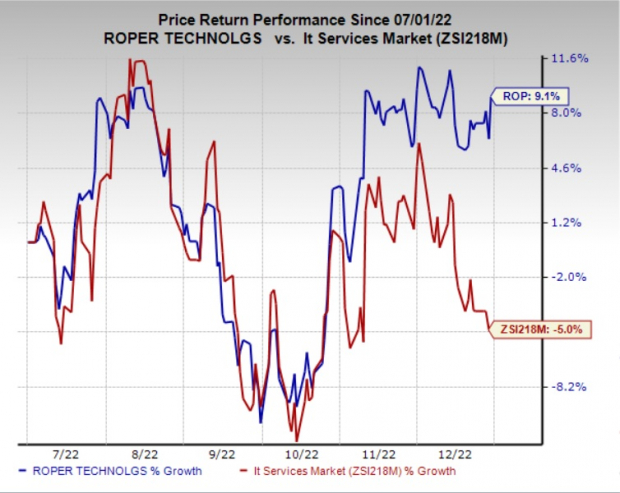

Shares of

Roper Technologies

ROP

have gained 9% in the past six months against the

industry

’s 5% decline. Strength across its segments, shareholder-friendly activities and benefits from acquisitions primarily drove the stock.

Image Source: Zacks Investment Research

Roper’s Application Software segment is benefiting from strength across its Deltek, Vertafore, Aderant, CliniSys and Data Innovations businesses. The segment’s growth is supported by strength in its recurring revenue stream, led by strong customer retention and continued migration to SaaS delivery models. For the fourth quarter of 2022, the company expects organic growth of 6-8% for the segment.

The Network Software segment is benefiting from the strong performance of the United States and Canada freight matching businesses. Strength across the Foundry business, owing to solid innovation capability, is driving the segment’s performance. Solid customer additions are aiding the iTradeNetwork business within the Network Software segment. For the fourth quarter, the company expects organic growth of 8-10%.

With record orders and backlog levels, Roper’s Neptune business is fueling growth of the Technology Enabled Products segment. Strong ordering activity in the medical product business, including Verathon and Northern Digital, is a key growth driver for the segment. For the fourth quarter, the company expects organic growth of 5-7% for the segment.

Roper’s measures to expand its operations through successive acquisitions are driving its growth. In October 2022, the company acquired Frontline Education for $3.7 billion. The acquisition builds on Roper’s Horizon software business (which it acquired in 2008), expanding its presence in the K-12 education market. The acquisition is expected to contribute approximately $370 million to Roper’s revenues and $175 million to its EBITDA in 2023.

ROP raised its full-year outlook to include the benefits of this acquisition. For 2022, the company expects adjusted earnings per share from continuing operations of $14.09-$14.13 (previous view: $13.46-$13.62). Organic growth from continuing operations is expected to be 9% in 2022.

Apart from the Frontline buyout, Roper acquired American LegalNet in January 2022, which strengthened its Aderant business. Acquisitions/divestitures boosted sales by 1% in the third quarter. In 2020, the company made several acquisitions, including Team TSI Corporation, Freight Market Intelligence Consortium, WELIS, Impact Financial Systems, Vertafore and EPSi.

Strong cash flow generation capacity supports Roper’s shareholder-friendly activities. In the third quarter, the company generated an adjusted free cash flow of $353 million, up 9.3% year over year. In the first nine months of 2022, ROP rewarded its shareholders with a dividend payment of $196.2 million, up 10.9% year over year. In November 2022, the company hiked its dividend by 10%.

Zacks Rank & Key Picks

Roper currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader

Computer and Technology

sector are as follows:

CoStar Group

CSGP

presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter average surprise of 22.4%. You can see

the complete list of today’s Zacks #1 Rank stocks

.

CoStar Group has an estimated earnings growth rate of 8.8% and 12.1% for 2022 and 2023, respectively. Shares of the company have gained 7.9% in the past three months.

Taboola.com Ltd

.

TBLA

currently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter average surprise of 189.5%.

Taboola.com has an estimated earnings growth rate of 230.8% and 5.9% for 2022 and 2023, respectively. Shares of the company have gained 57.7% in the past three months.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report