Repligen Corporation

RGEN

announced first-quarter 2022 adjusted earnings per share of 92 cents, beating the Zacks Consensus Estimate of 72 cents. Earnings also rose 35.3% year over year.

Total revenues of $206.4 million also surpassed the Zacks Consensus Estimate of $183.6 million. Sales rose 45% year over year (48% in constant currency) on robust demand across the filtration, chromatography and process analytics franchises.

Excluding the impact of currency and acquisitions/divestitures, Repligen’s organic revenues grew 44% year over year for first-quarter 2022.

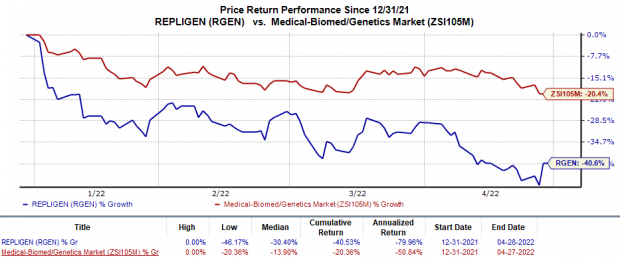

Shares of Repligen rose 10.5% on Apr 27, following the encouraging earnings results. Yet, the stock has plunged 40.5% in the year so far compared with the

industry’

s 20.4% decline.

Image Source: Zacks Investment Research

Quarter in Detail

During the quarter, Repligen’s base business accounted for 71% of revenues while COVID-related sales constituted 26%. Remaining growth was on account of inorganic revenues from the acquisitions made during 2021.

We note that Repligen’s base business can be categorized mainly under four franchises, namely filtration, chromatography, protein and process analytics.

Sales of the company’s overall base business registered growth of 37% year over year. While revenue growth from the filtration, chromatography and process analytics franchises was up over 30% year over year. Revenue growth of the protein franchise was in line with the year-ago quarter’s level.

The gene-therapy business was up more than 100% during the quarter.

Adjusted gross margin was 60.4% in the first quarter, up 100 basis points (bps) year over year.

For the reported quarter, adjusted research and development expenses were $11.8 million, up 60.1% from the year-ago quarter’s figure.

Adjusted selling, general and administrative expenses were $45.4 million, surging 43.2% year over year.

Adjusted operating income was $67.4 million, increasing 47% year over year. Adjusted operating margin was 32.6%, up 70 bps year over year.

As of Mar 31, 2022, Repligen had cash and cash equivalents worth $584.6 million compared with $603.8 million on Dec 31, 2021.

Updated 2022 Guidance

Repligen revised its financial guidance for 2022.

RGEN expects revenues in the range of $770-$800 million, reflecting a 4% reduction from the earlier projected levels of $800-$830 million. The new revenue guidance indicates overall revenue growth of 15-19% year over year on a reported basis while 17-21% growth on constant-currency basis. Organic growth is now expected in the range of 14-18%, down from the earlier projected growth band of 18-22%.

Repligen now expects base business revenues in the $598-$628 million range, up from the previously issued guided range of $578-$587 million.

The updated guidance lowers Repligen’s expectations from COVID-related sales due to slowing vaccination rates. However, RGEN expects a rise in demand for products sold under its base business.

Adjusted net income is now projected in the $177-$182 million band, down from the earlier guidance of $185-$190 million. Adjusted operating income is now anticipated within $225-$231 million, down from the earlier projected $234-$240 million band.

Adjusted EPS is anticipated within $3.07-$3.15, reflecting a decline from the earlier guidance range of $3.21-$3.30.

Zacks Rank & Stocks to Consider

Currently, Repligen has a Zacks Rank #3 (Hold). Better-ranked stocks in the same sector include

Angion Biomedica

ANGN

,

Deciphera Pharmaceuticals

DCPH

and

Vertex Pharmaceuticals

VRTX

. While Angion Biomedica sports a Zacks Rank #1 (Strong Buy), both Deciphera Pharmaceuticals and Vertex Pharmaceuticals carry a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Angion Biomedica’s loss per share estimates for 2022 have narrowed from $2.59 to $1.79 in the past 30 days. The same for 2023 has narrowed from $3.11 to $2.19 in the past 30 days.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark once, the average surprise being 47.5%.

Deciphera Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $2.94 to $2.84 in the past 30 days. The same for 2023 has narrowed from $2.38 to $2.27 in the past 30 days. The stock has risen 10.1% in the year-to-date period.

Earnings of Deciphera Pharmaceuticalsmissed estimates in three of the last four quarters and beat the mark once, the average surprise being 2.7%.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $14.52 to $14.56 in the past 30 days. The same for 2023 has risen from $15.31 to $15.35 in the past 30 days. VRTX has risen 21.7% in the year so far.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report