CDW Corporation

‘s

CDW

performance is gaining from the global digital transformation and higher revenue growth in Corporate, Small Business and CDW Canada segments owing to rebounding commercial customer spending.

The company has an impressive

Growth Score

of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

CDW’s 2022 and 2023 revenues are expected to increase 18.2% and 5.4%, respectively, year over year. Earnings are anticipated to rise 20.2% and 8.3% in 2022 and 2023, respectively.

CDW outpaced estimates in three out of the trailing four quarters, delivering an earnings surprise of 9.1%, on average. The dividend yield is pegged at 1.3%.

CDW Corporation reported first-quarter 2022 non-GAAP earnings of $2.20 per share, beating the Zacks Consensus Estimate by 10% and increasing 26.6% year over year. The company’s revenues increased 23% year over year to $5.95 billion. Quarterly revenues also surpassed the consensus mark by 5.2%. On a constant currency basis, net sales improved by 23.3%.

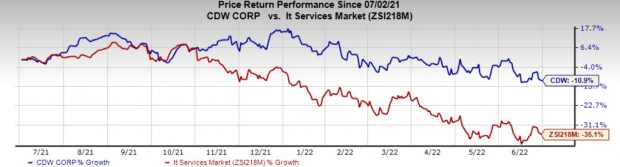

Amid the ongoing volatility, CDW stock has been more resilient compared with the Zacks

sub-industry

. The stock has lost 10.9% in the past year compared with a 35.1% plunge of the industry.

Image Source: Zacks Investment Research

CDW stock is down 24.5% from its 52-week high level of $208.71 on Jan 4, 2022, making it relatively affordable for investors.

Strong Fundamentals

Headquartered in Vernon Hills, IL, CDW is a leading provider of integrated IT solutions to small, medium and large business, government, education and healthcare customers in the United States, the U.K. and Canada. The company offers discrete hardware and software products to integrated IT solutions businesses such as mobility, security, data center optimization, cloud computing, virtualization and collaboration.

CDW is benefiting from the ongoing digital transformation and coronavirus-led work-from-home wave. In the past few quarters, the company has been witnessing strong demand for products that enable remote working and operations continuity plans. It is registering strong revenue growth in product categories, including collaboration tools, enterprise storage, notebook, desktops, video, hardware, and security software.

CDW’s approach to encouraging organic growth and pursuing buyouts is likely to have raised the company’s profile. Buyouts like Amplified IT and Focal Point Data Risk have helped it improve its educational and security capabilities, respectively.

CDW completed the acquisition of Sirius Computer Solutions in December 2021. The acquisition of Sirius is expected to have strengthened CDW’s managed services capabilities.

CDW has been working to improve its capabilities in high-growth solution areas. It has also been increasing its service skills to attract customers.

However, the pandemic-induced global supply-chain troubles, component shortages and increasing expenses continue to be major headwinds for this Zacks Rank #3 (Hold) stock.

Stocks to Consider

A few other top-ranked stocks from the broader technology sector worth consideration are

InterDigital

IDCC

,

PTC

PTC

and

Vishay Intertechnolog

y

VSH

. While PTC and InterDigital sport a Zacks Rank #1, Vishay Intertechnology carries a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vishay Intertechnology’s 2022 earnings is pegged at $2.68 per share, rising 10.3% in the past 60 days. The long-term earnings growth rate is anticipated to be 22.7%.

Vishay Intertechnology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 5%. Shares of VSH have declined 20.2% in the past year.

The Zacks Consensus Estimate for InterDigital 2022 earnings is pegged at $2.90 per share, up 27.2% in the past 60 days. IDCC’s long-term earnings growth rate is pegged at 15%.

InterDigital’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 141.1%. Shares of IDCC have lost 15.8% of their value in the past year.

The Zacks Consensus Estimate for PTC’s fiscal 2022 earnings is pegged at $4.55 per share, rising 2.9% in the past 60 days. The long-term earnings growth rate is anticipated to be 11.8%.

PTC’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 29.4%. Shares of PTC are down 26.1% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report