Ohno’s contribution to manufacturing was almost as big as Henry Ford’s assembly line. To be sure, if Ford built the thing, Ohno made it far, far more efficient.

So what does all of this have to do with the market. No, we’re not talking about manufacturing sector stocks or auto stocks today. Today, we will discuss two companies that have specifically utilized Ohno’s Kanban method to reach market caps in the billions. The companies are Asana (NASDAQ:ASAN) and Monday.com (NASDAQ:MNDY)

So is 2021 the year of the project manager? Let’s find out by looking at these two stocks…

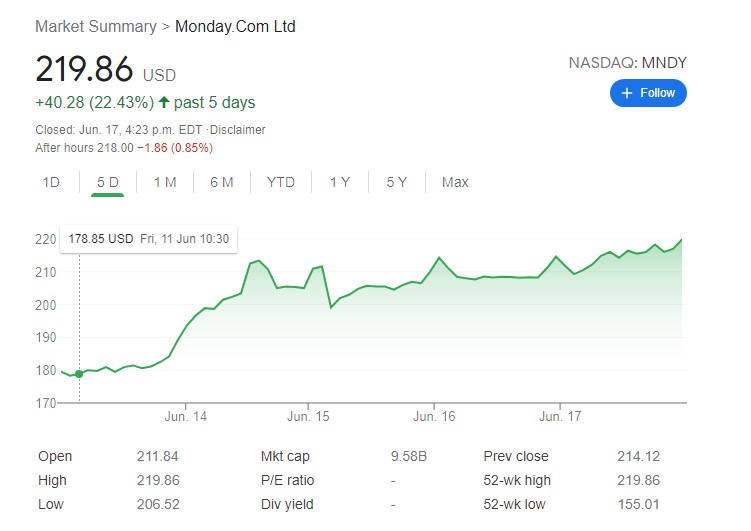

Monday.com (NASDAQ:MNDY)

Monday.com (NASDAQ:MNDY) claims its product is a ‘Work OS’, which it no doubt is. Users claim it is one of the most robust and intricate, yet easy-to-use project management platforms out there. As you can see from the 40% upswing since the company’s IPO, the users might not be wrong. The insanely competitive sector allows little room to distinguish between competitors. The company’s software operates on two common open-source javascript libraries. This makes Monday.com (NASDAQ:MNDY) one of the most attractive productivity apps for businesses. The company believes itself to be not just a project software, but as a ‘work operating system.’

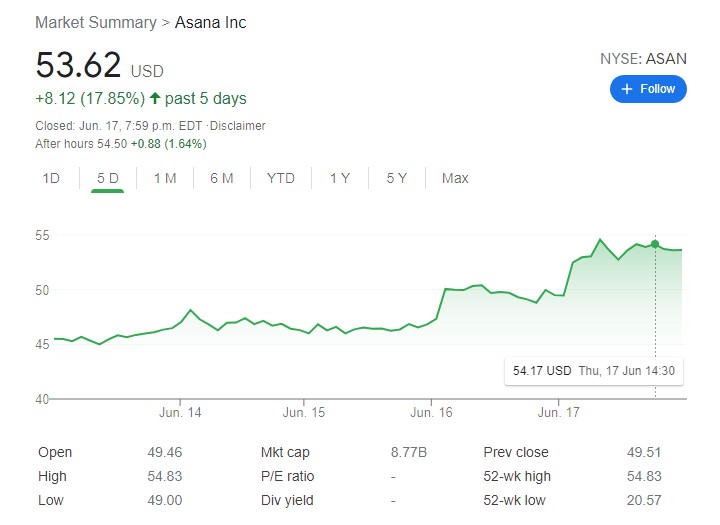

Asana (NASDAQ:ASAN)

Asana is derived from the Sanskrit word meaning seat or posture. It’s a common term for a yoga pose. The company is known for its minimalist interface and successful integration into Gmail, making stand out amongst others in the field. The company went public on the NYSE in September of 2020. Companies like Asana (NASDAQ:ASAN) are hedged by recurring subscription revenue in times of economic turmoil.

Conclusion

The takeaway is that no matter what happens, whether it’s a global pandemic or a global re-opening, tech stocks that make people more productive are hedged by ever-growing digitization. As internet connectivity strengthens around the world thanks to companies like Elon Musk’s Starlink, we may see a brighter future for ‘Work Operating Systems.’ Unlike meme stocks, this sector isn’t likely to be pumped by social media any time soon.