Puma Biotechnology

PBYI

reported first-quarter 2022 loss of 8 cents per share, narrower than the Zacks Consensus Estimate of a loss of 13 cents per share. In the year-ago quarter, the company had reported earnings of 40 cents per share.

Adjusted earnings (excluding stock-based compensation expense) were 1 cent per share for first-quarter 2022 compared with 55 cents in the year-ago quarter.

In the first quarter, total revenues were $45.7 million, down 53.5% year over year due to lower product sales and the absence of license revenues. Sales were in line with the Zacks Consensus Estimate.

Total revenues consisted of net product sales of Nerlynx (neratinib), Puma Biotech’s only marketed drug in the United States, and license fees and royalty revenues from PBYI’s sub-licensees.

Quarter in Detail

Nerlynx is indicated for extended adjuvant treatment of HER2-positive early-stage breast cancer in patients previously treated with

Roche’

s

RHHBY

Herceptin-based adjuvant therapy. In 2020, the FDA expanded Nerlynx’s label to allow its use in combination with Roche’s Xeloda for third-line HER2-positive metastatic breast cancer.

Product revenues from Nerlynx were $40.7 million in the first, down 11.1% year over year and 20% sequentially due to inventory drawdown at specialty pharmacies/distributors.

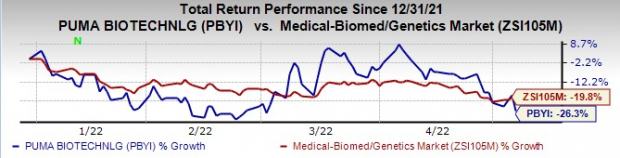

Shares were down almost 9% in after-hours trading, following the earnings release probably due to unimpressive Nerlynx product sales. Puma Biotech’s shares have declined 26.3% this year so far compared with the

industry

’s 19.8% decrease.

Image Source: Zacks Investment Research

Nerlynx’s product revenues were slightly better than management’s guidance of $35 million – $39 million.

In the first quarter, Nerlynx’s new prescriptions were up approximately 17% from the fourth quarter of 2021, while total prescriptions were down approximately 1.7%.

Royalty revenues were $5.0 million in the quarter compared with $2.4 million in the year-ago quarter. Puma Biotech did not record any license revenues in the first quarter compared with $50 million in the first quarter of 2021.

Total operating costs in the quarter were $46.4 million, down 40.5% year over year. Research and development expenses were $15.2 million in the quarter, down 24.8% year over year. Selling, general and administrative expenses declined 27.7% year over year to $20.4 million due to lower professional fees and expenses.

2022 Guidance

For 2022, Puma Biotech maintained Nerlynx’s net sales guidance range of $180-$190 million. Royalty revenues are expected in the range of $27-$34 million. However, pandemic-related disruptions may continue to hurt PBYI’s revenues in 2022. Operating expenses are expected to be lower in 2022 compared with 2021. SG&A expenses are expected to decline in the range of approximately 15% to 20% and R&D expenses are expected to be down 10% to 15% year over year.

Nerlynx’s net revenues are expected in the range of $44-$47 million in the second quarter of 2022 while royalty revenues are expected to be in the range of $7 million to $9 million.

Pipeline Update

Several additional studies on Nerlynx targeting different types of breast cancer patient populations and other types of cancers are currently underway.

A key analysis of Nerlynx is the phase II SUMMIT basket study for treating solid tumors in patients with activating EGFR, HER2 or HER4 mutated cancers.

The company plans to report data from a cohort of the SUMMIT study evaluating Nerlynx in HER2-mutated HR-positive breast cancer in the first half of the year and hold a pre-NDA meeting with the FDA to discuss the potential for an accelerated approval pathway for this indication in the second half.

The company plans to report data from another cohort of the SUMMIT study in second-half 2022, evaluating Nerlynx in non-small cell lung cancer patients with EGFR exon 18 mutations. The company also expects to report phase II data from the SUMMIT study from a cohort of patients with HER2-mutated biliary tract cancer in the first half and from another cohort of cervical cancer patients with HER2 mutations in second-half 2022.

Meanwhile, Puma Biotech plans to release results from the phase II TBCRC-022 study on Nerlynx in combination with Roche’s Kadcyla in patients with HER2-positive breast cancer with brain metastases who have previously been treated with Kadcyla in second-half 2022.

Zacks Rank & Stocks to Consider

Puma Biotech currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector include

Alkermes

ALKS

and

Deciphera Pharmaceuticals

DCPH

. While Alkermes sports a Zacks Rank #1 (Strong Buy), Deciphera Pharmaceuticals carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report