According to official narratives, the reason why countries like Egypt, the United Arab Emirates (UAE), and Bahrain followed Saudi Arabia in cutting off diplomatic and economic ties with Qatar was because Qatar was funding terrorists. Saudi Arabia’s decision severe its ties with Qatar came directly after Trump’s visit, where the recently-elected president urged for a stop on financial support of terrorism, and FT’s report that Qatar has provided about $1 billion in funding to Iran and terrorist groups that spun-off of al-Qaeda.

However, many believe that this official narrative is just a coverup for the real reason for the giant diplomatic fallout: Qatar’s dominance in the region’s natural gas properties. It’s not the first time that people have speculated Qatar’s dominance in the natural gas industry to be a reason for political upheaval. Some have speculated before that one of the reasons for why the Syrian war has been ongoing was because of competing gas pipelines. Qatar had wanted to pass its own pipeline in order to connect Europe to its natural gas supply, which would threaten government-owned Russian company Gazprom’s (MCX:$GAZP) monopoly of the European gas supply. As such, Qatar’s pipeline received in a firm and violent opposal from Russia. With Syria in crisis, Qatar can’t pass its pipeline. This helps to explain Putin’s support of the Assad regime and why the Russian leader has been trying to prevent a puppet regime from replacing Assad’s governance of Syria.

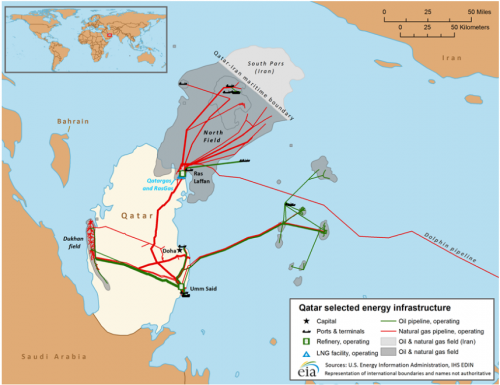

Bloomberg’s recently published an article also debunked the official reason for the Gulf crisis, saying that Saudi Arabia’s animosity towards Qatar — historically and presently — can be best explained by natural gas. There are numerous reasons why natural gas is the root of rivalry between the two countries, starting all the way back in 1995 when Qatar made its first shipment of liquid natural gas produced from the world’s largest reserve, the offshore North Field. The North Field, which is where almost all of Qatar’s gas is produced from, is shared with Iran — Saudi Arabia’s biggest rival.

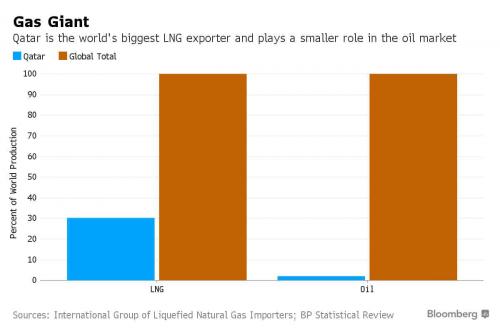

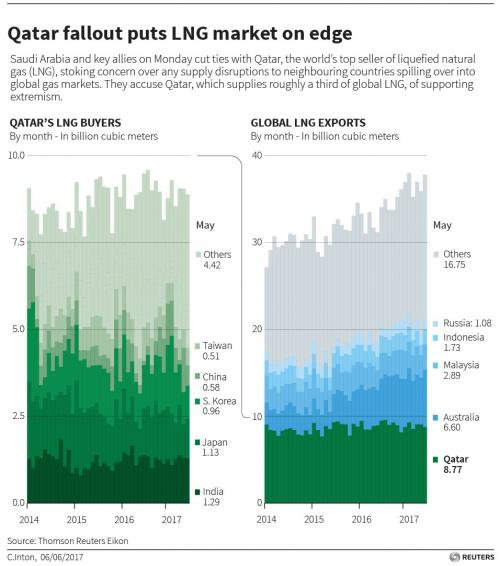

Besides sharing a natural gas field with one of Saudi Arabia’s most rivaled country, Qatar’s rise from the country’s ownership of the North Field began to rival Saudi Arabia’s. For the past two decades, Qatar not only turned into the world’s richest country, it also became the world’s biggest LNG exporter. Qatar’s focus on natural gas allowed the country to take over the domination of the energy industry in the region — a domination previously held by Saudi Arabia. Today, only Russia’s Gazprom is able to match up to Qatar’s presence in LNG exports.

Qatar has also been known to shift its alliances — in 2013, FT reported that Qatar had been a big supporter of the Syrian rebels who wanted to end the Assad regime, going so far as backing and financing the rebels. If the rebels managed to successfully topple the Assad regime, Qatar’s pipeline to Europe would come into fruition. However, what was supposed to be a revolution has turned into an all-out, violent civil war. As the war in Syria progressed, Qatar also began to realize that Russia would not let its pipeline through Syria.

