Roche

RHHBY

announced that the FDA has accepted the company’s supplemental biologics license application (sBLA) for its arthritis drug Actemra.

The sBLA is seeking approval for the intravenous formulation of the drug for the treatment of COVID-19 in hospitalized adults who are receiving systemic corticosteroids and require supplemental oxygen, non-invasive or invasive mechanical ventilation or extracorporeal membrane oxygenation.

The regulatory body has granted Priority Review to the sBLA and a decision on the same is expected in the second half of this year.

The sBLA submission is based on results from four studies ((EMPACTA, COVACTA, REMDACTA, and RECOVERY) that evaluated Actemra/RoActemra for the treatment of COVID-19 in more than 5,500 hospitalized patients. These studies suggested that Actemra/RoActemra may improve outcomes in patients receiving corticosteroids and requiring supplemental oxygen or breathing support.

We remind investors that Actemra/RoActemra received Emergency Use Authorization (EUA) from the FDA and is currently approved for use in 16 countries for defined patients hospitalized with severe or critical COVID-19.

Actemra/RoActemra is also approved for the treatment of COVID-19 in the European Union.

Earlier in 2022, the World Health Organization (WHO) prequalified Actemra/RoActemra for patients with severe or critical COVID-19, supporting access to care in low- and middle-income countries.

Following the emergence of the Omicron variant, the WHO reported that interleukin-6 receptor blockers, such as Actemra/RoActemra, are expected to be still effective for managing patients with severe COVID-19.

We note that Actemra/RoActemra is approved for the treatment of adult patients with moderately to severely active rheumatoid arthritis (RA) who have used one or more disease-modifying antirheumatic drugs (DMARDs), such as methotrexate (MTX), that did not provide relief. The subcutaneous injection is approved for the treatment of adult patients with giant cell arteritis (GCA) for the treatment of patients two years of age and older with active polyarticular juvenile idiopathic arthritis (PJIA) or active systemic juvenile idiopathic arthritis (SJIA).

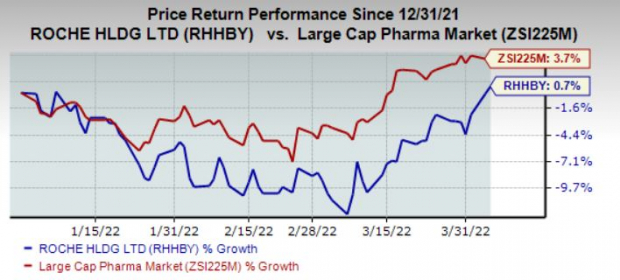

Roche’s stock has gained 0.7% in the year so far compared with the

industry

’s growth of 3.7%.

Image Source: Zacks Investment Research

The sudden emergence of COVID-19 forced many pharma/biotech companies to evaluate the efficacy of existing drugs for treating infected patients during the outbreak.

We note that

Gilead’s

GILD

Veklury was approved by the FDA for adults and pediatric patients 12 years of age and older and weighing at least 40 kg for the treatment of COVID-19 requiring hospitalization. The FDA also approved expanded Veklury’s label for treating non-hospitalized adult and adolescent patients at high risk of progression to severe COVID-19, including hospitalization or death.

Gilead also released data that demonstrated the in vitro activity of antiviral treatment for COVID-19, Veklury (remdesivir), against 10 SARS-CoV-2 variants, including the highly-contagious Omicron.

The FDA earlier revised the authorizations for two monoclonal antibody treatments –

Eli Lilly’s

LLY

bamlanivimab and etesevimab (administered together) and

Regeneron

’s

REGN

REGEN-COV (casirivimab and imdevimab).

Data indicated that these treatments are highly unlikely to be active against the Omicron variant, which is the dominant one in the United States.

The regulatory body stated that these treatments are no longer authorized for use in any U.S. states, territories and jurisdictions at this time.

Sales of REGEN-COV had significantly boosted the top line of Regeneron and this revision will adversely impact sales for now.

The regulatory body also issued a EUA to Lilly’s bebtelovimab, an antibody that demonstrates neutralization against the Omicron variant.

Roche currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Just Released: The Biggest Tech IPOs of 2022

For a limited time, Zacks is revealing the most anticipated tech IPOs expected to launch this year. Concerns about Federal interest rates and inflation caused many private companies to stay on the bench- leading to companies with better brand recognition and higher growth rates getting into the game. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity. See the complete list today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report