Roche

RHHBY

announced that the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) has recommended label expansion of the hemophilia A drug Hemlibra (emicizumab) in the European Union (EU).

The CHMP recommended Hemlibra for the routine prophylaxis of bleeding episodes in people with hemophilia A (congenital factor VIII deficiency) without factor VIII inhibitors who have moderate disease with a severe bleeding phenotype.

Hemlibra is a bispecific factor IXa- and factor X-directed antibody.

Per estimates, people with moderate hemophilia A make up 14% of the hemophilia A population. Hemophilia A is an inherited, serious disorder in which a person’s blood does not clot properly, leading to uncontrolled and often spontaneous bleeding. A final decision from the European Commission is expected shortly.

The positive recommendation is based on the results from the phase III HAVEN-6 study as well as on real-world data. The results from the study showed that Hemlibra demonstrated effective bleed control and a favorable safety profile in people with non-severe hemophilia A without factor VIII inhibitors, where prophylaxis was clinically indicated.

We remind investors that Hemlibra is already approved in many countries as a treatment for people with hemophilia A with factor VIII inhibitors and for people without factor VIII inhibitors.

The label expansion of the drug in the EU will provide an effective and convenient prophylactic treatment option with a favorable safety profile for people with moderate hemophilia A with a severe bleeding phenotype.

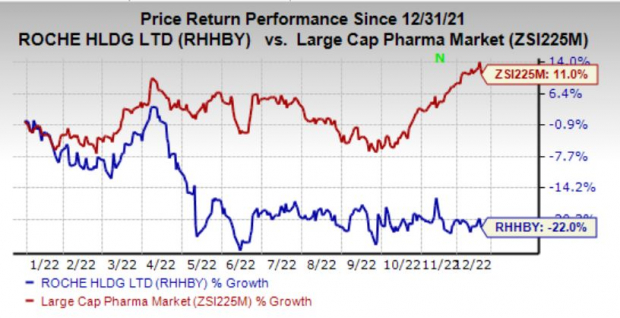

Shares of Roche have declined 22% in the year so far against the

industry

’s increase of 11%.

Image Source: Zacks Investment Research

The label expansion of Hemlibra will strengthen Roche’s strong hematology portfolio, which includes approved drugs like MabThera/Rituxan (rituximab), Gazyva/Gazyvaro (obinutuzumab), Polivy (polatuzumab vedotin), Venclexta/Venclyxto (venetoclax) in collaboration with AbbVie, Hemlibra (emicizumab) and Lunsumio (mosunetuzumab). The pipeline of investigational hematology medicines includes T-cell-engaging bispecific antibodies glofitamab, targeting both CD20 and CD3, and cevostamab, targeting both FcRH5 and CD3; Tecentriq (atezolizumab), a monoclonal antibody designed to bind with PD-L1 and crovalimab, an anti-C5 antibody engineered to optimize complement inhibition.

Strong demand for new drugs, namely Hemlibra, Ocrevus (multiple sclerosis), Evrysdi (spinal muscular atrophy), Phesgo (cancer) and Tecentriq (cancer), maintains momentum for the company and offsets stiff competition from biosimilars for some of Roche’s key drugs, such as Avastin, MabThera/Rituxan and Herceptin.

Roche currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Sanofi

SNY

and

Gilead Sciences, Inc

.

GILD

. Both carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Earnings estimates for Sanofi have increased 6 cents in the last 90 days to $4.16. Sanofi has surpassed earnings estimates in all of the past four quarters with an average positive beat of 9.50%.

Earnings estimates for Gilead Sciences have increased 48 cents in the last 60 days to $7.09. Gilead has surpassed earnings estimates in three of the past four quarters with an average positive beat of 0.36%.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report