As a result, Qatar has re-aligned itself to be pro-Russian, agreeing last year to invest $2.7 billion in government-owned Russian company Rosneft Oil (MCX:$ROSN). The agreement came despite the country being the location of the biggest U.S. military base in the region.

Qatar’s shift in allegiances shows that it is leaning more and more towards independence and breaking away from its neighbors. This fueled concern and frustration within the region. Energy research fellow at Rice University’s Baker Institute Jim Krane explained, “Qatar used to be a kind of Saudi vassal state, but it used the autonomy that its gas wealth created to carve out an independent role for itself.” To add on to further concerns from its neighboring countries, Qatar’s natural gas output stands alone and away from the pressures of OPEC, the Saudi Arabian dominated oil cartel. “The rest of the region has been looking for an opportunity to clip Qatar’s wings,” Krane stated.

So, when Trump called for an isolation on Iran during his visit to Saudi Arabia and Qatar disagreed, Saudi Arabia and other neighboring countries saw this as an opportunity to put Qatar in the hot seat. Trump has since then inserted himself into the official narrative of Qatar’s isolation, stating in a series of tweets, “So good to see the Saudi Arabia visit with the King and 50 countries already paying off. They said they would take a hard line on funding extremism, and all reference was pointing to Qatar. Perhaps this will be the beginning of the end to the horror of terrorism!”

However, as the U.S. signs a $100+ billion arms deal with Saudi Arabia, one of the biggest supporter of terrorism in the world, it is hard not to dismiss the official narrative of Qatar’s isolation.

This brings back natural gas as a reason for the isolation — to secure its wealth, Qatar have promoted engagement with Shiite Iran, where some may argue is how tension have emerged between Qatar and its neighbors. Qatar’s world domination in natural gas resources also came at a time where its neighbors have just begun to experience rising demand in the commodity. Ph.D. Associate Professor, Steven Wright, said,”You can question why Qatar has been unwilling to supply its neighboring countries, making them gas poor. There probably was an expectation that Qatar would sell gas to them at a discount price.” Instead of getting gas from Qatar, however, Gulf states have been spending large amounts of money on LNG imports and exploring domestic gas formations. In 2005, Qatar put a cap on further development at the North Field which could have allowed for more locally exported gas, frustrating Qatar’s neighbors. While Qatar argued that the moratorium was done for testing, many have claimed that the country was actually catering to Iran — who had been a lot slower in extracting gas from its share of the Northern Field. This can be clearly seen with the fact that Qatar has just recently lifted its moratorium just as Iran began to match Qatar’s gas extraction rates.

Qatar’s dominance on natural gas in the wake of rising demand also puts the small country in a powerful position amongst its neighbors. This lead to further frustration from its neighbors as Qatar began to use this leverage to fuel political influence around the region. The country backed the Muslim Brotherhood in egypt, the Hamas in the Gaza Strip, and armed groups in Libya and Syria who were opposed by the UAE and/or Saudi Arabia. Gas also helped pay for a global television network known for embarrassing and angering most Middle Eastern governments, called Al Jazeera.

As Qatar refuse to yield to its neighbors — instead gaining increasing political and economical independence, as previously mentioned — resentment towards the small country grew.

“People here are scratching their heads as to exactly what the Saudis expect Qatar to do,” Gerd Nonneman, a professor of international relations and Gulf studies at Georgetown University, said. “They seem to want Qatar to cave in completely, but it won’t called the Muslim Brotherhood a terrorist organization, because it isn’t. And it isn’t going to excommunicate Iran, because that would jeopardize a relationship that is just too fundamental to Qatar’s economic development.”

Whether or not the speculation that natural gas is the cause of Qatar’s isolation is correct is dependent on what both Saudi Arabia and Iran does next. Saudi Arabia, the UAE, and Egypt have all been extremely reliant on Qatar’s supply of gas via pipeline and LNG. Since the fallout between the Gulf countries, traders have begun to plan for any and all outcomes. In particular, industry sources and traders are paying close attention to the gas pipeline — known as the Dolphin pipeline — from Qatar to the UAE, according to Reuters. It is where Qatar will most likely take action if they were to retaliate from the isolation, as not only does the UAE makes use of 1.8 billion cubic feet a day of Qatar-supplied gas via the Dolphin pipeline, it also has LNG purchase agreements with its neighbor.

Even a partial shutdown of the Dolphin pipeline would be detrimental, traders said, as the UAE would have to look for replacements for its LNG supply just as demand have hit an all-time high. This will, in turn, affect the rest of the global gas market. While it could be argued that with LNG markets bearish and demand weak, the UAE could survive by relying on international markets, but the overall supplies delivered by the Dolphin pipeline is too big to be fully replaced.

Since it all boils down to who is the most powerful, however, Qatar can simply halt all its natural gas supplies to its neighbors in an act of Mutually Assured Destruction — damaging both its neighbors and own economy — in an attempt to find out who will suffer the most.

Featured Image: depositphotos/lunamarina