Patterson Companies, Inc.

PDCO

has been gaining on the back of a broad product line. A robust third-quarter fiscal 2022 performance, along with a promising dental market, is expected to contribute further. Supplier concentration issues and stiff competitive forces persist.

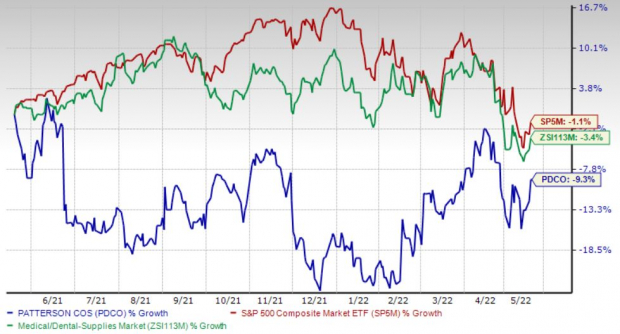

Over the past year, this Zacks Rank #2 (Buy) stock has lost 9.2% compared with 3.3% fall of the

industry

and the S&P 500’s 1.1% decline.

The renowned global dental and animal health company has a market capitalization of $3.17 billion. The company projects 9.9% growth for the next five years and expects to maintain its strong performance. Patterson Companies’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, delivering a surprise of 2.7%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Broad Product Spectrum:

We are optimistic about Patterson Companies’ wide range of consumable supplies, equipment and software, and value-added services. A notable offering from the company is a private-label brand named Pivotal (introduced during the fiscal first quarter of 2020). The company continues adding SKUs to its broader private-label portfolio. Patterson Companies’ NaVetor is an integrated cloud-based veterinary practice management software for its Animal Health segment (launched in fiscal 2019).

Dental Market Holds Promise:

Gradual recovery in the dental market and the rebounding dental equipment business (especially in North America), assisted by increased technology marketing/promotional activities, is expected to be advantageous for Patterson Companies, thus raising our optimism. Per management, in the third quarter of fiscal 2022, sales at this segment inched up year over year. Throughout the Dental segment, the company’s field sales, service and support teams remain committed to delivering value to its customers and business partners, thereby driving solid operational excellence.

Strong Q3 Results:

Patterson Companies’ better-than-expected earnings in third-quarter fiscal 2022 buoy optimism. The company saw solid performance in the Animal Health segment in the quarter under review. Apart from Dental Consumables, the Dental business showed improvement. Sustained momentum in the Animal Health business and the company’s solid position in the market were reflected in the fiscal third-quarter results. Prudent cost-saving initiatives and solid sales execution continue to work in favor of Patterson Companies.

Downsides

Stiff Competition in the Niche Space:

The U.S. dental products distribution industry is highly competitive and consists principally of national, regional and local full-service and mail-order distributors. Patterson Companies faces competition not only from other national and full-service firms, but also from at least 15 full-service distributors that operate on a regional level besides hundreds of small local distributors. Patterson Companies needs to continue to introduce new products in the market to withstand competitive pressures. Failure to do so can dilute the company’s market share.

Supplier Concentration Issues:

Patterson Companies has a significant key supplier concentration. The company’s top 10 supply vendors account for more than 40% of its cost of dental products sold in a fiscal year. Loss of relationship with these vendors will disrupt the supply of raw materials, which in turn will lead to lower sales. A prolonged period of economic instability could reduce customers’ ability to make payments.

Estimate Trend

Patterson Companies is witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 1.9% north to $2.12.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2022 revenues is pegged at $1.61 billion, suggesting a 3.2% improvement from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space that investors can consider include

Omnicell, Inc.

OMCL

,

Alkermes plc

ALKS

and

AMN Healthcare Services, Inc.

AMN

.

Omnicell, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 16%. OMCL’s earnings surpassed estimates in three of the trailing four quarters, the average beat being 13.4%. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicell has lost 18% compared with the

industry

’s 41.9% fall over the past year.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’s earnings surpassed estimates in all the trailing four quarters, the average beat being 350.5%. It currently flaunts a Zacks Rank #1.

Alkermes has gained 36.1% against the

industry

’s 36.1% fall over the past year.

AMN Healthcare has an estimated long-term growth rate of 1.1%. AMN’s earnings surpassed estimates in the trailing four quarters, the average beat being 15.6%. It currently sports a Zacks Rank #1.

AMN Healthcare has gained 2.2% against the

industry

’s 61.3% fall over the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report