Rio Tinto plc

RIO

announced that it has received approval from Turquoise Hill Resources Ltd’s shareholders to acquire the remaining 49% stake in the latter. This clears a significant milestone in the process of achieving full ownership in Turquoise Hill which will provide RIO 66% interest in Oyu Tolgoi, one of the world’s largest known copper and gold deposits.

The deal, however, remains subject to the final approval of the Supreme Court of Yukon, with a hearing scheduled for Dec 14. The acquisition is expected to be completed following court approval in the coming days.

Rio Tinto made its first offer to acquire the 49% stake in Turquoise Hill Resources that it does not currently own at C$34 of cash per share on Mar 14, 2022. This was rejected by Turquoise Hill on the premise that it undervalued the company.. In August, RIO had sweetened its bid to C$40 per share and finally, in September, both companies confirmed the settlement of the deal at C$43 per share. The agreed price represents a premium of 67% to Turquoise Hill’s closing share price on the Toronto Stock Exchange on Mar 11, 2022, a day prior to RIO’s first proposal. The deal is valued at $3.3 billion.

RIO currently has a 51% stake in Turquoise Hill, which is mainly focused on operating the Oyu Tolgoi copper-gold mine in Mongolia. Turquoise Hill has 66% ownership of the mine with the Government of Mongolia holding the remaining 34% stake. The deal will help simplify the Oyu Tolgoi ownership structure while augmenting Rio Tinto’s copper portfolio. It will also help RIO work directly with the government of Mongolia to expedite the Oyu Tolgoi project.

Following the comprehensive agreement reached between Rio Tinto, Turquoise Hill and the government of Mongolia in January this year, underground operations are underway at the Oyu Tolgoi project hub. The agreement unlocks the most valuable portion of the mine, with the first sustainable production expected in the first half of 2023. Once the underground project is complete, Oyu Tolgoi will be one of the biggest copper mines in the world. Production in early years is estimated at around 500,000 tons.

This will aid Rio Tinto in capitalizing on the growing demand for copper. Copper prices have been impacted this year by heightened concerns over a global economic slowdown and the resurgent COVID restrictions in China, which is the top consumer of the metal. However, prices are regaining ground lately fueled by worries about low supply from South America amid expectations of a pickup in industrial demand in China. Output from top producer Chile declined 6.7% in the first three quarters of the year and mine protests in Peru have impacted production, leading to supply concerns.

The long-term outlook for copper remains positive as copper demand is expected to grow, driven by electric vehicles, renewable energy and infrastructure investments. However, grade decline, rising input costs, water constraints and scarcity of high-quality developmental opportunities continue to disrupt the industry’s supply. This demand-supply imbalance will support copper prices in the future.

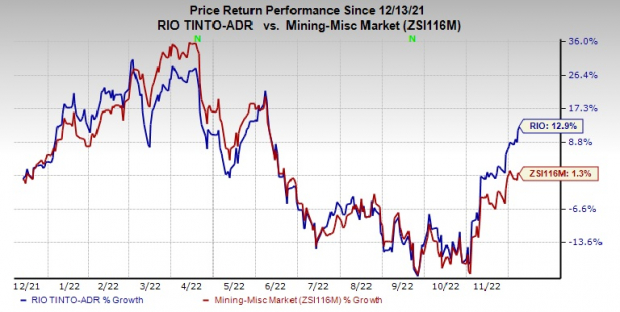

Price Performance

Image Source: Zacks Investment Research

In the past year, shares of Rio Tinto have gained 12.9% compared with the

industry

’s 1.3% growth.

Zacks Rank

Rio Tinto currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are

Olympic Steel, Inc.

ZEUS

,

Commercial Metals Company

CMC

and

Steel Dynamics, Inc.

STLD

.

Olympic Steel currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ZEUS’s current-year earnings has been revised 4.8% upward in the past 60 days. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 51% in a year.

Commercial Metals currently carries a Zacks Rank of 1. The consensus estimate for CMC’s current-year earnings has been revised 13.8% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 47% in a year.

Steel Dynamics has a projected earnings growth rate of 36.1% for the current year. The Zacks Consensus Estimate for STLD’s current-year earnings has been revised 7.3% upward in the past 60 days.

Steel Dynamics has a trailing four-quarter earnings surprise of roughly 6.2%. STLD has rallied roughly 81% in a year. The company currently carries a Zacks Rank #2 (Buy).

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report