SAP SE

SAP

has announced the acquisition of Askdata for an undisclosed amount to tap the growing demand for data and analytics solutions.

Per a research from

Fortune Business Insights

, the global big data analytics market is projected to reach $655.5 billion by 2029, at a CAGR of 13.4% from 2022 to 2029.

Askdata is a startup specializing in search-driven analytics that uses machine learning algorithms to provide a personalized experience to users. Natural language processing is combined with artificial intelligence technologies, enabling users to quickly find the answer to any data question.

This makes it easier for users to search, interact and collaborate on live data without learning a self-service analytics solution. It also allows users to get the most out of their data and enhance business insights.

The data personalization feature, available in multiple languages, connects live to source application without relocating data and keeps the entire business context to offer an insightful response.

Askdata’s intellectual property will be incorporated into SAP Business Technology Platform to assist customers in the SAP Analytics Cloud solution.

SAP continues to invest heavily in the cloud business as the Rise with SAP solutions and S/4HANA solutions gain traction. Previously, SAP

announced

the availability of a new solution within the SAP Signavio software that integrates experience data obtained from end-user surveys (customer, supplier or employee) with core IT systems.

It will enable enterprises to enhance their end-to-end business processes and boost operational efficiency and customer experience.

The company recently provided strong

second-quarter

revenue numbers driven by strength in the cloud business. Total revenues, on a non-IFRS basis, were €7.517 billion ($8.009 billion), up 13% year over year (up 5% at constant currency or cc).

In the second quarter, S/4HANA adoption rallied more than 15% (or 650 new clients) year over year to around 20,000 customers. SAP S/4HANA Cloud revenues increased 84% (up 72% at cc) year over year to €472 million.

SAP S/4HANA’s current cloud backlog was up 100% (up 87% at cc) year over year, which indicates the growing demand for this product.

However, the company has lowered full-year operating profit guidance due to the €350-million negative impact of the war in Ukraine and expectations of a decline in software licenses revenues.

SAP is a leading provider of enterprise resource planning software catering to the need of organizations. The demand for the software ranges from small and medium businesses to large, global enterprises.

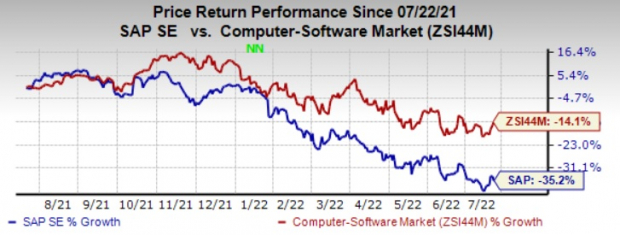

SAP currently carries a Zacks Rank #2 (Buy). Shares of the company have lost 35.2% compared with the

industry’s

fall of 14.1% in the past year

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

. Broadcom sports a Zacks Rank #1 (Strong Buy) whereas Aspen Technology and Synopsys carry a Zacks Rank #2.You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.49 per share, increasing 0.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.3%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 25.5% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.67 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 20.3% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 8.7% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report