ResMed Inc.

RMD

recently signed a definitive agreement to acquire privately-held MEDIFOX DAN from Hg, a leading software and services investor. The transaction is scheduled to close by the end of the second quarter of ResMed’s fiscal year 2023 (ending Dec 31, 2022), subject to fulfillment of regulatory clearances. Following the acquisition, ResMed plans to retain MEDIFOX DAN’s employees, management structure, locations, and business processes.

Germany’s MEDIFOX DAN is a developer of out-of-hospital software solutions for providers in major settings across the care continuum. The company’s clinical, financial and operational solutions are mission-critical for out-of-hospital care providers, including care documentation, personnel planning, administration, billing, etc.

The latest acquisition of MEDIFOX DAN is likely to bolster ResMed’s Software-as-a-Service (“SaaS”) business. Per ResMed’s management, the buyout will broaden the company’s SaaS business portfolio beyond its existing base in the U.S. market and improve its position as the global leader in healthcare software solutions for lower-cost and lower-acuity care.

Financial Terms of the Buyout

Under the terms of the agreement, ResMed will acquire MEDIFOX DAN for nearly $1.0 billion (€950 million). The company expects to fund the acquisition with its existing credit facilities. MEDIFOX DAN’s pro forma net revenue was roughly $83 million, with a pro forma adjusted EBITDA of around $35 million for the calendar year 2021.

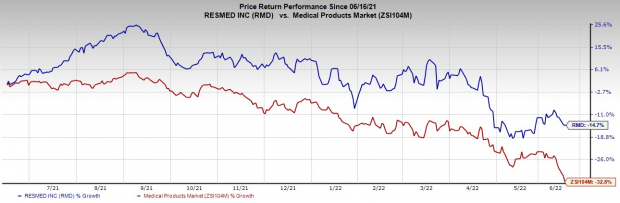

Image Source: Zacks Investment Research

Post completion, the transaction is slated to be accretive to ResMed’s non-GAAP diluted earnings per share.

Strategic Prospects

The MEDIFOX DAN-acquisition fortifies ResMed’s existing business in Germany as a leading provider of innovative cloud-connected medical devices that transform care for patients with sleep apnea and other respiratory conditions. MEDIFOX DAN’s German customer base is also complementary to ResMed’s SaaS customers in the United States.

MEDIFOX DAN has a strong track record of innovation. It has recently launched the new software generations MD Outpatient and MD Inpatient, setting new standards for the future of care. In addition, MEDIFOX DAN’s customer-centricity resulted in a strong and continuing demand for its software solutions across Germany.

The acquisition is expected to bring together the companies’ strengths and leverage synergies to improve the digitization of healthcare. Both companies are well poised to address the growing demand for digital solutions across Germany and help improve patient outcomes as one global team.

Industry Prospects

Per a report

by Allied Market Research, the global SaaS market is expected to see a CAGR of 18.82% during 2021 to 2030. Factors such as rising demand for the cloud-based platform during the pandemic, increasing usage of smartphones and app-based services and rising business outsourcing trend in the global economy, among other factors, can be attributable to market growth.

Given the substantial market prospects, ResMed’s latest acquisition seems well-timed.

Other Developments in SaaS Business

During the fiscal third quarter of 2022, the SaaS business registered revenue growth of 7.8%, driven by high-single-digit growth across home medical equipment and facility-based and home-based care settings on a year-over-year basis. The company also saw increased customer utilization of software and data solutions, including the landmark Brightree and SNF ReSupply products.

Global revenues from SaaS in the fiscal third quarter represented an 8% increase at CER year over year.

Share Price Performance

The stock has outperformed its

industry

in the past year. It has declined 14.7% compared with the industry’s 32.8% fall.

Zacks Rank and Key Picks

Currently, ResMed carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space are

Alkermes plc

ALKS

,

AMN Healthcare Services, Inc.

AMN

and

Medpace Holdings, Inc.

MEDP

.

Alkermes has an estimated long-term growth rate of 25.1%. Alkermes’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%. It currently carries a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

Alkermes has outperformed the industry in the past year. ALKS has gained 8.4% against the industry’s 45.5% decline in the said period.

AMN Healthcare has a long-term earnings growth rate of 1.1%. The company surpassed earnings estimates in the trailing four quarters, delivering an average surprise of 15.6%. It currently flaunts a Zacks Rank #1.

AMN Healthcare has outperformed its industry in the past year. AMN has gained 5.1% against the industry’s 53.9% fall.

Medpace has a historical growth rate of 27.3%. Medpace’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%. It currently has a Zacks Rank #2 (Buy).

Medpace has outperformed its industry in the past year. MEDP has declined 23.1% compared with the industry’s 53.9% fall.

Zacks’ Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report