Surmodics, Inc.

SRDX

has been gaining from consistent efforts to boost research and development (R&D) over the past few months. A robust first-quarter fiscal 2022 performance and solid prospects in the thrombectomy business are expected to contribute further. Yet, concerns related to stiff competition and reliance on third parties persist.

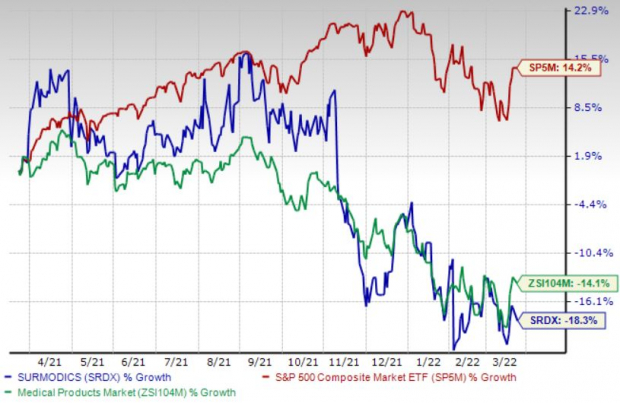

Over the past year, this Zacks Rank #2 (Buy) stock has lost 18.3% compared with a 14.1% fall of the

industry

it belongs to. The S&P 500 composite has appreciated 14.2% in the said time frame.

The renowned medical device and in-vitro diagnostics technology provider has a market capitalization of $592 million. Surmodics’ return on equity of 2.3% compares favorably with the industry’s negative return. SRDX’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in the other, with the average earnings surprise being 18.2%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Efforts to Boost R&D:

We are optimistic about Surmodics’ solid efforts to improve its R&D stature, which has been a key growth driver. During the first-quarter fiscal 2022 earnings call in February, Surmodics provided some updates regarding Sundance — below-the-knee sirolimus-coated balloon. Per the company, it completed the six-month data and follow-up visits in conjunction with the SWING first-in-human clinical trial during fourth-quarter fiscal 2021.

Thrombectomy Prospects Bright:

Surmodics’ aim to leverage its proprietary Pounce thrombectomy platform technology to develop products to treat acute vascular occlusion or the blocking of arteries by clots or plaque (a peripheral vascular condition commonly associated with peripheral artery disease) in a more effective, cost-efficient manner than the currently available treatments raises our optimism.

During its fiscal 2022 first-quarter earnings call, Surmodics confirmed that the Pounce arterial thrombectomy platform has been used to perform approximately 40 procedures in the United States. The company also confirmed that the Pounce arterial thrombectomy device is in the value analysis committee process in more than 15 hospitals.

Strong Q1 Results:

Surmodics’ solid first-quarter fiscal 2022 results buoy optimism in the stock. The company registered robust revenues from the Medical Device segment and Product sales. Surmodics confirmed making crucial progress on its SurVeil drug-coated balloon premarket approval submission and early commercialization of Sublime radial and Pounce arterial thrombectomy platforms. Surmodics also completed the required two and three-year mortality of analysis of SurVeil with respect to its clinical data from the TRANSCEND trial, which demonstrated positive results. These developments buoy our optimism.

Downsides

Stiff Competition:

Surmodics operates in a competitive and evolving field, and new developments are expected to continue at a rapid pace. Competition in the diagnostics market is highly fragmented and it faces an array of competitors in the product lines in which the company competes, ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of products.

Reliance on Third Parties:

A principal element of Surmodics’ business strategy is to enter into licensing arrangements with medical device and other companies that manufacture products incorporating its technologies. The revenues that the company derives from such arrangements depend upon its ability or its licensees’ ability to successfully develop, obtain regulatory approval for, manufacture (if applicable), market and sell products incorporating Surmodics’ technologies.

Estimate Trend

Surmodics is witnessing a positive estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has narrowed from a loss of $1.27 to $1.10 per share.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2022 revenues is pegged at $24.4 million, suggesting a 30.3% fall from the year-ago reported number.

Other Key Picks

Other top-ranked stocks in the broader medical space include

Henry Schein, Inc.

HSIC

,

IDEXX Laboratories, Inc.

IDXX

and

AMN Healthcare Services, Inc.

AMN

.

Henry Schein, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, with the average being 25.5%. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Henry Schein has gained 35.5% compared with the

industry

’s 10.5% growth over the past year.

IDEXX has an estimated long-term growth rate of 13%. IDXX’s earnings surpassed estimates in the trailing four quarters, with the average being 18.6%. It currently carries a Zacks Rank #2.

IDEXX has gained 10.7% against the

industry

’s 0.9% fall over the past year.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, with the average being 20%. It currently sports a Zacks Rank #1.

AMN Healthcare has gained 43.6% against the

industry

’s 54.7% fall over the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report