QuidelOrtho Corporation

QDEL

recently announced that its subsidiary, Ortho Clinical Diagnostics Trading (China) Co., Ltd., has inked a definitive agreement with Shanghai Medconn Biotechnology Co., Ltd., a subsidiary of Shanghai Runda Medical Technology Co., Ltd. The joint venture (JV) is aimed at developing and manufacturing assays in China for QuidelOrtho’s VITROS platform.

Following a successful assay pilot program, both companies expect to begin developing a broader set of assays in early 2023 in parallel with building out the JV organization in the Shanghai and Beijing areas.

The latest JV is expected to significantly boost QuidelOrtho’s business of in vitro diagnostic (IVD) reagent products in the Chinese market.

Rationale of the Latest JV

QuidelOrtho develops IVD reagent products that meet the needs of the Chinese market with a significant installed base of VITROS immunodiagnostic analyzers, including VITROS 3600 and 5600 instruments. It also includes the VITROS Automation System that connects these instruments and is well-known for quick turnaround STAT labs across China. Runda Medical, a key IVD distributor in China, has developed its own family of instruments and assays.

The JV is expected to leverage both the companies’ expertise in various incremental assays to broaden the VITROS test menu and gain efficiencies from local manufacturing at Runda Medical’s Shanghai facility.

Per QuidelOrtho’s management, its partnership with Runda Medical will likely aid the company in expanding its menu of VITROS assays abroad as well as in the Chinese market, which is an important and fast-growing region for QuidelOrtho. Management also believes that with the expanded immunoassay menu resulting from the partnership with Runda Medical, QuidelOrtho will be able to rapidly launch important assays to the market with accurate and efficient results.

Runda Medical’s management believes this partnership is another in-depth strategic cooperation in the field of IVD product research, development and production.

Industry Prospects

Per a report by Transparency Market Research

, the global clinical laboratory services market was estimated at $313.3 billion in 2021 and is anticipated to exceed $561.1 billion by 2031 at a CAGR of 5.9%. Factors like the increasing burden of chronic diseases, the growing demand for early diagnostic tests and rapid advancements in data management and sample preparation due to the growing volumes of testing samples are likely to drive the market.

Given the market potential, the latest JV will likely provide a significant impetus to QuidelOrtho in the IVD space in the China region.

Notable Development

Last month, QuidelOrtho reported its third-quarter 2022 results, where it saw a robust overall top-line performance driven by POC and Donor Screening product lines. The company recorded strong revenues in the majority of its geographies at a constant exchange rate, excluding COVID-19 revenues. The continued strength in QuidelOrtho’s comprehensive product portfolio and expanded global commercial footprint also raised optimism about the stock.

Price Performance

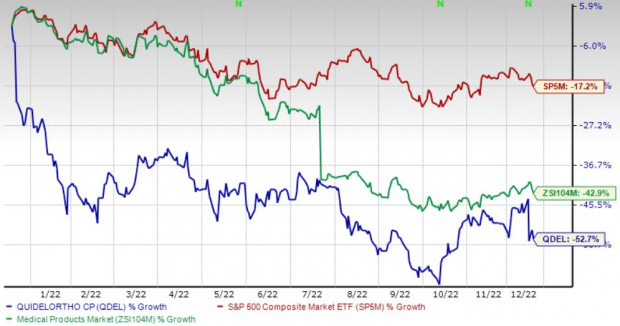

Shares of the company have lost 52.7% in the past year compared with the

industry

’s 42.9% decline and the S&P 500’s 17.3% fall.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, QuidelOrtho carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are

Exact Sciences Corporation

EXAS

,

ShockWave Medical, Inc.

SWAV

and

Merit Medical Systems, Inc.

MMSI

.

Exact Sciences, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 27.5%. EXAS’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one, the average beat being 0.6%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Exact Sciences has lost 34.5% compared with the

industry

’s 22.7% decline in the past year.

ShockWave Medical, carrying a Zacks Rank #2 at present, has an estimated growth rate of 21.2% for 2023. SWAV’s earnings surpassed estimates in all the trailing four quarters, the average beat being 146.1%.

ShockWave Medical has gained 21.1% against the

industry

’s 26.2% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 19.6% against the

industry

’s 10% decline over the past year.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report